Sensex live today: Index settles volatile session lower; Tata Steel top loser

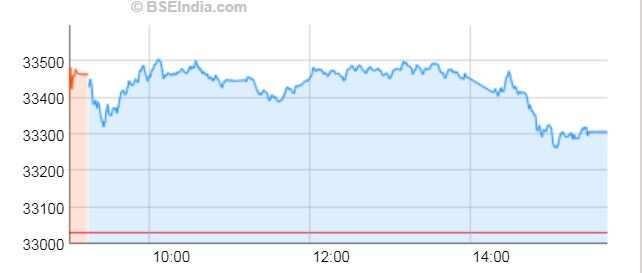

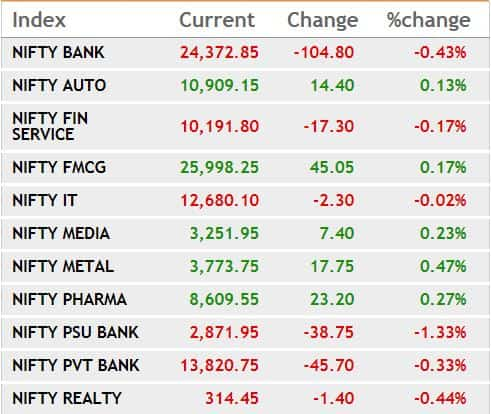

Sensex today: In a volatile trading session, the benchmark indices settled lower, paring all intraday gains, led by losses in banking and metal stocks. Mixed trend in global markets after investors reacted to President Donald Trump's decision to impose global duties on metal imports, also impacted the sentiment. The Sensex ended at 33,307, down 44.43 points, while the broader Nifty50 closed at 10,226, down 15.80 points.

Analysts feel that domestic markets have largely discounted global cues, but added that the uncertainty around the tariff on steel and aluminium imports proposed by Trump could have a short-term impact on steel companies.

“I would definitely avoid steel stocks at the moment because of global uncertainties but also the valuations are too high,” told Rudramurthy, managing director at Vachana Investments to Reuters.

Meanwhile, world shares hit a one-week high on Friday before easing a touch, as caution ahead of jobs data in the United States outweighed a potential breakthrough in nuclear tensions over the Korean peninsula. The MSCI All-Country World index, which tracks shares in 47 countries, was 0.1 per cent higher and set for a weekly gain of almost 2 per cent. However, European markets were trading mixed. The pan-European STOXX 600 was down 0.1 per cent, with most sectors in the red except for defensive industries such as healthcare or utilities, which made limited gains. Germany’s DAX was down half a per cent and France’s CAC 40 was down 0.2 per cent. Britain’s FTSE 100 was up 0.1 per cent.

Sensex today: In a volatile trading session, the benchmark indices settled lower, paring all intraday gains, led by losses in banking and metal stocks. Mixed trend in global markets after investors reacted to President Donald Trump's decision to impose global duties on metal imports, also impacted the sentiment. The Sensex ended at 33,307, down 44.43 points, while the broader Nifty50 closed at 10,226, down 15.80 points.

Analysts feel that domestic markets have largely discounted global cues, but added that the uncertainty around the tariff on steel and aluminium imports proposed by Trump could have a short-term impact on steel companies.

“I would definitely avoid steel stocks at the moment because of global uncertainties but also the valuations are too high,” told Rudramurthy, managing director at Vachana Investments to Reuters.

Meanwhile, world shares hit a one-week high on Friday before easing a touch, as caution ahead of jobs data in the United States outweighed a potential breakthrough in nuclear tensions over the Korean peninsula. The MSCI All-Country World index, which tracks shares in 47 countries, was 0.1 per cent higher and set for a weekly gain of almost 2 per cent. However, European markets were trading mixed. The pan-European STOXX 600 was down 0.1 per cent, with most sectors in the red except for defensive industries such as healthcare or utilities, which made limited gains. Germany’s DAX was down half a per cent and France’s CAC 40 was down 0.2 per cent. Britain’s FTSE 100 was up 0.1 per cent.

Latest Updates

Vinod Nair, Head of Research, Geojit Financial Services

Market started off in a positive territory but absence of major triggers to maintain the upward trend influenced investors to sell on rally. Global trade fears continue to pull the domestic metal index while weakening trend on rupee supported IT companies. Market participants are cautiously awaiting CPI & IIP data. Inflation is expected to come down to 4.74% in February which will ease bond yield in the near term.

FAST MONEY: Key intraday trading calls

Shree Renuka (Buy)

Target: Rs 16.2

Stoploss: Rs 15.4

- Board entered into a deal with banks for re-structuring

- Stock jumped above 200-DEMA on daily chart

- Board signs restructuring agreement with banks.

Wall Street on Thursday

The three major US stock indexes closed higher on Thursday after President Donald Trump appeared to soften his stance on trade tariffs, easing trade war fears that had had the market on edge for a week.

Trump announced import tariffs on steel and aluminum but said Canada and Mexico would be exempt and that other countries could apply for exemptions, although details of when they would be granted were thin.

The Dow Jones Industrial Average rose 93.85 points, or 0.38 percent, to close at 24,895.21, the S&P 500 gained 12.17 points, or 0.45 percent, to 2,738.97 and the Nasdaq Composite added 31.30 points, or 0.42 percent, to 7,427.95.

Asia shares jump as Trump agrees to meet North Korea leader

Asian shares rallied and the safe-haven yen eased on Friday after North Korean leader Kim Jong Un offered to stop nuclear and missile testing and U.S. President Donald Trump agreed to a meeting that could come before May. South Korea’s national security adviser made the announcement at the White House, after delivering a letter from Kim. Trump’s aides have been wary of North Korea’s diplomatic overtures because of its history of reneging on international commitments.

The chance of any easing in geopolitical tensions in the region helped Japan’s Nikkei climb 2.3 percent. South Korean stocks enjoyed their best day since May with a rise of 1.76 percent.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6 percent, while Australia firmed 0.5 percent.