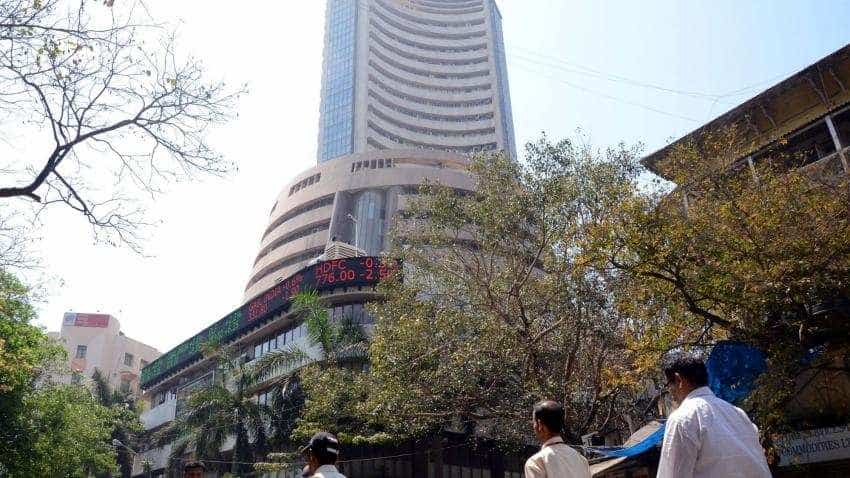

Live Market: Sensex ends 294 pts below, Nifty down 99 pts; HUL, Yes Bank, Wipro gainers

Dalal Street saw positive movement in today’s trading session, with both Sensex and Nifty 50 opening higher by 0.06% and 0.10% respectively. However, this breather was short lived, as at around 09:57 hours, Sensex was trading at 37,561.81 down by 23.70 points or 0.06%, while Nifty 50 plunged by 9.40 points or 0.08% trading at 11,368.35. The fact is that Sensex and Nifty 50 have been seeing heavy selling pressure in recent weeks.

Top gainers on BSE are - Hindustan Unilever at Rs 1652.30 per piece up by 3.07%, followed by Yes bank Rs 324 per piece up by 1.69%, Asian paints at Rs 1324.45 per piece up by 1.47%, ONGC at Rs 173.65 per piece up by 1.58%, SUNPHARMA at Rs 654.45 per piece up by 1.29%

Lossers on BSE are- Vedanta ltd at Rs 230.60 per piece low by 1.73%, Powergrid at Rs 198.35 per piece low by 1.56%, TATA MOTORS at Rs 257 per piece low by 1.23%, SBIN at Rs 282.40 per piece low by 1.10%, BAJAJ-AUTO at Rs 2831 per piece low by 0.95%

Dalal Street saw positive movement in today’s trading session, with both Sensex and Nifty 50 opening higher by 0.06% and 0.10% respectively. However, this breather was short lived, as at around 09:57 hours, Sensex was trading at 37,561.81 down by 23.70 points or 0.06%, while Nifty 50 plunged by 9.40 points or 0.08% trading at 11,368.35. The fact is that Sensex and Nifty 50 have been seeing heavy selling pressure in recent weeks.

Top gainers on BSE are - Hindustan Unilever at Rs 1652.30 per piece up by 3.07%, followed by Yes bank Rs 324 per piece up by 1.69%, Asian paints at Rs 1324.45 per piece up by 1.47%, ONGC at Rs 173.65 per piece up by 1.58%, SUNPHARMA at Rs 654.45 per piece up by 1.29%

Lossers on BSE are- Vedanta ltd at Rs 230.60 per piece low by 1.73%, Powergrid at Rs 198.35 per piece low by 1.56%, TATA MOTORS at Rs 257 per piece low by 1.23%, SBIN at Rs 282.40 per piece low by 1.10%, BAJAJ-AUTO at Rs 2831 per piece low by 0.95%

Latest Updates

The equity benchmark Sensex extended its fall for a fifth straight session Tuesday, making it the longest losing spree in over three months as concerns persist on multiple fronts in the form of rising crude prices, tumbling rupee and ongoing global trade tiff.

Watch Zee Business video here:

S&P BSE SENSEX shuts by sliping at 294.84 per piece low upto 0.78%, whereas Nifty50 at 11,278.90 per piece low upto 0.87% for today,

Metal stocks turns red, S&P BSE METAL was at Rs 13915.83 per piece low by nearly 0.95% with the previous close of Rs 14049.59 at around 1457 hrs.

Top gainers in metal stocks on BSE are- Hindzinc at 302.05 per piece up by 1.16%, followed by TATA steel at Rs 616.20 per piece up by 0.11%.

Lossers list in metal stocks are Nation aluminium at Rs 68 per piece low by 2.79%, followed by Jindal steel at Rs 230.50 per piece low by 3.15%, Sail at Rs 75.80 low by 2.94% , Hindalco at Rs 234.94 low by 2.73%, Vedanta at Rs 230.05 per piece low by 1.96%.

Banking sector turns red, S&P BSE BANKEX was at Rs 29992.35 per piece low by nearly 1% with the previous close of Rs 30290.81 at around 1350hrs.

Top gainers in banking sectors on the INDEX are- YES bank at 327.95 per piece up by 2.93%, followed by HDFC Rs 2005.20 per piece up by 0.64%.

Watch Zee Business video here:

Losers list in banking sector are bank of Baroda being in a top of the list of losers with Rs 116 per piece by previous close of 135.10 which means around 14.14% low from previous close, followed by Punjab national bank at Rs 79.25 per piece low by 4.52%, SBIN at Rs 272.65 low by 4.53%, Federal bank at Rs 75.80 low by 2.45%, Axis Bank at Rs 616.40 low by 1.54%.

The Infrastructure Leasing & Financial Services (IL&FS) and its subsidiaries are currently in dire need of financial assistance, especially as its major shareholders bailed out on the company over a Rs 30 billion loan. This has forced the company to knock on the doors of the central government for support in this massive crisis that it is going through.

However, while IL&FS is trying to save itself from a default crisis, investors on stock exchanges today have removed their money from three of the company's subsidiaries.

IL&FS Transportation Network Ltd has taken the biggest hit compared to other subsidiaries of the group. The company slipped by nearly 7% with intraday low of Rs 25.45 per piece. However, at around 10:57 hours, the stock price was trading at Rs 26.10 per piece below Rs 1.15 or 4.22%.

The rupee was trading at 72.40 to the dollar, compared with Monday`s close of 72.51, while the 10-year benchmark bond yield fell to 8.07 percent from 8.10 percent at previous close, eyeing the currency market.

S&P500 E-mini futures were almost flat at 0.07 percent in Asian trade on Tuesday. The MSCI`s broadest index of Asia-Pacific shares outside Japan dropped 0.25 percent but Japan`s Nikkei bucked the trend to gain 1.6 percent.

A new merger of public sector banks (PSBs) has been announced and this time it would merge the third largest state-owned Bank of Baroda with two smaller lenders of government that are entangled in horrific amounts of stressed assets namely, Vijay Bank and Dena Bank. The merger decision was announced yesterday evening. Now that investors have gotten to react on the decision of government in today’s trading session, looks like they were not much pleased in Bank of Baroda stock price, on the other hand, they showed all their love for Vijaya Bank and Dena Bank.

On BSE, Bank of Baroda opened with an intraday low of Rs 116.5 per piece which took its stock price down by massive 13.76% in few minutes of trading session. However, at around 0926 hours, the stock price was trading at Rs 123.65 per piece down by Rs 11.45 or 8.48%.

Meanwhile, share price of Vijaya Bank opened by touching an intraday high of Rs 65.9 per piece rising by over 10.36%.

Going ahead, Dena Bank saw heavy buying in their stock price as it touched an upper circuit of Rs 19.10 per piece resulting in surge of nearly 19.75%.