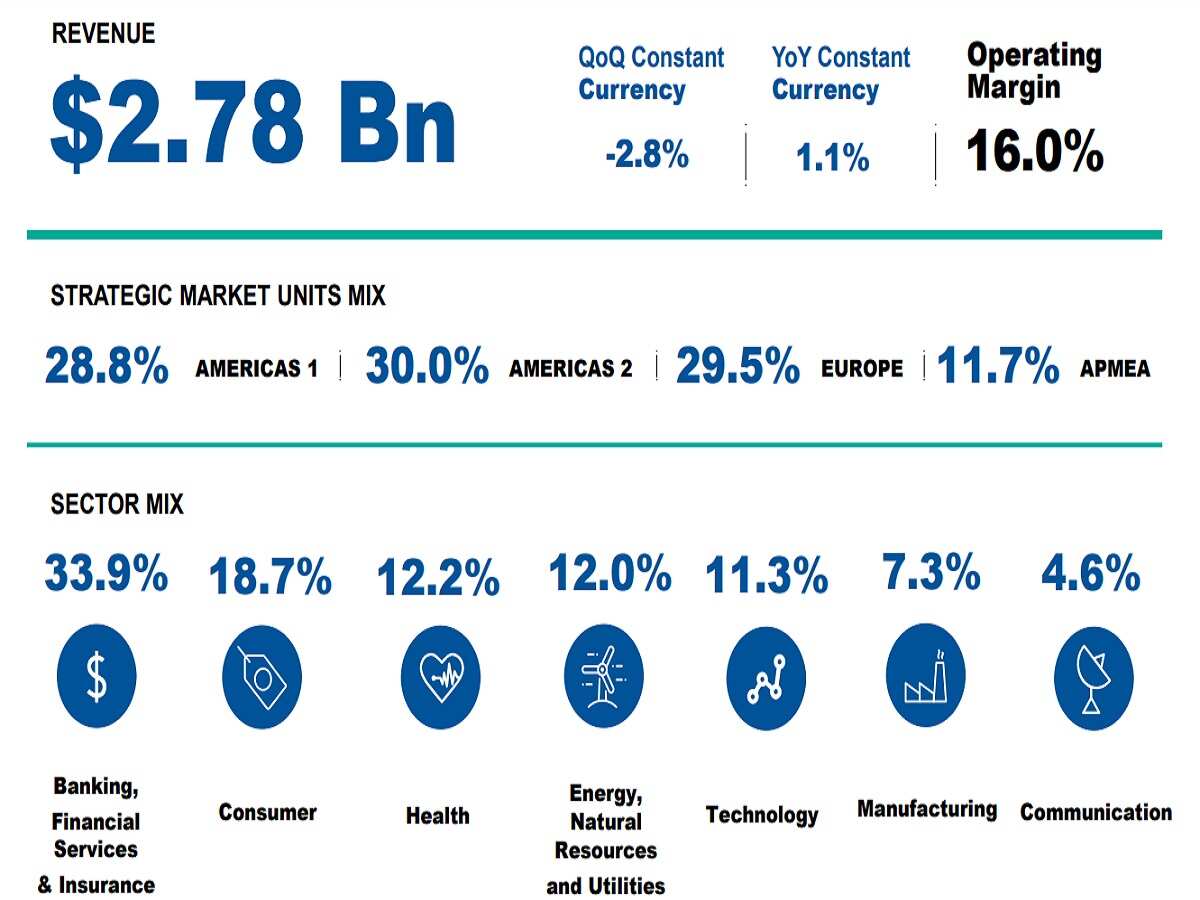

Wipro Q1 results: Net profit slips 6.65% QoQ to Rs 2,870 crore, operating margin stands at 16%

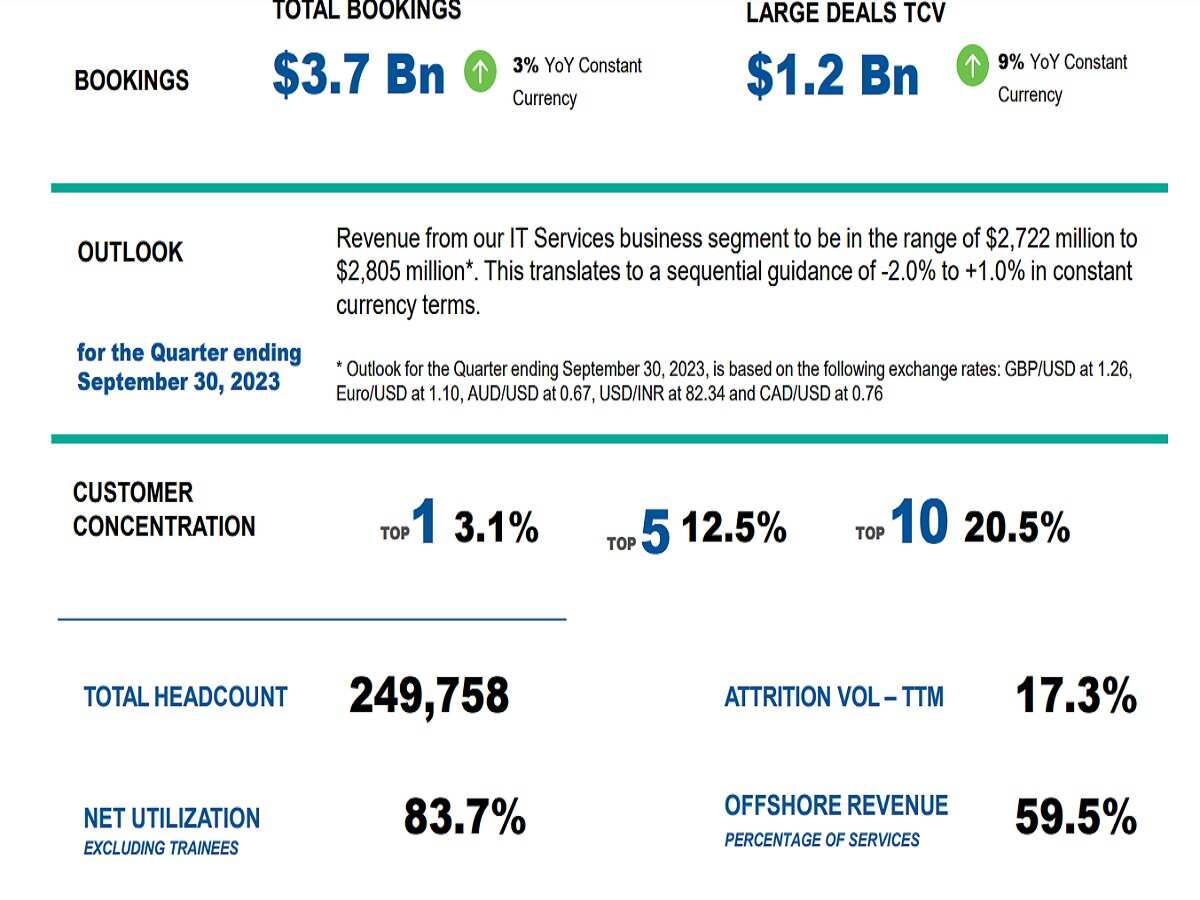

Wipro Q1 Results: Wipro expects revenue from its IT Services business segment to be in the range of $2,722 million to $2,805 million. This translates to sequential guidance of -2.0% to +1.0% in constant currency terms.

)

Wipro Q1 Results: Wipro on July 13 reported a consolidated net profit of Rs 2,870 crore for the quarter ended June 30, 2023 (Q1FY24). The firm had posted a net profit of Rs 3,074.5 crore in the previous quarter. In the year-ago period, the net profit stood at Rs 2,563.6 crore. So, on a sequential basis, the company's profit slipped 6.65 per cent while on a year-on-year (YoY) basis, the figure grew 11.95 per cent.

Income from operations for the quarter under review stood at Rs 22,831 crore, up 6.04 per cent YoY and down 1.54 per cent on a QoQ basis.

Analysts at Zee Business Research had projected Wipro's consolidated net profit at Rs 2,980 crore, down 3.1 per cent on a sequential basis. The company's revenue was expected to slip 1.1 per cent QoQ to Rs 22,930 crore against Rs 23,190 crore logged in the March 2023 quarter.

Outlook for Q2FY24

Wipro expects revenue from its IT Services business segment to be in the range of $2,722 million to $2,805 million. This translates to sequential guidance of -2.0% to +1.0% in constant currency terms.

“Wipro’s first-quarter results come with a strong backbone of large deal bookings, robust client additions, and resilient margins,” said Thierry Delaporte, CEO and Managing Director. “Despite a gradual reduction in clients’ discretionary spending, we maintained new business momentum. We earned our clients’ trust with strong delivery, innovation, and expanded services that strengthen our long-term businesses, and help capture market share. The launch of Wipro ai360 and the USD 1 billion investment solidifies Wipro’s position as a leading transformation partner that delivers the results and innovation our clients need to future-proof their businesses," Delaporte added.

Q1 Highlights

Source: Earnings release

Source: Earnings release

"Our ongoing focus on operational improvement has ensured that margin remains steady even in a softening revenue environment. Our operating margin for the first quarter was 16 per cent, an expansion of 112 basis points YoY. We generated strong operating cash flows at 130 per cent of our net income for the quarter. EPS for the quarter grew by 11.5 per cent YoY," said Jatin Dalal, Chief Financial Officer.

Buyback update

In April this year, the company's board approved a buyback for the value of Rs 12,000 crore, approximately $1.5 billion, at the price of Rs 445 per equity share. "I am glad that we have successfully completed the buyback, the biggest in Wipro’s history. It is heartening to see that small shareholders have participated and benefitted from the buyback," said Rishad A Premji, Chairman, at the company's 77th AGM.

Key highlights from 77th AGM: Speech by Rishad A Premji, Chairman

The macroeconomic environment last year was challenging. Even as the pandemic receded, the Ukraine war entered a second year, and the global interest rates stayed high. These factors impacted client spending, especially towards the second half of FY 2023, said Rishad A Premji, Chairman.

While technology adoption as a whole remained secular, we saw that in sectors like BFSI and Technology, clients spent more on cost optimisation and less on discretionary spending. We were well prepared for this change. Our strong portfolio of solutions on both sides of growth as well as efficiency helped us to react quickly and pertinently to these developments.

The Chairman further said that Artificial Intelligence will be one of the strategic growth areas for the future.

"At Wipro, we are very excited about the possibilities that AI brings and have been investing ahead of the curve to understand and leverage its power inside Wipro, and to create multiple solutions for our clients," the chairman added.

For two years now, Wipro’s Generative AI Center of Excellence has conducted research with leading academic institutions, built accelerators and frameworks, and developed deep competency through the Wipro AI Academy.

"Our AI practice has created several cross-industry solutions for our clients, such as demand and revenue forecasting models, deployed AI in autonomous vehicles, improved supply chain efficiencies, and driven efficiencies & quality in areas such as content moderation," Rishad A Premji added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

06:10 AM IST

D-Street Newsmakers: Infosys, BPCL and HDFC Bank among 7 stocks that made headlines today

D-Street Newsmakers: Infosys, BPCL and HDFC Bank among 7 stocks that made headlines today  Wipro Q2 results: PAT drops 7.5% QoQ; revenue slips over 1% to Rs 22,516 crore

Wipro Q2 results: PAT drops 7.5% QoQ; revenue slips over 1% to Rs 22,516 crore Wipro Q1 preview: Q2FY24 growth guidance and Consulting business outlook eyed

Wipro Q1 preview: Q2FY24 growth guidance and Consulting business outlook eyed Wipro's decline in net profit goes beyond hike in wages

Wipro's decline in net profit goes beyond hike in wages