Fall in global currency highest in 20 years: Here's what it means for Indian economy

IMF data shows the fall was highest in the last 20 years recording more than a 6 per cent fall (Q-o-Q) in 2022, as it touched $12 trillion. The forex reserve fell by $4.85 billion to $532.66 billion for the week ending September 30.

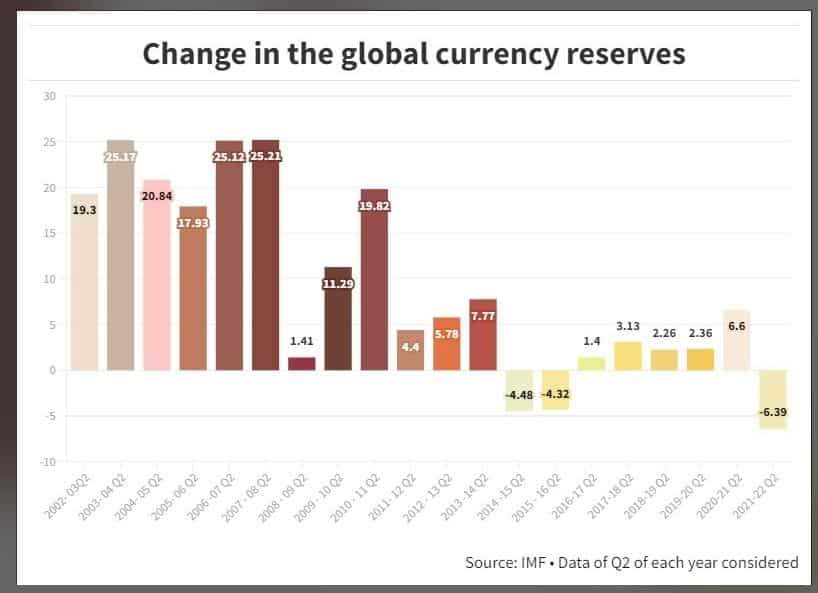

The fall in the global currency reserve in the second quarter of 2022 has been the highest as compared to the same quarter of the previous year, shows the recent data from the International Monetary Fund (IMF). According to various economists and forex experts, central banks worldwide have dipped into foreign exchange reserves to prevent sharp depreciation in their respective currencies.

The global currency reserves have mostly shown an upward trend over the years from quarter to quarter. But the drop was highest in the last 20 years recording more than a 6 percent fall (Q-o-Q) in 2022, as it touched $12 trillion. As pointed out by various economists, the reserves of most economies have fallen faster than the Lehmann Crisis and Taper Tantrum.

Contributing factors behind the fall

Major factors behind falling currency reserves are mostly stemming from a stronger dollar, stated various economists.

“On one side, dollar strengthening is leading to a decline in the value of the reserves. This is the valuation effect. On the other hand, most global currencies have been under pressure due to the rising dollar. As a result, central banks in several countries, most notably Japan and India, have been actively intervening in the foreign exchange market by selling dollars from their respective forex kitty,” added Aditi Gupta, economist, at Bank of Baroda.

Alongside, hopes of aggressive rate hikes by the Fed and increasing risks of a global recession have fuelled a risk-averse sentiment and have contributed to the recent strengthening of the dollar. This has further led to the fall of global currency reserves.

The currency reserve is going for funding of the higher oil and gas generally and partly back to US investments in their bonds which are now providing higher yields, added experts.

Impact on the Indian Economy

India also lost $ 57.7 billion during Lehmann and $ 21.6 billion during the Taper tantrum, but the loss has been much more for India recently. The forex reserve fell by $4.85 billion to $532.66 billion for the week ending September 30, according to data released by the Reserve Bank of India in the first week of October.

Although the country has a better forex reserve as compared to other countries but the vulnerabilities that India is likely to face can’t be ignored, asserted economists and forex analysts.

“India’s position in terms of FX reserves is fairly stable. FX reserves are enough to cover 9 months of import,” added Swati Arora, economist, HDFC Bank.

As a country, India is most vulnerable to a rise in oil prices as 83 per cent of the country’s oil is imported. So any rise in oil prices increases there will be an impact on the FEX reserves and accordingly there will be a hit on the rupee. “This time RBI had been continuously buying $ since 2020 and accumulated reserves worth $ 147 billion since then till September 21. It has been using those reserves judiciously to protect the rupee which has resulted in the lowest fall out for the currency as against many other Asian currencies which have fallen by 12-20 per cent,” added Anil Kumar Bhansali, Head Of Treasury, Finrex Treasury Forex.

Moreover, as per the latest RBI data, by end of June 2022, the ratio of India’s short-term debt to foreign exchange reserve was at 22 per cent which is lower compared to historical trends and thus there is no threat to external debt servicing.

RBI has sufficient arsenals left in its quiver to prevent any massive depreciation as in 2013 but increasing oil prices and falling exports will not change its direction, as per various economists.

Despite the falling reserve, India is likely to maintain a comparatively safer position. “Also India’s top 5 trade partners are the US, China, UAE, Hong Kong, and Singapore. These countries have comfortable import cover ratios. Hence, a fall in global forex reserve will not impact India,” added Dr. Sudarshan Bhattacharya, principal economist, of Yubi (formerly CredAvenue), a Corporate Debt Solution company.

Forex Reserves and Liquidity

The banking system liquidity in India has come down recently as part of RBI’s effort to absorb the excess liquidity from the banking system post-Covid-19. The RBI’s forex intervention has complemented other tools in mopping up excess liquidity from the banking system as RBI was selling the dollar and buying rupees in the forex market, according to economists.

“If RBI reduces the pace of forex intervention going forward then it will be able to absorb excess rupee liquidity from the banking system at a slower pace in which case there will be a build-up of excess liquidity in the banking system as government spending is expected to be significant in H2FY23 that will see higher banking system liquidity,” added Bhattacharya.

What lies ahead?

Extreme hawkishness by the Fed and the resultant dollar rally have led to the dwindling of reserves. Besides, most of the reserves are stored in treasuries and the MTM (market to market) on the same has been a huge drawdown.

“As the US bonds yields again start to fall, the Central banks reserves will automatically stop reducing and start getting bolstered even. 2-3 declining prints of inflation numbers and consequent pause to the hawkish commentary will see the reversals in the world markets and eventually, the reserves would also stabilize,” said Saurabh Goenka, CEO and MD, Zenith FinCorp.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

03:35 PM IST