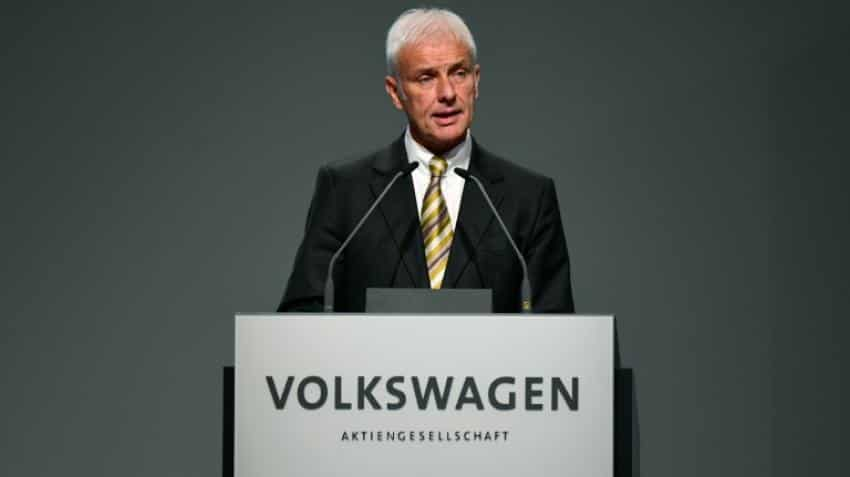

VW boss Matthias Mueller apologises to shareholders over emissions scandal

The stock has since recovered somewhat, but is still 26% below the levels before the scandal broke last September

The boss of embattled German auto giant Volkswagen on Wednesday issued an apology to angry shareholders over the emissions cheating scandal that has plunged the group into an unprecedented crisis.

Facing an annual general shareholders meeting for the first time since the scandal erupted in September, Matthias Mueller said: "On behalf of the Volkswagen Group and everyone who works here, I apologise to you shareholders for your trust in Volkswagen being betrayed.

"This misconduct goes against everything that Volkswagen stands for," he added nine months after the start of the "Dieselgate" affair, when it emerged VW had installed emissions-cheating software into 11 million diesel engines worldwide.

Volkswagen is still far from drawing a line under the scandal, with the costs of the affair still incalculable while it remains unclear if the company`s own internal investigation will pinpoint the major culprits behind the scam.

And the auto giant, which owns 12 brands ranging from Volkswagen and Porsche to Audi and SEAT, still faces a myriad of regulatory fines as well as lawsuits from customers and shareholders.

Shareholders used the AGM in the northern city of Hanover to let off steam at the way management has handled the affair.

Two days ahead of the meeting, prosecutors provided more fodder to irate shareholders when they said they were investigating former VW chief executive Martin Winterkorn for having allegedly manipulated the market by holding back information about the emissions cheating.

A second former member of the board was also under probe, prosecutors said, without giving the individual`s name, but a Volkswagen spokesman told AFP that the suspect was Herbert Diess -- who is in charge of the VW brand. Listed companies are required to disclose information that could affect market prices immediately.

But VW complied with its disclosure obligation only on September 22, 2015, prosecutors said, four days after US regulators went public that they were charging the company for emissions cheating.

- `Crisis has opened doors` -

The allegations struck at the heart of shareholders` misgivings, as they have since early on in the scandal also accused management of dragging their feet in informing them about the scam, which led to a stunning 40-percent drop in the company`s share price last autumn.

The stock has since recovered somewhat, but is still 26% below the levels before the scandal broke last September, and the company`s finances also remain weak.

After it was forced to set aside 16 billion euros ($18 billion) in provisions to cover the costs of the affair so far, Volkswagen sank to a net loss of 1.6 billion euros, its first loss in two decades.

Giving an update of the company`s internal investigation into the affair, chairman Hans Dieter Poetsch said some 550 interviews had been carried out by the US consultants charged with the probe, Jones Day.

Nevertheless, a number of shareholder lobby groups are demanding special enquiries into who should be held responsible for the affair, arguing that Jones Day is not sufficiently independent.

Seeking to reassure shareholders of management`s commitment to regain their trust, Mueller said the crisis could eventually prove to be "beneficial".

"The crisis has also opened doors. It forced us to strengthen and speed up overdue changes, and to set new priorities. To turn this crisis into an opportunity has been my goal from the beginning," he said.

- `Mafiosi` -

Mueller hinted in a newspaper interview on Tuesday that the car giant could abandon diesel engine technology in the wake of the scandal.

"We have to ask ourselves whether... we want to spend more money on the further development of diesel," Mueller told the business daily Handelsblatt.

The move appeared to be in line with the group`s plans to reposition itself as a leading player in environmentally sustainable modes of transport, with more than 30 all-electric models to be unveiled by 2025.

But some investors were not convinced.

"The management will lie to us again," Juergen Lindemann told AFP, describing the company`s former bosses Ferdinand Piech and Winterkorn as "mafiosi".

Yet regardless of any doubts small shareholders may have, the power they wield remains limited.

They hold just 11% of the voting rights in VW, while the founding families Porsche and Piech hold 52%, the regional state of Lower Saxony 20% and the state of Qatar 17%.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Dearness Allowance (DA) Calculations: Is your basic monthly salary Rs 25,500, Rs 35,400, or Rs 53,100? Know how much DA will you get at different rates

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 35,000, or Rs 50,000? Know what can be your total pension as per latest DR rates

Fixed Deposit Rates for 1 Lakh Investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 3-year FD returns

08:40 PM IST

From VW to Suzuki: a timeline of automobile scandals

From VW to Suzuki: a timeline of automobile scandals Former Volkswagen CEO investigated over emissions scandal

Former Volkswagen CEO investigated over emissions scandal