RBI Governor invokes Mahatma Gandhi, Netaji to urge citizens to keep their confidence afloat in India's growth story

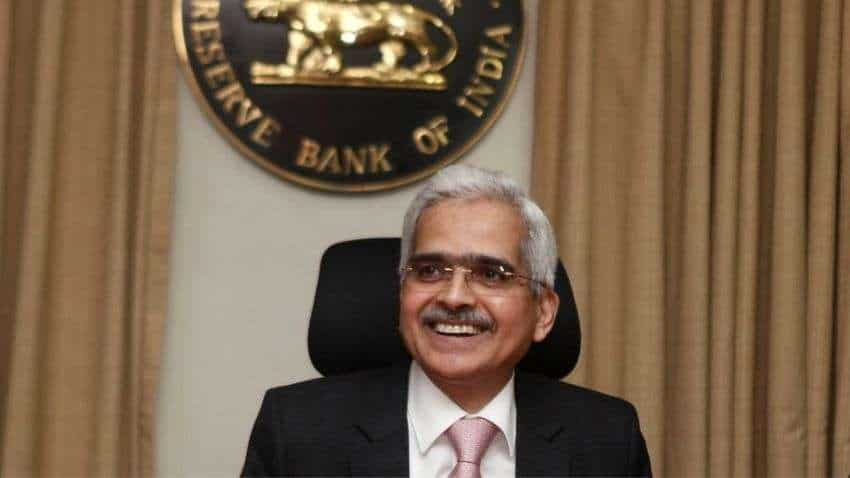

RBI Monetary Policy: RBI Governor Shaktikanta Das on Wednesday invoked Mahatma Gandhi and Netaji Subhas Chandra to boost citizens' confidence in India's growth story.

RBI Monetary Policy: RBI Governor Shaktikanta Das on Wednesday invoked Mahatma Gandhi and Netaji Subhas Chandra to boost citizens' confidence in India's growth story. While announcing the outcome of the six-member Monetary Policy Committee, he said urged Indians to keep their confidence afloat in the Indian economy, saying "India has emerged stronger than before despite multiple global challenges".

"In the current unsettled global environment, emerging market economies (EMEs) are facing sharp trade-offs between supporting economic activity and controlling inflation, while preserving policy credibility. As global fault lines emerge in trade, technology and investment flows, there is an urgent need to reinforce global cooperation. The world is looking to India, now at the helm of G-20, to energise global partnership in several critical areas. This reminds me of what Mahatma Gandhi had said: I do believe that…India…can make a lasting contribution to the peace and solid progress of the world," he said.

Click Here For Latest Updates On Stock Market | Zee Business Live

"As we begin a new year, it is a good time to reflect upon our journey so far and what lies ahead. When I look back, it is heartening to note that the Indian economy successfully dealt with multiple major shocks in the last three years and has emerged stronger than before,” Das said.

“India has the inherent strength, an enabling policy environment, and strong macroeconomic fundamentals and buffers to deal with future challenges,” he added.

“Never lose your faith in the destiny of India,” Das quoted Netaji as he signed off MPC address.

RBI MPC policy: Measures announced today; Key highlights

- Despite global challenges, RBI has projected the Indian economy to grow at 6.4 per cent in FY24.

- RBI projected retail inflation to ease to 5.3 per cent in next fiscal from 6.5 per cent this year on assumptions of lower imported inflation, even though core inflation remains sticky.

- Among the measures announced on Wednesday was allowing lending and borrowing of government securities or G-secs with a view to "provide investors with an avenue to deploy their idle securities, enhance portfolio returns and facilitate wider participation".

- RBI restored market hours for the Government Securities market to the pre-pandemic timing of 9 am to 5 pm.

- On the rupee, Das said it has remained one of the least volatile currencies among its Asian peers. The depreciation and the volatility of the Indian rupee during the current phase of multiple shocks is far lower than during the global financial crisis and the taper tantrum.

- The current account deficit (CAD), which stood at 3.3 per cent in the first half of 2022-23, is expected to moderate in the second half and "remain eminently manageable and within the parameters of viability". Das also said draft guidelines for the levy of penal interest on advances will be issued for comments.

- With UPI becoming hugely popular for retail digital payments in India, the RBI has proposed to permit all inbound travellers to India to use UPI for their merchant payments (P2M) while they are in the country. "To begin with, this facility will be extended to travellers from G-20 countries arriving at select international airports," he said.

- The RBI will also launch a pilot project on QR Code-based Coin Vending Machines (QCVM) in 12 cities. These vending machines will dispense coins against debit to the customer's account using UPI instead of physical tendering of banknotes. This will enhance the ease of accessibility to coins.

Also read- RBI MPC meeting LIVE

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How soon will monthly SIP of Rs 6,000, Rs 8,000, and Rs 10,000 reach Rs 5 crore corpus target?

SBI Guaranteed Return Scheme: Know how much maturity amount you will get on Rs 2 lakh, 2.5 lakh, 3 lakh, 3.5 lakh and Rs 4 lakh investments under Amrit Vrishti FD scheme

SBI Senior Citizen FD Rate: Here's what State Bank of India giving on 1-year, 3-year, 5-year fixed deposits currently

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

02:06 PM IST

RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI, Maldives Monetary Authority sign pact to promote use of local currencies RBI cautions public about 'deepfake' video of governor being circulated on social media

RBI cautions public about 'deepfake' video of governor being circulated on social media RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Consumer inflation worsens to 6.21% in October from 5.49% in previous month

Consumer inflation worsens to 6.21% in October from 5.49% in previous month Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public