Why Anil Ambani Group shares—Reliance Infra, Reliance Capital, Reliance Power, RHFL — are rising? | All you need to know

Anil Dhirubhai Ambani Group or ADAG group shares: The shares of Anil Dhirubhai Ambani Group or ADAG group have been performing exceptionally well for the past few months.

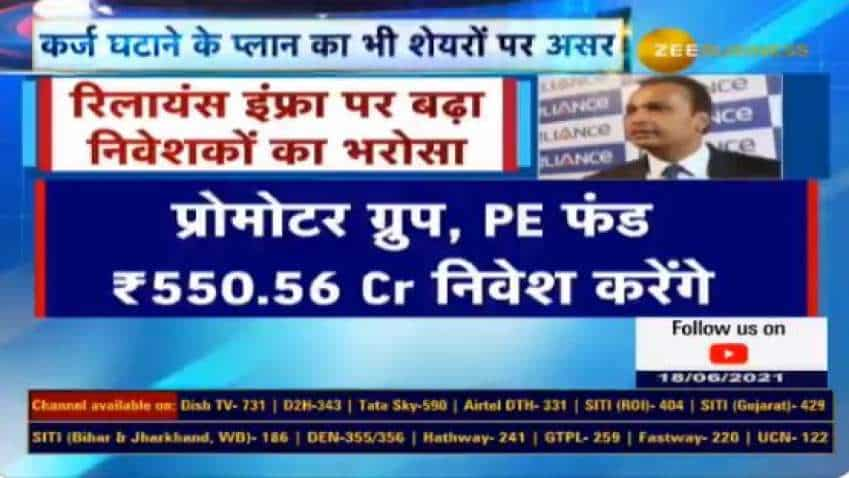

The shares of Anil Dhirubhai Ambani Group or ADAG group have been performing exceptionally well for the past few months. Reliance Infrastructure Limited, Reliance Capital and Reliance Power shares—All of these stocks have given bumper returns to their investors. The rally is led by Reliance Infra, which has more than tripled in the last three months. Reliance Infra shares zoomed from Rs 32.95 on March 19, 2021, to Rs 105.75 on June 19 this year.

See Zee Business Live TV Streaming Below:

Reliance Infra shares

This reversal is because of revival of promoters and investors' faith in the Anil Ambani-led companies. Promoter group and PE fund have committed to jointly invest Rs 550.56 crore in Reliance Infra. The fresh fund will not only strengthen the balance sheet of the company but will also infuse new life in it. With this contribution from promoters' group, their stake in Reliance Infra will grow from around 5 per cent to 23 per cent.

Reliance Infra also boasts of whopping 25,000 crore EPC order, while the company claims that it has completed order worth Rs 2 lakh crore. Reliance Infra also has power distribution and defence manufacturing businesses in Delhi.

अनिल अंबानी के रिलायंस ग्रुप के शेयरों में लौट रही रौनक...

स्पेशल सीरीज में देखिए किन कंपनियों में आए बड़े एलानों से बंधी है उम्मीद... #StoryofRecovery #Reliance #AnilAmbani pic.twitter.com/Bdq7dfXPAi

— Zee Business (@ZeeBusiness) June 18, 2021

Reliance Capital shares

Similarly, another Anil Ambani Group compnay is also planning to cut down its debt. Under this strategy, Reliance Power Board has approved preferential allotment of shares and convertible warrants to Reliance Infrastructure (RInfra). Reliance Power will allot 59.50 crore shares 73 crore warrants. This will cut down debt of Reliance Power by Rs1325 crore. With the issuance of new shares, Reliance Infra's stake in Reliance Power will go to around 25 per cent, while on conversion of warrants into shares, the stake will grow to around 38 per cent. The company aims to cut down debt by Rs 3200 crore by the end of FY22.

RHFL shares

Another Anil Ambani's Reliance Group company, Reliance Capital Ltd, has also almost finalised buyer for its subsidiary Reliance Commercial Finance. Authum Investment and Infrastructure has emerged as the highest bidder with Rs 9017 crore. At Rs 2,887 crore, Authum Investment and Infrastructure is also leading the race to acquire Reliance Housing Finance (RHFL), another subsidiary of Reliance Capital

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

10:44 PM IST

Reliance Infra to set up integrated project for manufacturing explosives, ammunition, small arms

Reliance Infra to set up integrated project for manufacturing explosives, ammunition, small arms  Reliance Infrastructure shareholders clear Rs 6,000-crore fund-raising plan

Reliance Infrastructure shareholders clear Rs 6,000-crore fund-raising plan Calcutta High Court rules in favour of Reliance Infra, upholds Rs 780 crore arbitration award against Damodar Valley Corp

Calcutta High Court rules in favour of Reliance Infra, upholds Rs 780 crore arbitration award against Damodar Valley Corp Reliance Power board approves Rs 1,525 crore preferential issue

Reliance Power board approves Rs 1,525 crore preferential issue  Reliance Infrastructure shares tank 20%; hit lower circuit limit

Reliance Infrastructure shares tank 20%; hit lower circuit limit