Anil Singhvi’s Strategy June 6: NBFC sector is Negative; Sell Bharat Forge Futures with a stop loss of 470

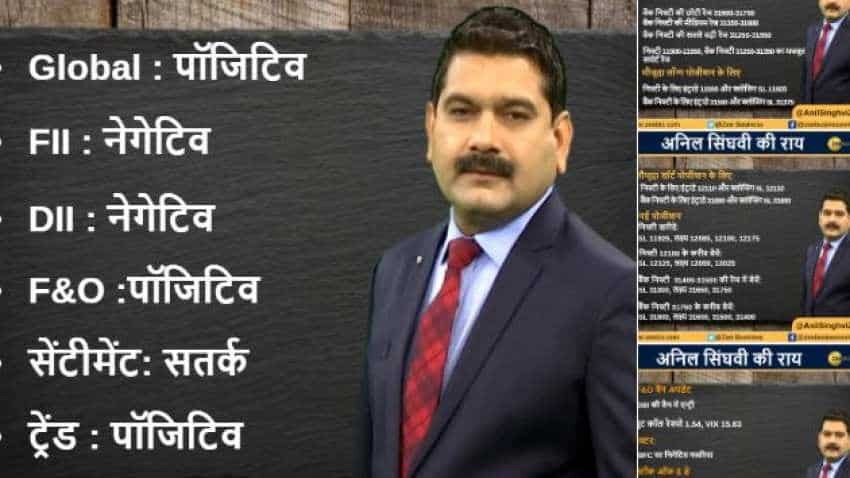

Amid positive global market, F&O, negative FII and DIIs cues, the short-term trend of the domestic Indian market will be positive says Zee Business Managing Editor Anil Singhvi.

Amid positive global market, futures and options (F&O), negative foreign institutional investors (FII) and domestic institutional investors (DIIs) cues, the short-term trend of the domestic Indian market will be positive on Thursday, June 6, 2019, while the sentiments are cautious.

In the previous session on Tuesday, June 4, 2019, the benchmark indices Sensex and Nifty retreated from their record highs and closed lower as investors booked profit. Despite selling pressure across the board, Sensex managed to close above the crucial 40,000 mark and Nifty above the 12,000 level. On the day, the BSE Sensex closed 184.08 points, or 0.46 per cent, lower at 40,083.54; while Nifty edged 66.90 points, or 0.55 per cent, down at 12,021.65. Similarly, Bank Nifty lost 64.60 points, or 0.20 per cent, and settled at 31,589.05.

Besides, the six-member Monetary Policy Committee (MPC) of the Reserve Bank of India will announce the second bi-monthly monetary policy statement for 2019-20 today. It is expected that the committee will announce a rate cut of 25 basis points. The key lending rate or the repo rate currently stands at 6 per cent. It is believed that RBI has enough room to cut rates further as inflation has remained below the RBI's medium-term goal of 4 per cent for the ninth month in a row. Consumer Price Index, CPI inflation for April 2019 stood at 2.92 per cent. The rate cut is also likely to revive the economy that is going through a slowdown.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for June 6:

12,000 and 31,500 are going to be the deciding levels on Nifty and Bank Nifty respectively.

The small and medium day range for trading on Nifty lies between 12,000-12,085 and 11,950-12,110. The bigger range stands at 11925-12175.

The small and medium day range for trading on Bank Nifty lies between 31,500-31,750 and 31,350-31,800 medium range. The bigger range stands at 31250-31950.

The important support zone on the two indices, Nifty and Bank Nifty, lies between 11,900-11,950 and 31,250-31,350 respectively.

For Existing Long Positions:

Nifty intraday 12,000 and closing basis stop loss 11,925.

Bank Nifty intraday 31,500 and closing basis stop loss 31,375.

For Existing Short Positions:

Nifty intraday and closing basis stop loss 12,110.

Bank Nifty intraday and closing basis stop loss 31,800.

For New Positions:

Buy Nifty with a stop loss of 11,925 and target 12,085, 12,100, 12,175.

Sell Nifty near 12,100 with a stop loss of 12,125 and target 12,050, 12,025.

Buy Bank Nifty in 31,400-31,500 range with a stop loss of 31,300 and target 31,650, 31,750.

Sell Bank Nifty near 31,750 with a stop loss of 31,800 and target 31,600, 31,500, 31,400.

Enters F&O Ban: IDBI

The put-call ratio (PCR) stands at 1.54 and the volatility index (VIX) is 15.63.

Sectors:

Negative: NBFC

Stock of the Day:

Sell DHFL Futures: Stop loss 113 and target 105, 100, 92. CRISIL downgraded DHFL debt to the default category.

Aaj Ka Hero:

Sell Bharat Forge Futures: Stop loss 470 and target 455, 450. Class 8 truck sales at 3 years low.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Mukhyamantri Majhi Ladki Bahin Yojana: Know eligibility, benefits, and documents to apply for this women-centric government scheme

Gratuity Calculator: Rs 37,000 as last-drawn salary; 6 years and 3 months as service period; know your gratuity?

Top 7 Gold ETFs With Highest Annualised Returns in 10 Years: Know how Rs 10 lakh investment in each ETF has performed in last decade

Defence PSU Stock to BUY: This multibagger scrip corrects 49% from 52-week high - Is this right time to buy?

Top 7 Large and Mid Cap Mutual Funds With up to 43% Return in 1 Year: Rs 25,000 monthly SIP investment in No. 1 scheme is now worth Rs 3,64,654

08:53 AM IST

Final Trade: Sensex tanks 1,190 pts; Nifty slips below 23,950, auto and IT stocks drag

Final Trade: Sensex tanks 1,190 pts; Nifty slips below 23,950, auto and IT stocks drag  Sensex dives 1200 pts; Nifty below 24,100; IT and auto stocks drag

Sensex dives 1200 pts; Nifty below 24,100; IT and auto stocks drag  FIRST TRADE: Equities open tad higher; Nifty tops 24,300, Sensex up 41 pts

FIRST TRADE: Equities open tad higher; Nifty tops 24,300, Sensex up 41 pts GIFT Nifty futures hint at a flat opening; mixed trends across Asian markets

GIFT Nifty futures hint at a flat opening; mixed trends across Asian markets Final Trade: Sensex closes 230 pts higher; Nifty above 24,250; bank, auto stocks rise

Final Trade: Sensex closes 230 pts higher; Nifty above 24,250; bank, auto stocks rise