G20 Conference: CEA Nageswaran says debt vulnerability affects developing and developed countries – Details!

CEA said the fact that the monetary policies adopted by several advanced economies have an impact on emerging economies and the responsibility lies on both of them to address such global economic issues.

Chief Economic Advisor Dr Anantha Nageswaran touched upon the issue of debt vulnerability by both emerging and advanced economies will be the focus of India. He pointed out that issues like spillover and debt vulnerability are no more confined to a single country, rather they are the challenges faced by countries across borders.

Nageswaran was addressing the 14th Annual International G20 Conference session on Tuesday organized by Indian Council for Research on International Economic Relations.

The chief economic advisor said the fact that the monetary policies adopted by several advanced economies have an impact on emerging economies and the responsibility lies on both of them to address such global economic issues.

According to Nageswaran, “Debt vulnerability is an issue that not just affects developing countries but also that are regarded as developed over the years”. He argued that the challenges imposed by debt vulnerability are also interlinked with global capital outflows.

As per CEA’s view, the challenge becomes even worse for the developing economies as they face the heat of spillovers as well as that of capital flows due to the advanced economies.

The situation gets complicated for emerging economies as the advanced economies are not curtailing or taking any measures on their capital flows, he added.

Nageswaran pointed out how the monetary policies of the last 20 years need to be studied to understand the shortfall while talking about measures of the Reserve Bank of India (RBI) and other central banks to address the spillovers from advanced economies.

When we talk about spillovers, we must consider the monetary policies of the last 20 years, the CEA further said. “Quantitative easing, zero interest rates, and minuscule rates, all of them glide up returns on safe assets.”

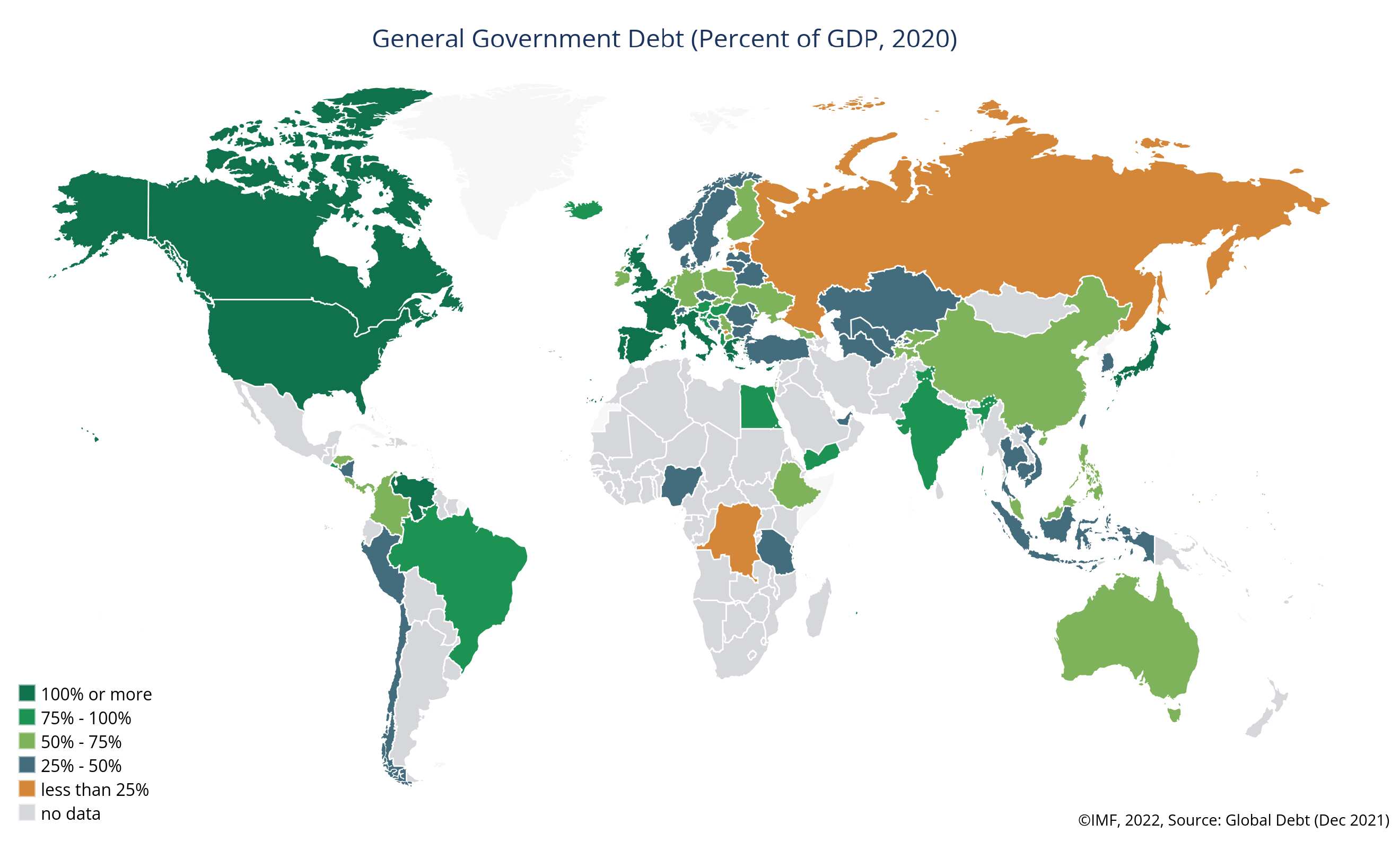

Global debt rose by 28 percentage points to 256 percent of GDP, in 2020, according to the latest update of the IMF’s (International Monetary Fund) Global Debt Database.

Borrowing by governments accounted for slightly more than half of the increase, as the global public debt ratio jumped to a record 99 percent of GDP.

Finance Minister Nirmala Sitharaman recently took up the matter of spillover during a meeting with IMF (International Monetary Fund).

She said that in the near-term, advanced nations should take the responsibility for the global spillover of their political and economic decisions and put in place safety nets rather than impose sanctions on nations, which are fulfilling their moral and democratic obligations to their people.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

PPF For Regular Income: How you can get Rs 78,000 a month tax-free income through Public Provident Fund investment?

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

09:07 PM IST

India only G20 nation to achieve climate targets, its efforts surprise world: PM Modi

India only G20 nation to achieve climate targets, its efforts surprise world: PM Modi G20 to work for advancing good governance

G20 to work for advancing good governance IMF, World Bank cite significant progress in debt restructuring cases

IMF, World Bank cite significant progress in debt restructuring cases Brazil's G20 presidency kicks off in Rio with foreign ministers meeting

Brazil's G20 presidency kicks off in Rio with foreign ministers meeting India got everybody to the table: EAM Jaishankar on unanimous adoption of G20 Declaration

India got everybody to the table: EAM Jaishankar on unanimous adoption of G20 Declaration