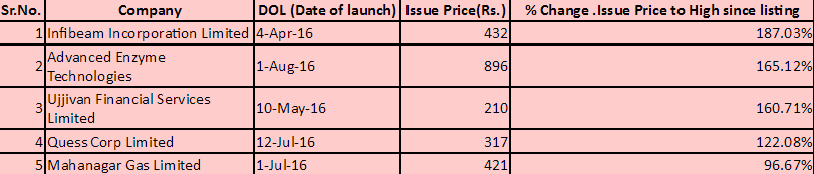

5 IPOs that gave over 100% return in 2016

2016 has been a good year for companies wanting to list on stock markets to raise money. With over 80 initial public offerings (IPOs) hitting the Indian markets, over Rs 26,000 crore was raised this year.

In terms of funding, 2016 was the best one since 2010 and was double to that of 2015.

"Marketmen say that while the first nine months of 2016 saw strong activity in the primary market, weakness started trickling into the secondary market from September and the activity has been slow in the past two months", PTI said.

Looking at the performance of these companies, here are five companies, that gave more than 100% returns in 2016.

ALSO READ: 83 IPOs hit Indian market, raised $3.8 billion in 2016: EY

Infibeam Incorporation: E-commerce company Infibeam Incorporation focuses on developing an integrated and synergistic e-commerce business model.

It was listed at 6% premium from its issue price on April 4, 2016. Its issue price was Rs 432 per share. On November 28, the company touched 52-week high of Rs 1,240 per share.

This means that the company gave returns of 187.03% to its investors.

Advanced Enzyme Technologies Limited: Advanced Enzyme Technologies is engaged in research, development, manufacturing and marketing of Healthcare, Nutrition and Bio-Processing products.

The company was the eighth IPO of the year and was listed on August 8, 2016 with the issue price at Rs 896 per share. On October 25, the company touched 52-week high at Rs 2,377 per share, giving returns of 165.12%.

Ujjivan Financial Services Limited: Micro-finance Services major Ujjivan Financial provides collateral free, small ticket-size loans to economically weak women.

It was listed at Rs 232 per share on May 10, 2016, at a premium of 10.47% from its issue price at Rs 210 per share. On August 27, the company touched its 52-week high at Rs 547 per share giving returns of 160.71% in just three months of listing.

Quess Corp Limited: Thomas Cook backed company, on its first day of listing on stock exchanges, debuted with a 57% premium over its issue price of Rs 317 per share. According to NSE data, its IPO was the most oversubscribed in nine years.

On November 29, the shares of the company touched 52-week high at Rs 702.20 per piece, giving returns of 122.08% to its investors.

Mahanagar Gas Limited: Joint venture of GAIL and British Gas, Mahanagar Gas is a sole authorised distributor of CNG and piped natural gas in Mumbai and near-by areas.

On its first day of listing, the company made its debut at Rs 540, a 28% premium from its issue price of Rs 421 per share. On November 28, the company touched its 52-week high at Rs 899 per piece, giving returns of 97% to its investors.

ALSO READ: Six out of seven IPOs in FY17 listed at a premium

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI Senior Citizen FD Rates: Want to invest Rs 3,00,000 in SBI FD? You can get this much maturity amount in 1 year, 3 years, and 5 years

5 Stocks to Buy: Varun Beverages, ICICI Bank, Godrej Consumer, and 2 others for up 67% upside; check out long-term targets

EPS Pension Calculation: Rs 40,000 basic salary, 30 years of service, what will be your monthly EPS pension amount?

Retirement Planning: How one-time investment of Rs 11,00,000 can create a Rs 3,30,00,000 retirement corpus

SBI vs PNB vs BoB- 5 year FD Scheme: Which bank can give you higher return on Rs 1 lakh and Rs 2 lakh investment?

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 45,000, or Rs 55,000? Know what can be your total pension as per latest DR rates

Income Tax Calculations: Is your annual salary Rs 6.75 lakh, Rs 9.25 lakh, Rs 14.50 lakh, or Rs 18.50 lakh? Know how much tax you will pay in old and new tax regimes

10:26 AM IST

83 IPOs hit Indian market, raised $3.8 billion in 2016: EY

83 IPOs hit Indian market, raised $3.8 billion in 2016: EY Here's the profit you made in this year's top 5 IPOs

Here's the profit you made in this year's top 5 IPOs Six out of seven IPOs in FY17 listed at a premium

Six out of seven IPOs in FY17 listed at a premium  IPOs at 9-year high; raises Rs. 5,855 crore in Q1FY17

IPOs at 9-year high; raises Rs. 5,855 crore in Q1FY17 IPOs weapon of choice for companies looking to raise money

IPOs weapon of choice for companies looking to raise money