Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

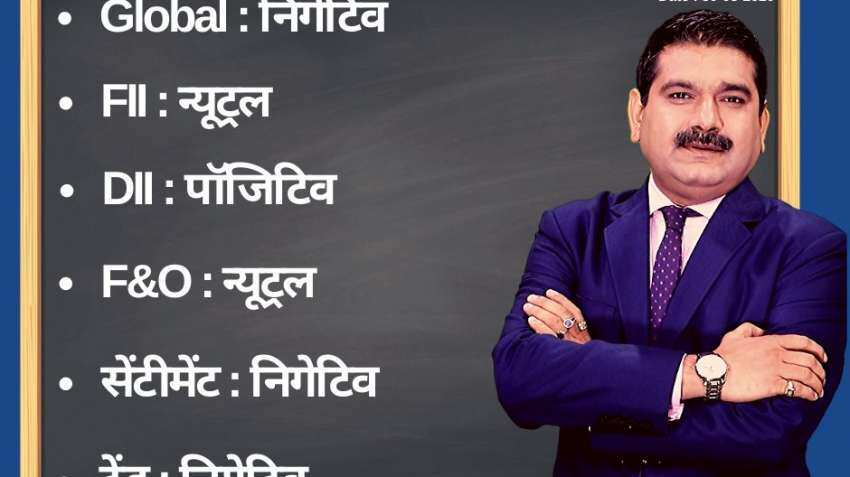

Amid positive domestic institutional investors (DIIs), neutral foreign institutional investors (FIIs), futures & options (F&O) and negative global markets and sentiment cues, the short-term trend of the Indian stock markets will be negative on Monday, March 30, 2020

Amid positive domestic institutional investors (DIIs), neutral foreign institutional investors (FIIs), futures & options (F&O) and negative global markets and sentiment cues, the short-term trend of the Indian stock markets will be negative on Monday, March 30, 2020.

Breaking the three-day rising streak on Friday, March 27, 2020, the S&P BSE Sensex corrected itself and closed in a red. The Nifty, however, managed to close with minor gains above 8660 level. The Reserve Bank of India (RBI) on Friday joined the global central banks in slashing interest rates to minimize the damage from Covid-19 crisis. Despite RBI's monetary bazooka, the sentiment was clouded by worries of evolving situation on COVID-19 crisis and its implications on the economy and corporate profitability.

The barometer index, the S&P BSE Sensex fell 131.18 points or 0.44% at 29,815.59. The index surged 1179.26 points in early trade to hit the day's high of 31,126.03. The Nifty 50 index added 18.80 points or 0.22% at 8,660.25. It erased gains after spurting 397.45 points at the day's high of 9,038.90. Bank Nifty gained 355.10 points or 1.81% to close at 19,969.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for March 30:

The small day range for trading on Nifty is 8,500-8,650, while the medium and bigger ranges are 8,400-8,750 and 8,300-8,900 respectively.

The small day range for trading on Bank Nifty is 19,600-20,000, while the medium and bigger ranges are 19,300-20,300 and 18,900-20,600 respectively.

Next Support Zone on Nifty is 8,300-8,400 and Bank Nifty is 18,900-19,300.

Strong Sell Zone on Nifty is 8,900-9,200 and Bank Nifty is 21,000-21,500.

For Existing Long Positions:

Nifty intraday stop loss 8,500 and closing stop loss 8,250.

Bank Nifty intraday stop loss 19,600 and closing stop loss 18,500.

For Existing Short Positions:

Nifty intraday stop loss 9,050 and closing stop loss 8,700.

Bank Nifty intraday stop loss 20,600 and closing stop loss 20,000.

For New Positions:

Buy Nifty in 8,300-8,400 range with a stop loss of 8,150 and target 8,500, 8,650, 8,750.

Sell Nifty in 8,750-8,950 range with a stop loss of 9,200 and target 8,650, 8,500, 8,400, 8,300.

Buy Bank Nifty in 18,900-19,300 range with a stop loss of 18,700 and target 19,500, 19,600, 20,000, 20,300.

Sell Bank Nifty in 20,600-21,000 range with a stop loss of 21,300 and target 20,300, 20,000, 19,600.

See Zee Business Live TV Streaming Below:

Put-Call Ratio (PCR) High 1.23, Volatility Index (VIX) down by 2% to 70.39.

No stocks in F&O Ban

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

IPL Auction 2025 Free Live Streaming: When and where to watch Indian Premier League 2025 mega auction live online, on TV, Mobile Apps, and Laptop?

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

08:54 AM IST

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today