Anil Singhvi’s Strategy July 10: Market Trend is Neutral; Sell Indigo Futures and Stop Loss 1600

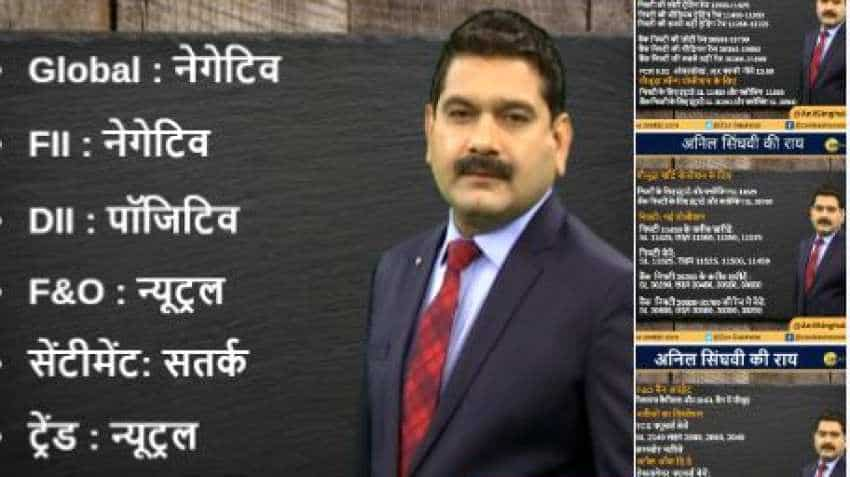

Amid positive DIIs, neutral F&O and negative global markets and FII, the short-term trend of the Indian markets will be neutral, says Zee Business Managing Editor Anil Singhvi.

Amid positive domestic institutional investors (DIIs), neutral futures and options (F&O) and negative global markets and foreign institutional investors (FII) cues, the short-term trend of the domestic Indian markets will be neutral on Wednesday, July 10, 2019, while sentiment is cautious.

Earlier on Tuesday, July 9, 2019, Benchmark Domestic indices, Sensex and Nifty, closed almost flat after losing around three per cent in last two sessions amid a selloff in global equities. Sensex at Bombay Stock Exchange gained 10.25 points (0.03%) to end at 38,730.82 while Nifty at National Stock Exchange slipped 2.70 points (0.02%) to settle at 11,555.90. Bank Nifty lost 34.70 points (0.11%) and closed at 30,569.15.

See Anil Singhvi's Tweet below:

#MarketStrategy | जानिए #Nifty और #BankNifty पर अनिल सिंघवी की दमदार रणनीति।@AnilSinghviZEE pic.twitter.com/9oOjliBTn1

— Zee Business (@ZeeBusiness) July 10, 2019

Indian Oil Corporation (up 5.73%), Bajaj Finance (up 5.59%) and Sun Pharma (up 5.51%) were the top gainers of the day while Titan, which slipped by 12.25%, was the biggest loser. The other major losers include UPL, TCS and GAIL.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for July 10:

Nifty has given a breakdown signal below 11,625. Trend Negative if Bank Nifty trades below 30,200.

The next important support range on the two indices, Nifty and Bank Nifty, resides at 11,350-11,400 and 30,200-30,300 respectively.

The small day range for trading on Nifty stands at 11,500-11,625 while the medium and bigger ranges lie between 11,450-11,650 and 11,350-11,725 respectively.

The small day range for trading on Bank Nifty stands at 30,500-30,700 while the medium and bigger ranges lie between 30,350-30,850 and 30,200-31,000 respectively.

Put-Call Ratio (PCR) 0.91 oversold and the volatility index (VIX) 13.69 very low.

For Existing Long Positions:

Nifty intraday stop loss 11,450 and closing stop loss 11,550.

Bank Nifty intraday stop loss 30,350 and closing stop loss 30,500.

For Existing Short Positions:

Nifty intraday and closing stop loss 11,625.

Bank Nifty intraday and closing stop loss 30,700.

For New Positions:

Buy Nifty near 11,450 with a stop loss of 11,425 and target 11,500, 11,550, 11,575.

Sell Nifty with a stop loss of 11,625 and target 11,525, 11,500, 11,450.

Buy Bank Nifty near 30,350 with a stop loss of 30,200 and target 30,450, 30,550, 30,650.

Sell Bank Nifty in 30,600-30,700 range with a stop loss of 30,800 and target 30,500, 30,350, 30,250.

In F&O Ban: Reliance Capital, DHFL.

Result Analysis:

Sell TCS Futures: Stop loss 2140 and target 2080, 2060, 2040. Weak results.

Stock of the Day:

Sell Hexaware Futures: Stop loss 360 and target 345, 340. Weak results expected.

Sell Indigo Futures: Stop loss 1600 and target 1525, 1500, 1460. Corporate Governance issues raised by the promoter.

Aaj Ka Hero:

Sell Reliance Infrastructure Futures: Stop loss 49.50 and target 43, 41.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Reduce Home Loan EMI vs Reduce Tenure: Which prepayment option can help save Rs 55 lakh, & 7 years and 9 months on Rs 80 lakh, 30-year loan

SBI Latest FD Rates: This is what you can get on Rs 10 lakh investment in 1-year, 3-year, and 5-year tenures

09:43 AM IST

Final Trade: Sensex sheds 467 points, Nifty closes below 23,600 amid weak sentiment

Final Trade: Sensex sheds 467 points, Nifty closes below 23,600 amid weak sentiment Midday Market: Sensex falls more than 500 points; Nifty slips below 23,600; realty sector lags

Midday Market: Sensex falls more than 500 points; Nifty slips below 23,600; realty sector lags FIRST TRADE: Sensex falls 216 points, Nifty dragged to 23,639

FIRST TRADE: Sensex falls 216 points, Nifty dragged to 23,639 GIFT Nifty Futures down 42 pts; markets likely to start on a cautious note

GIFT Nifty Futures down 42 pts; markets likely to start on a cautious note Final Trade: Market wraps up in red; Sensex slips 50 points, Nifty ends at 23,675

Final Trade: Market wraps up in red; Sensex slips 50 points, Nifty ends at 23,675