Anil Singhvi’s Strategy September 4: Market Trend & Sentiment are Negative; Sell Sun Pharma Futures with Stop Loss 445

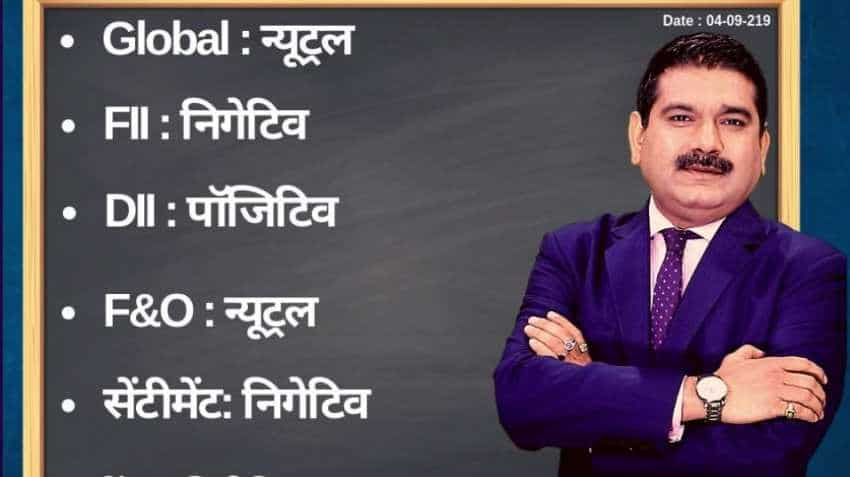

On account of positive DIIs, neutral F&O and negative FIIs, the short-term trend of the domestic Indian markets will continue to be negative, says Zee Business Managing Editor Anil Singhvi.

Amid positive domestic institutional investors (DIIs), neutral global markets and futures and options (F&O) and negative foreign institutional investors (FIIs), and sentiment cues the short-term trend of the domestic Indian markets will continue to be negative on Wednesday, September 4, 2019.

Earlier on Tuesday, September 3, 2019, the domestic stock markets show a steep fall after data released last week showed GDP grew at 5%, which is the weakest pace in over six years as consumption demand had weakened. On the day, the Sensex at the Bombay Stock Exchange tanked 769.88 points, or 2.06 per cent - its biggest one-day fall since October last year - to close at 36,562.91. The Nifty at the National Stock Exchange also plummeted 225.35 points, or 2.04 per cent, to end at 10,797.90. Similarly, Bank Nifty tanked 603.70 points, or 2.20 per cent, to settle at 26,824.15.

See Zee Business Live TV streaming below:

Tata Steel, Ultratech Cement, ICICI Bank, Titan and Indian Oil – each fall by more than 4 per cent - were the biggest losers of the day.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for September 4:

Small day range for trading on Nifty stands at 10,775-10,850 while the medium and bigger range lie between 10,725-10,900 and 10,650-10,950.

Small day range for trading on Bank Nifty stands at 26,750-26,950 while the medium-range resides at 26,550-27,250.

Next support range on the two indices, Nifty and Bank Nifty, lies between 10,650-10,700 and 26,500-26,550 respectively.

For Existing Long Positions:

Nifty intraday 10,775 and closing stop loss 10,725.

Bank Nifty intraday stop loss 26,500 and closing stop loss 26,800.

For Existing Short Positions:

Nifty intraday and closing stop loss 10,950.

Bank Nifty intraday and closing stop loss 27,250.

For New Positions:

Buy Nifty with a stop loss of 10,770 and target 10,850, 10,900, 10,925.

Sell Nifty in 10,900-10,925 range with a stop loss of 10,975 and target 10,825, 10,800.

Buy Bank Nifty with a stop loss of 26,700 and target 26,950, 27,125, 27,250.

Sell Bank Nifty in 27,000-27,150 range with a stop loss of 27,300 and target 26,850, 26,750.

The put-call ratio (PCR) is at 1.04 and the volatility index (VIX) is 18.05.

No stock in F&O Ban

Stock of the Day:

Sell Sun Pharma Futures: Stop loss 445 and target 425, 410. Media reports of forensic audit on the company by SEBI.

Sell Yes Bank Futures: Stop loss 59.50 and target 57, 55, 53. MS downgrades with a target of 55

Aaj ka Hero:

Sell Balkrishna Futures: Stop loss 735 and target 715, 700. Macquarie initiates coverage with a target of 575.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Ppf interest rate maturity retirement corpus planning calculator how to get inr rs 85000 month tax free income from public provident fund calculations 80c tax benefits what will be interest amount

Reduce Home Loan EMI vs Reduce Tenure: Which prepayment option can help save Rs 55 lakh, & 7 years and 9 months on Rs 80 lakh, 30-year loan

08:36 AM IST

Final Trade: Sensex jumps 598 points; Nifty at 24,450; Media leads sectoral rally

Final Trade: Sensex jumps 598 points; Nifty at 24,450; Media leads sectoral rally Centre slaps fines on Sun Pharma CMD and directors over related-party transactions

Centre slaps fines on Sun Pharma CMD and directors over related-party transactions  Sun Pharma drops 5% after US court halts launch of alopecia treatment drug

Sun Pharma drops 5% after US court halts launch of alopecia treatment drug Sun Pharma Q2 Results Preview: PAT likely to grow 11.5%; gross margin may improve

Sun Pharma Q2 Results Preview: PAT likely to grow 11.5%; gross margin may improve FINAL TRADE: Sensex ends volatile session down 398 pts, Nifty slides to 24,918 dragged by energy, auto shares

FINAL TRADE: Sensex ends volatile session down 398 pts, Nifty slides to 24,918 dragged by energy, auto shares