Anil Singhvi’s strategy August 1: Banks, Metal and Auto sectors are Negative; Sell Eicher Futures with Stop Loss 16,600

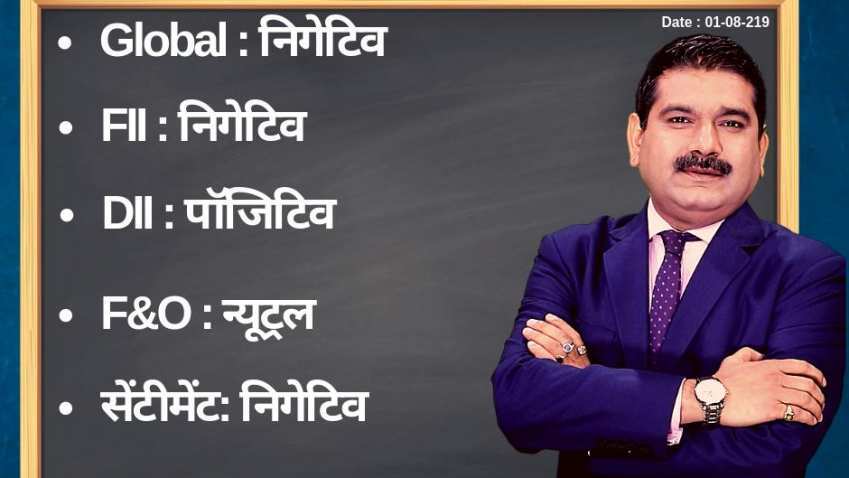

Amid positive domestic institutional investors (DIIs), neutral futures and options (F&O), negative global markets, foreign institutional investors (FIIs) and sentiment cues, the short-term trend of the domestic Indian markets will be Negative today.

Amid positive domestic institutional investors (DIIs), neutral futures and options (F&O), negative global markets, foreign institutional investors (FIIs) and sentiment cues, the short-term trend of the domestic Indian markets will be Negative today.

Earlier on Wednesday, July 31, 2019, the Benchmark Domestic indices closed with modest gains after witnessing losses in two sessions. Sensex and Nifty, both, appreciated even as cues from Asian stocks were negative. Sensex at Bombay Stock Exchange climbed 83.88 points or 0.22 per cent to end at 37,481.12. Nifty at National Stock Exchange also added 32.60 points or 0.29 per cent to settle at 11,118 while Bank Nifty gained 84.40 points or 0.29 per cent and closed at 28,876.

IndusInd Bank (up 5.29 per cent), Tata Steel (up 4.32 per cent) and Yes Bank (up 4.24 per cent) were the top gainers of the day.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for August 1:

The small day range for trading on Nifty stands at 11,075-11,150 while the medium day range resides at 11,000-11,200.

The small day range for trading on Bank Nifty stands at 28,750-28,950 while the medium day range resides at 28,550-29,100.

Further down risk opens if Nifty and Bank Nifty trades below 11,000 and 28,500.

For Existing Long Positions:

Nifty intraday and closing stop loss 11,000.

Bank Nifty intraday and closing stop loss 28,500.

For Existing Short Positions:

Nifty intraday and closing stop loss 11,200.

Bank Nifty intraday and closing stop loss 29,000.

For New Positions:

Sell Nifty with a stop loss of 11,150 and target 11,075, 11,000.

Buy Nifty near 11,000 with a stop loss of 10,950 and target 11,075, 11,100.

Sell Bank Nifty with a stop loss of 29,000 and target 28,750, 28,550.

Buy Bank Nifty near 28,550 with a stop loss of 28,450 and target 28,700, 28,800.

The put-call ratio (PCR) stands at 1.09 and the volatility index (VIX) is 13.66.

#EditorsTake | #FedCutsRates पर अनिल सिंघवी की राय। #BazaarKiBaat #FederalReserve #JeromePowell @AnilSinghviZEE pic.twitter.com/ClnXTUhagU

— Zee Business (@ZeeBusiness) August 1, 2019

Sectors: Negative: Banks, Metals, Auto

Results Analysis:

Sell Eicher Futures: Stop loss 16,600 and target 16,100, 15,950, 15,800. Weak margins, lower volumes, most expensive auto stocks.

Watch Zee Business Live TV

Stock of the Day: Sell UPL Futures: Stop loss 605 and target 580, 575. Weak Results due to one-off, don’t short if opens big gap down.

Aaj Ka Hero: Buy Ashok Leyland Futures: Stop loss 68 and target 72, 74. Results in line, margins are better and short-covering expected.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

IPL Auction 2025 Free Live Streaming: When and where to watch Indian Premier League 2025 mega auction live online, on TV, Mobile Apps, and Laptop?

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

08:45 AM IST

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today