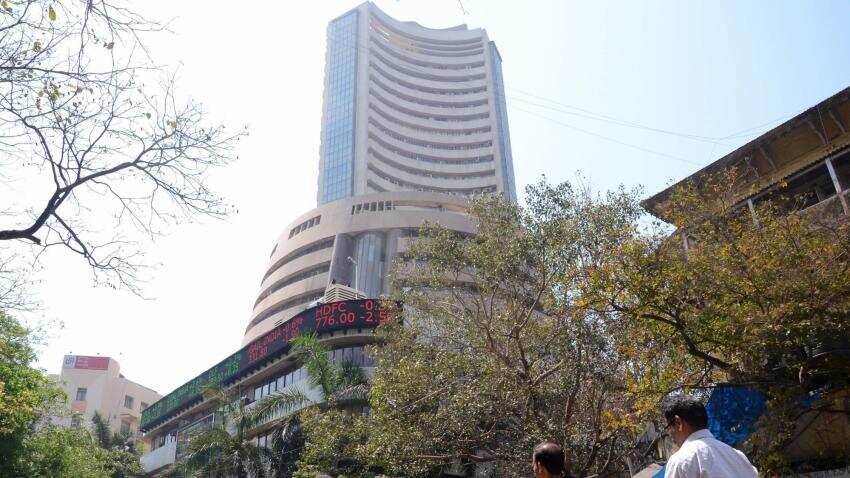

Sensex ends above 290 points; Nifty up 1.08%; Gail India gains over 3%

Indian markets may open between flat to negative amid weak global cues and corporate earning season.

Last week, markets after opening beween flat to positive have been giving away their gains by end of the trade.

On Friday, Sensex closed at 29,365.30 below 57.09 or 0.19%, while Nifty 50 finished at 9,119.40 down 17 points or 0.19%.

If Nifty sustains above 9120 level then traders could expect positive move in the Nifty towards 9180 followed by 9240 level. If Nifty trades below 9120 level for first hour of trade then traders may see down move, which could take Nifty towards 9050 level followed by 9020 level.

Indian markets may open between flat to negative amid weak global cues and corporate earning season.

Last week, markets after opening beween flat to positive have been giving away their gains by end of the trade.

On Friday, Sensex closed at 29,365.30 below 57.09 or 0.19%, while Nifty 50 finished at 9,119.40 down 17 points or 0.19%.

If Nifty sustains above 9120 level then traders could expect positive move in the Nifty towards 9180 followed by 9240 level. If Nifty trades below 9120 level for first hour of trade then traders may see down move, which could take Nifty towards 9050 level followed by 9020 level.

Latest Updates

Indian markets closed on higher note during Monday's trading session as few sectors like auto, banking, realty, capital goods and finance sector saw rally in their stocks.

Sensex finished at 29,655.84 soaring over 290 points or 0.99%, while Nifty closed at 9,217.95 above 98 points or 1.08%.

Top gainers on BSE were - Gail India at Rs 413.20 per piece (3.17%), followed by Axis Bank at Rs 498.20 per piece (2.25%), Larsen & Toubro at Rs 1,730 per piece, HDFC Bank at Rs 1,532.75 per piece and Maruti Suzuki at Rs 6,316.55 per piece (1.82%).

Among losers were - Lupin at Rs 1,362.15 per piece down 3.13%, followed by Cipla at Rs 556.10 per piece (1.30%), NTPC at Rs 166.20 per piece (0.51%), Power Grid at Rs 205 per piece (0.29%) and Wipro at Rs 491.80 per piece (0.28%).

Shares of Ultratech Cement climbed nearly 5% despite reporting 11% drop in consolidated net profit for the fourth quarter ended March 31, 2017 result.

At 1402 hours, Ultratech Cement soared over Rs 171 or 4.37% on BSE, trading at Rs 4,163 per piece.

The company reported consolidated net profit of Rs 725.90 crore in Q4, a decline of 11.27% compared to Rs 818.11 crore in the corresponding period of the previous year.

Consolidated sales stood at Rs 6,922 crore, growing by 3% from Rs 6,747 crore in the similar period of the previous year.

On standalone front, the company reported net profit of Rs 688 crore also down 11.84% on year-on-year (YoY) basis. On the other hand, net sales was at Rs 6,500 crore, increasing by 2.65% on yoy basis.

In it's meeting held on Monday, the board of directors recommended a dividend of 100% at the rate of Rs 10 per share of face value of Rs 10 each aggregating Rs 274.51 crores.

Reliance Communication on Monday received shareholders approval with 99.99% majority for the demerger of wireless business into Aircel Limited.

The share holders have approved demerger of Rcom's wireless division and Reliance Telecom Limited (RTL), a wholly owned subsidiary of the Company into Aircel Limited and Dishnet Wireless Limited (the Scheme).

RTL's shareholders have also approved the scheme in a meeting held on Monday. While Aircel shareholders approved the scheme on April 22, 2017.

RCom said, "The transaction will reduce the company's debt and deferred spectrum liability by Rs 20,000 crore or over 40% of total debt and Aircel debt by Rs 4,000 crore or over 22% of total debt on closing."

Shares of Reliance Communication were trading at Rs 34.40 per piece on BSE, up 1.47%.

Shares of JSW Holding jumped over 3% after when the company reported nearly 18% rise in its standalone net profit for fourth quarter ended March 31, 2017.

The company reported standalone net profit of Rs 7.16 crore in Q4, rising by 17.76% from Rs 6.08 crore in the corresponding period of the previous year.

Standalone total revenue stood at Rs 10.36 crore, growing by 17.32% compared to Rs 8.83 crore in the similar period of previous year.

For FY17, consolidated net profit stood at Rs 48.20 crore, while total revenue was at Rs 63.35 crore.

At 1337 hours, share price of JSW Holding surged over Rs 47 or 3.10% on BSE, trading at Rs 1,588.50 per piece.

Hexaware Technology on Monday reported a whopping 36% rise in consolidated net profit for the quarter ended March 31, 2017.

The company reported net profit of Rs 1,139 crore, which was a growth of 35.9% year-on-year (YoY) but was down by 7.4% quarter-on-quarter (QoQ) basis.

Consolidated revenue stood at Rs 9,605 crore, growing by 17.1% yoy and 2.1% qoq.

Constant currency revenue stood at $144.6 million in Q1, up 19.9% yoy and 4% qoq.

Atul Nishar, Chairman, Hexaware Technologies said, "We commence calender year 2017 on a positive note, with a sustained revenue and EBIT growth of 19% and 41.2% yoy respectively in USD terms. This is driven by our Shrink IT Grow Digital strategy where we are enabling clients to reimagine their business, shrink IT costs and accelerate digital transformation."

After the result announcement, share price of Hexaware jumped over 4.17% or Rs 9 trading at Rs 224.55 per piece.

HCL Technologies on Monday announced an agreement to acquire Urban Fulfillment Services (UFS) - a provider of mortgage business process and fulfillment services.

Anoop Tiwari, Corporate Vice President and Global Head - Business Services of HCL Technologies said, "The acquisition of UFS strengthens HCL's capabilities in mortgage BPO services, loan fulfillment and debt servicing space."

HCL will acquire 100% stake in UFS. Total cash consideration for this transaction is upto $ 300 million including contingent payments subject to certain financial milestone.

Shares of HCL Tech was trading at Rs 821 per piece on BSE, up Rs 8 or 1.04%.

Shares of JHS Svendgaard Laboratories touched a 52-week high of Rs 58.70 per piece after when the company said it has settled an on-going disputes.

At 1120 hours, share price of JHS was trading at Rs 56.35 above Rs 3.50 or 6.62% on BSE.

In a BSE filing, JHS said, "The on-going disputes at various courts between the JHS Svendgaard and various group companies of Procter & Gamble Inc have been settled with mutual consent and concluded positively for JHS."

Settlement clears contingent liabilities to the tune of Rs 206.15 crore from the balance sheet of JHS.

Further JHS said, "The company's management expects that the new expansion plan underway shall also be operational by June 2017 and shall positively add to the growth of JHS in coming years."

Divi's Laboratories hit a 52-week low of Rs 607 per piece on Monday's early trade, after when the company announced that the US drug regulator has issued a warning letter for it's Unit-II at Visakhapatnam.

At 1019 hours, the share price of Divi's Lab was trading at Rs 623 per piece down Rs 8 or 1.24% on BSE.

In a BSE filing, Divi's said, "The company responded to the US-FDA inspection observation with an appropriate remediation process to overcome the deficiencies observed. A part of our commitments, we have also provided periodic updates to the USFDA."

The USFDA in the import alert letter issued has exempted several products manufactured at Divi's Unit-II. For which Divi's said, "We will continue to supply the active ingredients to meet its obligations to our customer."

"Divi's along with external consultants is working to address the concerns of USFDA and will respond to this warning letter with a detailed plan within stipulated time," the company said in the statment.