Fed raises rate again amidst banking crisis in the USA, will RBI follow the same?

Economists made it clear that, in contrast to the US economy, where a recession is expected to occur, there is room for future repo rate increases in India because the RBI must give reducing inflation a top priority.

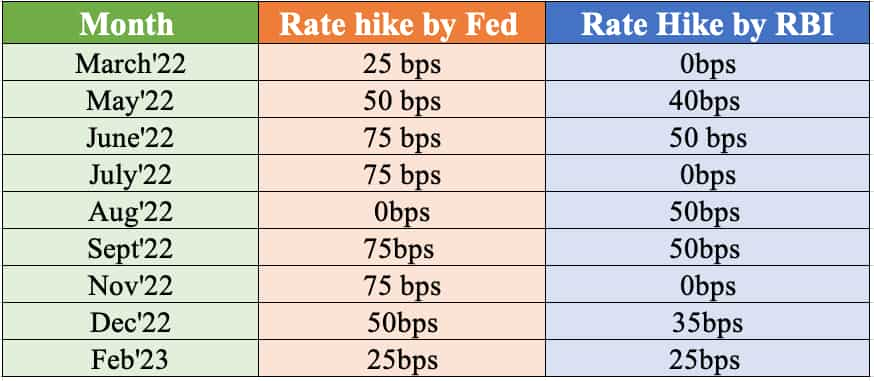

The Federal Reserve has increased the repo rate – the rate at which central bank charge borrowings by commercial banks – again by 25 basis points (bps), its 9th hike since March 2022, when the US monetary policy regulator began sucking out excess liquidity to tame inflation. The hike has come amid many on the Wall Street hoping the Fed to halt its aggressive rate tightening - also seen as a factor behind the banking crisis that started with the failure of the Silicon Valley Bank (SVB) on March 10.

With the Fed not giving in to popular view, the question that now emerges is what the Reserve Bank of India (RBI) would do in its April bi-monthly meet. Would it follow in the Fed's footsteps?

Economists that ZeeBiz.com spoke to agree that the RBI will likely increase interest rates by 25 basis points in April as long as inflation stays above 6 per cent. That said, the members of the Monetary Policy Committee (MPC) will also closely track how the banking situation in the US evolves.

“If the regional banking situation in the US takes a turn for the worse ahead of the RBI’s meeting, the possibility of a pause remains,” Sakshi Gupta, senior economist, HDFC Bank told ZeeBiz.com.

In the beginning of March, Silicon Valley Bank (SVB)announced a $1.75 billion share sale programme to further strengthen its balance sheet. This programme triggered a massive sell-off in the group's shares. Thereafter, market went severely bearish and bear rampage wiped out over $80 billion of its market value. Alongside, the bond prices of the group collapsed and created a panic in the market. Before the investors could recover from the shock of SVB collapse, regulators shuttered Signature Bank on March 12 after its depositors had withdrawn billions following the collapse of SVB. Things got further worsened when Credit Suisse, one of the largest and oldest banks in Switzerland collapsed, forcing the Swiss government to broker a deal that saw rival UBS buy the bank for $3.2 billion.

Also Read: How Indian banking remained resilient amidst the SVB crisis and Credit Suisse Collapse

However, economists made it clear that, in contrast to the US economy, where a recession is expected to occur, there is room for future repo rate increases in India because the RBI must give reducing inflation a top priority.

“Domestically CPI inflation remains elevated at 6.4 per cent and more importantly core CPI inflation remains uncomfortably high at 6.2 per cent in February. At the same time, growth conditions in India have held up, providing monetary policy space to focus on Inflation,” Gaura Sengupta, Economist, IDFC First Bank told ZeeBiz.com.

Given India's status as an emerging economy, the RBI tends to follow the Fed, which may go for another rate hike in its May meet.

"Externally, the Fed is still indicating one more 25bps hike (likely in May). Hence both domestic and external factors support a 25bps hike by RBI in April," Sengupta added.

Despite the American banks under pressure, experts predict that the Fed will raise interest rates once again in May. RBI too may continue with a couple of more rate hikes in 2023.

"The Fed could raise rates by 25bps in May if indeed the current market turmoil stabilises with no major system-wide contagion risks emerging. The Fed could stop here and keep rates on hold through 2023. While the market has raised bets of rate cuts in 2023 (Fed futures expecting 50-75bps rate cuts by the end of the year), the Fed has pushed back against this possibility, and we think that rate cuts are not a given just yet,” added HDFC Bank's Gupta.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

10:13 PM IST

US economic growth last quarter is revised up sharply to a 2% annual rate

US economic growth last quarter is revised up sharply to a 2% annual rate Why a Fed rate-hike pause may not be as great for stocks as Wall Street hopes

Why a Fed rate-hike pause may not be as great for stocks as Wall Street hopes RBI MPC Meeting: Reserve Bank of India may raise repo rate by 25 bps on April 6, cut by year-end

RBI MPC Meeting: Reserve Bank of India may raise repo rate by 25 bps on April 6, cut by year-end Rupee leaps to 82.27 against US dollar after Fed rate hike

Rupee leaps to 82.27 against US dollar after Fed rate hike  Federal Reserve raises 0.25% interest rate amid global banking crisis - Key takeaways

Federal Reserve raises 0.25% interest rate amid global banking crisis - Key takeaways