India's GDP expands 7.8% in Q1, meets economists' estimates

The country's GDP expanded 7.8 per cent in the quarter ended June, according to official data released on Thursday.

)

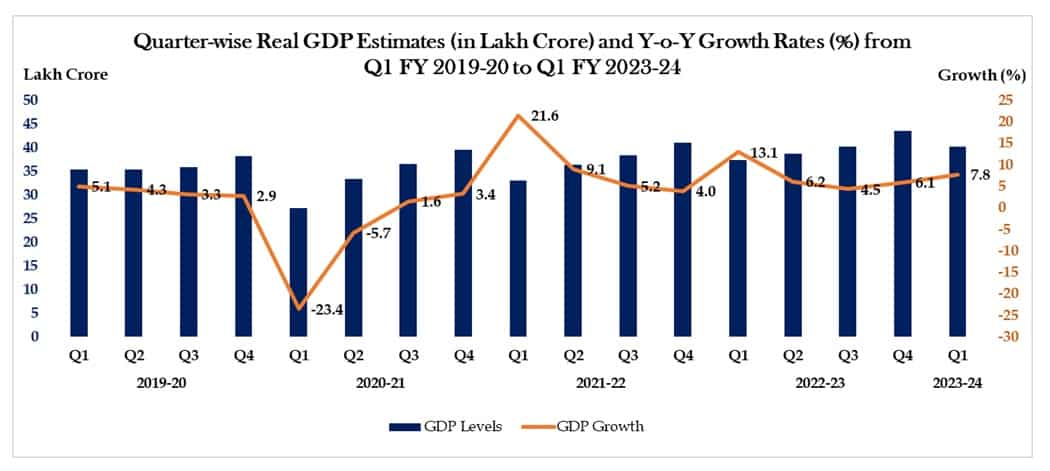

The country's GDP expanded 7.8 per cent in the quarter ended June, in line with economists’ expectations, according to official data released on Thursday. While the reading was better than a growth rate of 6.1 per cent in the January-March period, it was in stark contrast to an expansion of 13.1 per cent in the quarter ended June 2022.

Economists in a Zee Business poll had estimated the quarterly GDP growth rate for the first quarter of the current financial year to come in at exactly 7.8 per cent.

The GDP reading for the June quarter was the best since April–June 2022, driven by double-digit growth in the country's buoyant services sector, according to an official statement.

The government retained its GDP growth projection for the current financial year at 6.4 per cent.

Chief Economic Adviser V Anantha Nageswaran said that the government does not expect inflation to get out of control. He also said the government expects further expansion in the construction sector in the coming years.

Here's how the economy has fared in the past 17 quarters—the April-June period included:

All the sectors as well as activities within the services space fared well during the quarter ended June 30, the statistics ministry said.

Here's how some of the key sectors of the economy fared in the three-month period on a year-on-year basis:

| Sector | GDP growth (%) | |

| Q1 FY24 | Q1 FY23 | |

| Farming | 3.5 | 2.4 |

| Mining | 5.8 | 9.5 |

| Manufacturing | 4.7 | 6.1 |

| Construction | 7.9 | 16 |

| Services | 10.3 | 16.3 |

| (Source: Ministry of Statistics & Programme Implementation) | ||

The data comes roughly three weeks after the RBI retained its GDP forecast at 6.5 per cent for the year ending March 2024, citing "evenly-balanced" risks, while maintaining the key lending rate—or the key interest rate at which the central bank lends money to commercial banks— on hold as widely expected by economists. However, the RBI has already increased the repo rate by a total of 250 basis points (bps) since May 2022 with an aim to tame inflation without damaging the pace of growth.

What economists say

"While the growth print is in line with our expectations, the growth mix was a bit of a surprise. Ideally, the year-on-year fall in commodity prices should have boosted manufacturing firms’ operating profits and thereby lifted the value-added growth of the manufacturing sector. Thus, the disappointment on that front was surprising. On the other hand, strong government capex and credit growth expectedly led to double-digit construction sector growth and financial services growth respectively," said Madhavi Arora, Lead Economist at Emkay Global Financial Services.

"While we retain our FY24E GDP growth at sub-six per cent (levels), we recognise economic activity recovery is not yet broad-based. Besides, falling income growth in the urban sector, shrinking corporate profitability, demand-curbing monetary policies, and diminishing global growth prospects may weigh on output," Arora added.

The RBI has forecast GDP growth at 6.6 per cent for the first quarter of the financial year 2024-25.

ALSO READ: When India’s GDP briefly exceeded China’s

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

03:43 PM IST

Indian economic growth set to end five-quarter slide: Reuters poll

Indian economic growth set to end five-quarter slide: Reuters poll