Anil Singhvi’s Strategy July 16: Market Trend is Neutral; Sell Wipro Futures with Stop Loss 265

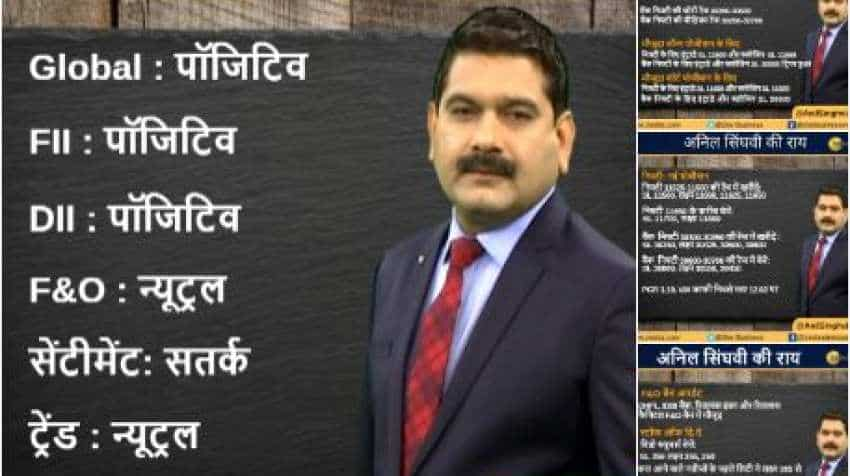

On account of positive global markets, DIIs and FIIs and neutral F&O, the short-term trend of the Indian markets will be neutral, says Zee Business Managing Editor Anil Singhvi.

Amid positive global markets, domestic institutional investors (DIIs) and foreign institutional investors (FIIs) and neutral futures and options (F&O) cues, the short-term trend of the domestic Indian markets will be neutral on Tuesday, July 16, 2019, while sentiment will continue to be cautious.

Earlier on Monday, July 15, 2019, the domestic equity benchmarks, Sensex and Nifty, closed in a Green. The gains were driven by gains in IT stocks and positive macroeconomic data. Sensex at Bombay Stock Exchange climbed 160.48 points or 0.41 per cent to end at 38,896.71. Nifty at National Stock Exchange also surged 35.85 points or 0.31 per cent to settle at 11,588.35. However, Bank Nifty was down by 155.50 points or 0.51 per cent and closed at 30,445.95.

See Anil Singhvi's tweet below:

#MarketStrategy | पढ़िए #Nifty और #BankNifty पर अनिल सिंघवी की दमदार रणनीति।@AnilSinghviZEE pic.twitter.com/6WDru0rMPJ

— Zee Business (@ZeeBusiness) July 16, 2019

Zee Business's Managing Editor Anil Singhvi's Market Strategy for July 16:

11,600 and 30,500 are going to be the deciding levels on Nifty and Bank Nifty respectively.

The small day range for trading on Nifty stands at 11,525-11,650 while the medium-range resides at 11,500-11,700.

The small day range for trading on Bank Nifty stands at 30,350-30,600 while the medium-range resides at 30,250-30,700.

For Existing Long Positions:

Nifty intraday 11,500 and closing stop loss 11,550.

Bank Nifty intraday and closing stop loss at 30,500 already triggered yesterday.

For Existing Short Positions:

Nifty intraday stop loss 11,650 and closing stop loss 11,625.

Bank Nifty intraday and Closing stop loss 30,600.

For New Positions:

Buy Nifty in 11,525-11,550 range with a stop loss of 11,500 and target 11,600, 11,625, 11,650.

Sell Nifty near 11,650 with a stop loss of 11,700 and target 11,600.

Buy Bank Nifty in 30,300--30,350 range with a stop loss of 30,250 and target 30,425, 30,500, 30,600.

Sell Bank Nifty in 30,600-30,700 range with a stop loss of 30,800 and target 30,550, 30,450.

The put-call ratio (PCR) stands at 1.19 and the volatility index (VIX) is 12.02 very low.

4 Already in F&O Ban: Reliance Capital, DHFL, IDBI, Reliance Infrastructure.

Stock of the Day:

Sell Wipro Futures: Stop loss 265 and target 255, 250. Citi reduces the target to 255 from 285 just before results on July 17, 2019. Results could be weak.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Mutual Funds With Best SIP Returns in 1 Year: Rs 33,333 monthly SIP investment in No. 1 fund has generated Rs 5,12,069; know more details

SBI Guaranteed Return Schemes: Here's what PSU bank is giving on Amrit Vrishti and other fixed deposit schemes to senior citizens and others

Small SIP, Big Impact: Rs 11,111 monthly investment for 15 years, Rs 22,222 for 10 years or Rs 33,333 for 7 years, which do you think works best?

Top 7 Large and Mid Cap Mutual Funds With Highest SIP Returns in 1 Year: Rs 27,27,2 monthly SIP investment in No. 1 fund has zoomed to Rs 4,05,296

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,252 monthly SIP investment in No. 1 scheme has sprung to Rs 3,74,615; know about others

Power of Compounding: How can you create Rs 5 crore, 6 crore, 7 crore corpuses if your monthly salary is Rs 20,000?

08:52 AM IST

Final Trade: Sensex closes 109 points lower on final trading day of 2024; Nifty dips below 23,650

Final Trade: Sensex closes 109 points lower on final trading day of 2024; Nifty dips below 23,650  Sensex flat at 78,210, Nifty below 23,650; IT stocks drag

Sensex flat at 78,210, Nifty below 23,650; IT stocks drag FIRST TRADE: Sensex tumbles nearly 400 pts, Nifty falls to 23,552

FIRST TRADE: Sensex tumbles nearly 400 pts, Nifty falls to 23,552 GIFT Nifty futures point to a gap down start; markets to remain under pressure

GIFT Nifty futures point to a gap down start; markets to remain under pressure Final Trade: Sensex drops 451 points, Nifty ends below 23,650

Final Trade: Sensex drops 451 points, Nifty ends below 23,650