After coronavirus pandemic, there is a change in the nature of consumers, says Uday Kotak

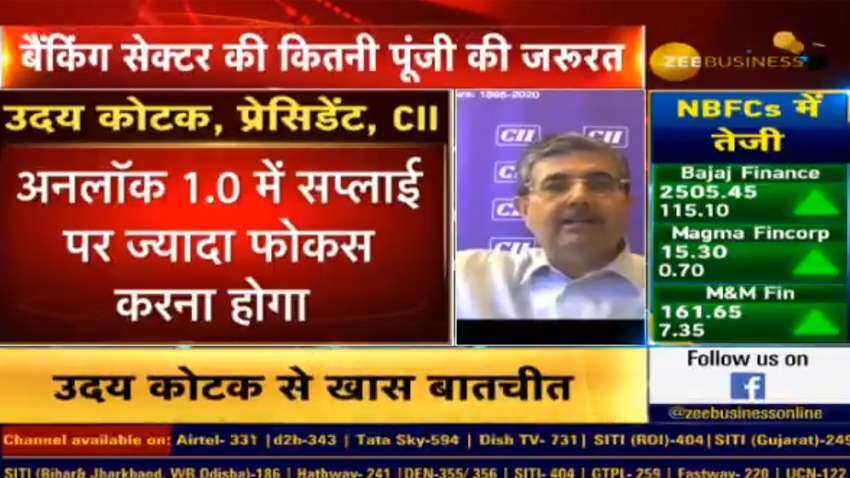

One of the leading private bankers in the country, Uday Kotak, Managing Director & CEO, Kotak Mahindra Bank Limited, on Monday spoke to Zee Business on a number of topics - how the industry will change after coronavirus, how firms will reduce input costs, importance of digital infra in the wake of COVID-19, and steps needed for employment security.

One of the leading private bankers in the country, Uday Kotak, Managing Director & CEO, Kotak Mahindra Bank Limited, on Monday spoke to Zee Business on a number of topics - how the industry will change after coronavirus, how firms will reduce input costs, importance of digital infra in the wake of COVID-19, and steps needed for employment security.

Talking to Zee Business, Uday Kotak said, "Saving people's lives is an important responsibility as there is a sense of fear in people's mind due to COVID 19. Coronavirus has hit the economy very badly, and in unlock 1.0, the government is more focussed on supply. Moreover, the government has to take more steps to increase supply. Also, migrant crisis is a big issue. We need major steps for employment security."

Moreover, Kotak said, "Now, FMCG demand has increased, and we have to focus on supply in unlock 1.0...also, financial help should be given to people of BPL category. After corona, there is a change in the nature of consumers as now they are spending only on the basis of their needs."

Further, Kotak said, "Business strategy needs to be changed. Aviation, hotel and tourism are the three sectors which have been hit the most by corona..business in these sectors is challenging. The trades which have more input costs will face more problems."

Talking about the banking sector, Kotak said, "Banking sector needs capital of around Rs 4 lakh to Rs 5 lakh crores. Government has to infuse more capital in PSU banks...funds should be gathered from private banks and NBFCs."

Speaking about loan moratorium, Kotak said, "Interest waiver on the 6 months loan moratorium will increase problems. Government and the Supreme Court should resolve this together. Interest waiver will increase problems in the financial sector."

#ZBizExclusive | लॉकडाउन खुलने पर डिमांड में बढ़ोतरी होगी, सप्लाई पर फोकस करना होगा : उदय कोटक, प्रेसिडेंट, CII

देखिए पूरा इंटरव्यू: https://t.co/hQT2OPcwVj#ZBizExclusive #CII #UdayKotak @SwatiKJain @udaykotak @FollowCII @CIIEvents pic.twitter.com/re27YVv7jh

— Zee Business (@ZeeBusiness) June 8, 2020

Recently, Uday Kotak sold 2.83 per cent of the promoter group's holding in the private sector lender Kotak Mahindra Bank for Rs 6,944 crore. The deal came within days of the bank raising over Rs 7,400 crore through a qualified institutional placement (QIP) of shares over the weekend. The promoter holding in the bank had come down a tad over 1 per cent from 29.8 per cent after the QIP issue.

Also, the Confederation of Indian Industry (CII) had announced its new office-bearers for the year 2020-21. Uday Kotak has assumed office as the President of CII for 2020-21. He takes over from Vikram Kirloskar, Chairman and Managing Director of Kirloskar Systems Ltd., and Vice Chairman of Toyota Kirloskar Motor.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

06:25 PM IST

Kotak-linked NBFC donated not Rs 600 million but Rs 1.3 billion in electoral bonds

Kotak-linked NBFC donated not Rs 600 million but Rs 1.3 billion in electoral bonds Uday Kotak resigns as MD and CEO of Kotak Mahindra Bank; Dipak Gupta takes interim charge

Uday Kotak resigns as MD and CEO of Kotak Mahindra Bank; Dipak Gupta takes interim charge IL&FS resolves Rs 52,200 cr debt, to address Rs 4,800 cr more by March: Uday Kotak

IL&FS resolves Rs 52,200 cr debt, to address Rs 4,800 cr more by March: Uday Kotak Government extends Uday Kotak's term as IL&FS chairman by 6 months

Government extends Uday Kotak's term as IL&FS chairman by 6 months Border issue with China has created a strong resolve to build domestic capacity: Uday Kotak

Border issue with China has created a strong resolve to build domestic capacity: Uday Kotak