Anil Singhvi’s Market Strategy November 20: Cement sector is Positive; Banks and Metals are negative

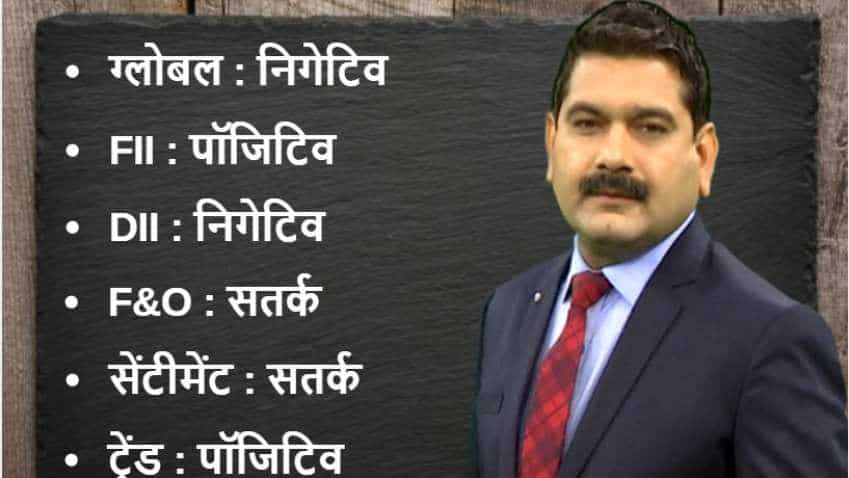

Amid positive foreign institutional investors (FII), negative global market, domestic institutional investors (DIIs), cautious future and option and sentiment cues, the short-term trend of the Indian market will remain positive on November 20, 2018.

Continuing its bullish momentum on the third day, the Indian market closed the day, November 19, 2018, in favour of the Bulls. The Bulls pushed the Nifty 50 up by 81.20 points or 0.76 per cent to close at 10,763.40 while Nifty Bank was up by 55.15 points or 0.21 per cent and closed at 26,300.70. Similarly, S&P BSE Sensex was up by 317.72 points or 0.90 per cent to close at 35,774.88.

Yes Bank was up by 7.83% while ITC and IndusInd bank were up by 2.87 per cent and 2.72 per cent respectively.

Amid positive foreign institutional investors (FII), negative global market, domestic institutional investors (DIIs), cautious future and option and sentiment cues, the short-term trend of the Indian market will remain positive on November 20, 2018.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for November 20:

Weakness in global markets and the outcome of RBI meet is not encouraging.

PCR 1.73 Nifty near 10800, be alert at higher levels.

Deciding levels on Nifty and BankNifty lies at 10,700 and 26,200.

The small trading range on Nifty stands at 10,700-10,800 while the bigger and extreme range lies between 10,650-10,825 and 10,575-10,900.

In the case of the BankNifty, the small and bigger trading range lies between 26,200-26,375 and 26,050-26,450 while the extreme range stands at 25,900-26,500.

Intraday support zone on the two indices, Nifty and Bank Nifty reside at the mark of 10,650 and 26,050.

The intraday profit booking zone on the two indices lies between 10,775-10,825 and 26,375-26,475 respectively.

Traders are advised to reduce their buying positions if Nifty and BankNifty closes below the mark of 10,600 and 26,050.

Buy and Sell Strategy on Nifty

Sell Nifty with a stop loss of 10,825 and target of 10,700, 10,675, 10,650.

Buy Nifty in the range of 10,650-10,700 with a stop loss of 10,600 and target of 10,750, 10,775, 10,800.

#RBIBoardMeet | 9 घंटे की #RBI मैराथन बैठक का पूरा विश्लेषण और इसका बाज़ार पर असर समझिए अनिल सिंघवी से।@AnilSinghviZEE @amitdutta09 @SwatiKJain @SumitResearch @dkalra81 @deepaliranaa @12_AparnaRoy pic.twitter.com/8aJzONuiqq

— Zee Business (@ZeeBusiness) November 20, 2018

Buy and Sell Strategy on BankNifty

Sell BankNifty with a stop loss of 26,500 and target of 26,200, 26,150, 26,050, 25,900.

Buy BankNifty in the range of 25900-26050 with a stop loss of 25,750 and target of 26,150, 26,200.

The put-call ratio (PCR) stands at 1.73 and the volatility index (VIX) is 19.25.

Sectors:

Positive: Cement buy on dips

Negative: Banks, Metals

Enters F&O ban: Jet Airways, PC Jewellers

Out of ban: Nil

Already in F&O ban: Adani Power, Adani Enterprises

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

PPF For Regular Income: How you can get Rs 78,000 a month tax-free income through Public Provident Fund investment?

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

09:01 AM IST

Anil Singhvi Market Strategy December 26: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 26: Important levels to track in Nifty50, Nifty Bank today Santa Pick by Anil Singhvi for long term: Market wizard bullish on this smallcap IT services stock

Santa Pick by Anil Singhvi for long term: Market wizard bullish on this smallcap IT services stock Anil Singhvi Market Strategy December 24: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 24: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 23: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 23: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today