Yes Bank drops 4% as RBI norms weigh on fourth quarter results

Yes Bank said, “The increase in NPA and consequent provision is in conformity with the divergence observed by the RBI as per its compliance process referred to in the RBI circular dated April 18, 2017 on 'Disclosure in the notes to accounts to the financial statements – Divergence in asset classification and provisioning.”

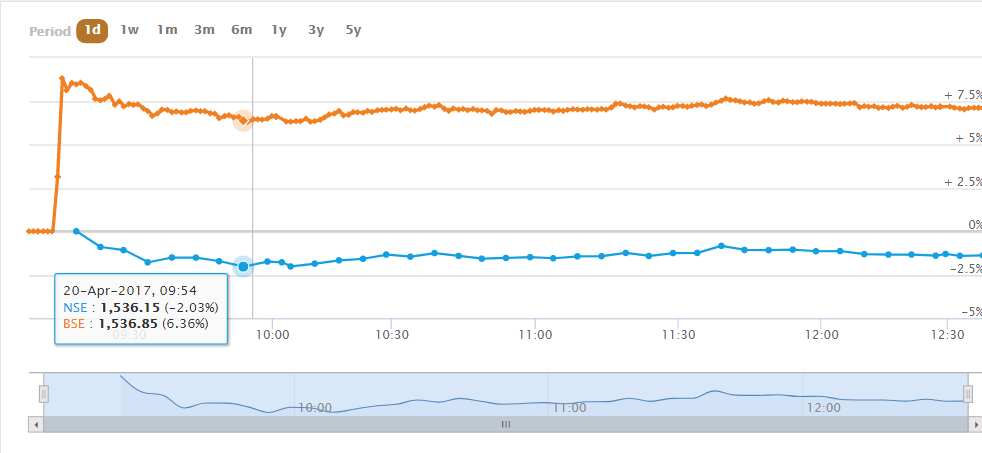

Shares of Yes Bank tanked over 4% on both BSE and NSE on Thursday after its asset quality worsened more than expected in the fourth quarter of last year.

At 1308 hours, Yes Bank shares were trading at Rs 1,547.85 per piece on NSE, down Rs 58 or 3.59%. However, in early trade it was below Rs 1537-mark.

For the given quarter, Yes Bank witnessed growth in both top-line (total income) and bottom-line (profit after tax) for the fourth quarter ended March 31, 2017, result (Q4FY17).

Net interest income (NII) rose by 32.1% to Rs 1,639.7 crore in Q4, against Rs 1,241.4 crore in Q4FY16.

Overall total income was at Rs 2897.1 crore recording a whopping 41.7% rise versus Rs 2,044.2 crore in Q4FY16.

Nilesh Parikh, Kunal Shah and Prakhar Agarwal of Edelweiss Financial Service said, “Yes Bank once again impressed with sturdy operating profitability - up >30% YoY, aided by healthy NII on strong loan momentum (up ~35% YoY, hinting market share gain) and superior NIMs (up 10bps QoQ to 3.6%).”

Though there was sharp rise in other income, net interest income and operating profit, HDFC Securities said, “The growth was restricted by higher provisioning and deterioration in asset quality.”

Gross non-performing assets of Yes Bank more than doubled compared to previous quarters to stand at 1.52%, up 73 basis points.

Provisions of Yes Bank too rose by 40% to Rs 309.73 crore in Q4, compared to Rs 186.46 crore in Q4FY16.

Yes Bank said, “The increase in NPA and consequent provision is in conformity with the divergence observed by the RBI as per its compliance process referred to in the RBI circular dated April 18, 2017 on 'Disclosure in the notes to accounts to the financial statements – Divergence in asset classification and provisioning.”

Yes Bank said, “This includes one borrower with gross exposure of 0.69% of gross advances which have a lone of Rs 911.5 crore and net exposure of 0.52% with Rs 683.6 crore of net advances which is expected to be recovered in the near term.”

Edelweiss said, “In absence of this account, GNPAs would have shown improvement, with flat net NPAs. Barring the above exposure, net slippage additions during Q4FY17 were Rs 1 billion.”

The bank maintained 0.29% net NPA for last four quarters.

RBI, on Wednesday, said, "There have been instances of material divergences in banks’ asset classification and provisioning from the RBI norms, thereby leading to the published financial statements not depicting a true and fair view of the financial position of the bank."

The central bank added, "In order to ensure greater transparency and promote better discipline in asset quality, it has been decided that banks shall make suitable disclosures as per Annex, wherever either (a) the additional provisioning requirements assessed by RBI exceed 15 percent of the published net profits after tax for the reference period or (b) the additional Gross NPAs identified by RBI exceed 15 percent of the published incremental Gross NPAs1 for the reference period, or both."

Edelweiss said, "The RBI’s directive on recognition & stress reporting divergence may weigh on the sector in near term till clarity emerges, but Yes Bank’s business strength - loan underwriting and structuring - will restrict overall loss given default."

"Moreover, structurally, progress in branch banking will aid the bank clock best-in-class return ratios, reduce volatility and fuel re-rating, " added Edelweiss .

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

01:05 PM IST

RBI imposes monetary penalty on these two banks, check details

RBI imposes monetary penalty on these two banks, check details D-Street Newsmakers: Yes Bank, Tata Motors among stocks that buzzed most on November 16

D-Street Newsmakers: Yes Bank, Tata Motors among stocks that buzzed most on November 16 Yes Bank introduces UPI payments through its RuPay credit cards; Know how it works

Yes Bank introduces UPI payments through its RuPay credit cards; Know how it works Yes Bank Q1 Results: Bank's net profit rises 10% to Rs 343 crore; total income jumps 29%

Yes Bank Q1 Results: Bank's net profit rises 10% to Rs 343 crore; total income jumps 29% RBI rejects appointment of Akash Suri as CEO of Yes Bank-JC Flowers ARC: Sources

RBI rejects appointment of Akash Suri as CEO of Yes Bank-JC Flowers ARC: Sources