Sensex ends above 31,000 for the first time; HPCL up 12% post Q4 result

Indian markets may open in green on Friday after an agreement by OPEC to extend existing supply curbs disappointed many who had hoped for larger cuts.

On Thursday, Sensex closed higher by 448.39 points or 1.48% at 30,750.03, while Nifty finished at 9,509.75 up 149.20 points or 1.59%.

The broader market snapped six-session long losing streak to gain 1.4% and 2%, respectively. The market breadth, indicating the overall health of the market, was strong. On BSE, 1,881 shares rose and 801 shares fell. A total of 147 shares were unchanged NSE cash turnover was at Rs. 35,117 crore.

Indian markets may open in green on Friday after an agreement by OPEC to extend existing supply curbs disappointed many who had hoped for larger cuts.

On Thursday, Sensex closed higher by 448.39 points or 1.48% at 30,750.03, while Nifty finished at 9,509.75 up 149.20 points or 1.59%.

The broader market snapped six-session long losing streak to gain 1.4% and 2%, respectively. The market breadth, indicating the overall health of the market, was strong. On BSE, 1,881 shares rose and 801 shares fell. A total of 147 shares were unchanged NSE cash turnover was at Rs. 35,117 crore.

Latest Updates

The Dalal Street touched new high with Sensex crossing over 31,000-mark for the first time and Nifty nearing 9,600-level.

Sensex closed at 31,028.21 above 278 points or 0.90%, while Nifty 50 finished at 9,580.45 up by 70.70 points or 0.74%.

Top gainers involved Tata Steel taking the lead at Rs 511.50 a piece up 5.40%, followed by Reliance Industries at Rs 1338 a piece (2.69%), Power Grid at Rs 203.80 a piece (2.57%), Asian Paints at Rs 1134.80 a piece (2.02%) and ITC at Rs 305.55 a piece (1.95%).

Losers involved Sun Pharma at Rs 566 a piece down 4.36%, Cipla at Rs 489.50 a piece (2.90%), Cipla at Rs 489.50 a piece (2.28%), Lupin at Rs 1112 a piece (2.28%) and TCS at Rs 2571.05 a piece (1.87%).

Sun Pharma also clocked a 52-week low of Rs 564.90 a piece in intra-day trading ahead of Q4 results.

Hindustan Petroleum Corporation Ltd (HPCL) surpassed analysts estimates by reporting a whopping 31% rise in its net profit for the fourth quarter ended March 31, 2017 result.

HPCL posted net profit of Rs 1,818.79 crore, a rise of 31.04% from Rs 1,387.91 crore in the corresponding period of the previous year. Q4FY17 net profit also increased by 9.77% from Rs 1,656.81 crore in the preceding quarter.

A Bloomberg poll expected net profit of HPCL at Rs 1,170 crore this Q4.

Share price of HPCL climbed over Rs 60.75 or 11.93% on BSE, trading at Rs 568.05 per piece.

Tata Chemical on Friday reported nearly 32% rise in its consolidated net profit for the fourth quarter ended March 31, 2017.

The company posted net profit of Rs 343.02 crore in Q4, growing by 31.82% compared to Rs 260.21 crore in the corresponding period of the previous year.

However, total income stood at Rs 3079.47 crore, declining by 14.88% from Rs 3618.14 crore recorded a year ago same period.

At 1325 hours, the company was trading at Rs 614.95 per piece on BSE, down 0.23%. However, when the result was announced Tata Chemical's share price surged by nearly 2%.

After declining by nearly 10% in the previous trading, Raymond shares saw some sign of relief on Friday.

At 1143 hours, Raymond of was trading at Rs 712 per piece on BSE, surging by Rs 32 points or 4.68%.

Investors boosted the stocks after when Raymond on Friday called IiAS report media speculation is based on incorrect and incomplete information and not been understood in a correct manner.

Raymond said, "We adhere to the highest level of corporate governance. Consequently and given that offer required to be made by the company under the tripartite agreement pertaining to JK House is a related party transaction which is in not in the ordinary course of business, the Raymond audit committee and board of directors have, based on legal advice and fiduciary duty to the shareholders, deferred the matter to shareholders for decision."

Institutional Investor Advisory Services (IiAS) on May 24, 2017, criticized textile major Raymond for its move to sell J.K House to promoters.

IiAS estimated that the move will cost over Rs 650 crore in opportunity lost and thus IiAS askedshareholders to vote against a resolution in the upcoming meeting held on June 05, 2017.

On Thursday, the stock plummeted 9.83% to Rs 598.10 on BSE.

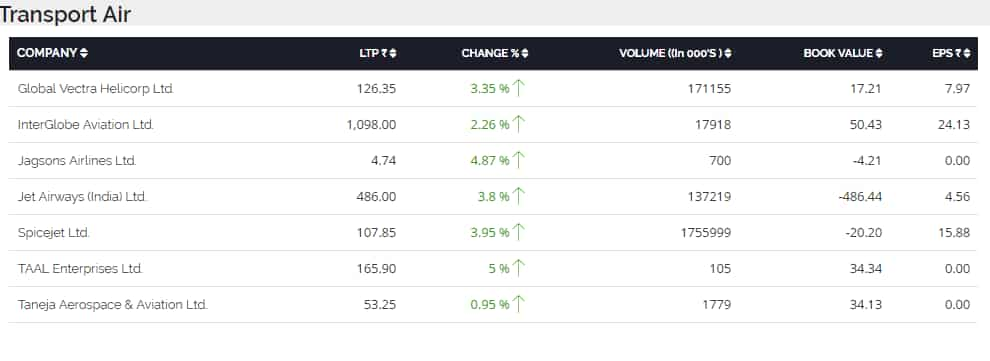

Share price of aviation stocks were trading on a higher note on both Sensex and Nifty as crude prices dropped after an agreement by OPEC to extend the extending supply cuts of 1.8 million barrels per day by end of first quarter of 2018.

Following which investors boosted stocks of SpiceJet, Jet Airways and Interglobe Aviation.

On BSE, SpiceJet was trading at Rs 108.15 a piece up Rs 4 or 4.24%, while Jet Airways soared over Rs 18 or 3.97% trading at Rs 486.80 a piece.

Interglobe Aviation surged over Rs 23 or 2.22% on the index, trading at Rs 1097.50 a piece.

Top gainers on BSE involved - Tata Steel trading at Rs 505.80 a piece up 4.22%, Adani Ports at Rs 349.60 a piece (2.60%), Power Grid at Rs 203.50 a piece (2.42%), Asian Paints at Rs 1138.40 a piece (2.31%) and Bharti Airtel at Rs 377.75 a piece (2.22%).\

Losers were - Cipla at Rs 490.90 a piece (2.62%), TCS at Rs 2592.05 a piece (1.14%), Hindustan Unilever at Rs 1036.55 a piece (0.64%), State Bank of India at Rs 288.60 a piece (0.48%) and HDFC Bank at Rs 1610 a piece (0.44%).

Key events to watch:

Major companies that will be announcing their fourth quarter ended March 31, 2017, results are - Crompton Greaves, Hindustan Petroleum Corp Limited, ITC, NBCC, Tata Chemical and ONGC.

Stocks of the above mentioned companies will be in focus during Friday's trading session.

The Dalal Street made a mixed opening on Friday with Nifty 50 trading below 9,500-mark.

At 9.21 am, where Sensex index soared over 39 points or 0.13% trading at 30,789.61, Nifty 50 slumped by 11 points or 0.12% trading at 9,498.50

For Nifty, analysts at Motilal Oswal said, "It has almost engulfed the price consolidation of last five trading sessions and closed strongly above 9500 mark. Now it has to hold above 9450 zone to witness an up move towards 9550 and 9600 zone while on the downside supports are seen at 9420 and 9380."

They added, "Overall results related reactions, expectation of positive monsoon, govt action in sectors like infra, defence, banking and sanguine global cues could help maintain momentum in short term."

Stocks in focus will be:

Indian Oil Corp: State-owned IOC registered a whopping 85% rise in its net profit for the fourth quarter ended March 31, 2017 result. The company posted net profit of Rs 3,720.62 crore, a rise of 85.48% from Rs 2,005.89 crore in the corresponding period of the previous year.

Ashok Leyland: Commercial vehicle major Ashok Leyland on Thursday announced its financial results for the quarter ended on March 31. The company reported a net profit of Rs 476 crore, as against a net loss of Rs 141 crore during the same period last year.

Britannia Industries: The company posted nearly 6% rise in consolidated net profit for the fourth quarter ended March 31, 2017 period. The company registered net profit of Rs 210.91 crore, rising by 5.96% compared to Rs 199.03 crore in the corresponding period of the previous year.

However, Q4FY17 dropped by 4.32% from Rs 220.44 crore of the preceding quarter.

Bajaj Hindustan: The company reported net profit of Rs 259 crore in its Q4, rising by 100% yoy and that of sales were at Rs 1690 crore declining by 3.5% yoy.

Larsen & Toubro: In media reports, it was stated that L&T plans to begin switchgear ops sale process for Rs 2500 crore. Companies like Mitsubishi, Panasonic, Hitachi, Honeywell have submit their expression of interest

Indian markets may open in green on Friday after an agreement by OPEC to extend existing supply curbs disappointed many who had hoped for larger cuts.

On Thursday, Sensex closed higher by 448.39 points or 1.48% at 30,750.03, while Nifty finished at 9,509.75 up 149.20 points or 1.59%.

The broader market snapped six-session long losing streak to gain 1.4% and 2%, respectively. The market breadth, indicating the overall health of the market, was strong. On BSE, 1,881 shares rose and 801 shares fell. A total of 147 shares were unchanged NSE cash turnover was at Rs. 35,117 crore.