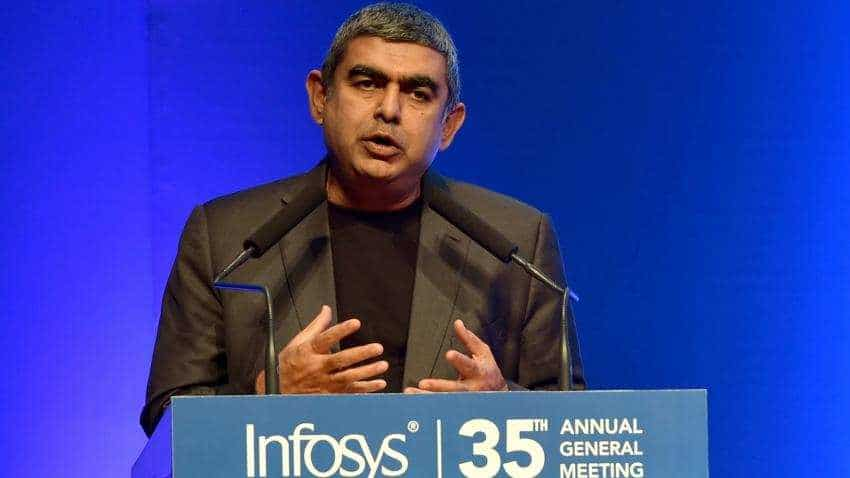

This Vishal Sikka deal is a burden for Infosys; here's how

Infosys posted 3.70% growth in net profit to Rs 3,612 crore in Q1FY19 compared to net profit of Rs 3,483 crore in the corresponding period of the same month.

The IT-major Infosys has announced its first quarter result for FY19 (Q1FY19). Overall the company reported growth in its financial book in both bottom-line and top-line growth, however, it still missed analysts estimate. One deal which was brought in the company by ex-CEO Vishal Sikka has played spoilsport in Infosys true earnings. Yes, we are talking about Panaya deal which was signed by Sikka in 2015. Infosys is trying to get rid of Panaya now, as it is moving from crisis to shutdown, but the Salil Parekh-led company is facing hurdles in getting a potential buyer for this stake sale, which has left no option, but to sell it at a discounted value. This in return has impacted Infosys earnings in Q1FY19 which could have been upbeat if we look at the data provided by the company.

The financial audit report highlights that, during the three months ended June 30, 2018, on re-measurement, including consideration of progress in negotiations on offers from prospective buyers for Panaya, the Company has recorded a reduction in the fair value of Disposal Group held for sale amounting to Rs 270 crore in respect of Panaya.

Consequently, profit for the three months ended June 30, 2018 has decreased by Rs 270 crore resulting in a decrease in Basic earnings per equity share by Rs 1.24 for the quarter ended June 30, 2018.

This results in Rs 270 crore decrease in Infosys earnings for Q1FY19.

Infosys posted 3.70% growth in net profit to Rs 3,612 crore in Q1FY19 compared to net profit of Rs 3,483 crore in the corresponding period of the same month. However, net profit logged a decline of 2.11% from Rs 3,690 crore in the preceding quarter.

A Bloomberg poll of analysts expected Infosys earnings to come in at Rs 3,741 crore in Q1FY19. If we take the loss caused by Panaya of Rs 270 crore, Infosys net profit could have been Rs 3,882 crore recording a growth of 11.45% on yearly basis.

Not only this, the Panaya deal had even hampered Infosys earning during last quarter of FY18.

In the quarter ended March 2018, on conclusion of a strategic review of the portfolio businesses, the Company had initiated identification and evaluation of potential buyers for its subsidiaries, Kallidus and Skava (together referred to as "Skava”) and Panaya (collectively referred to as the“Disposal Group”).

Consequently, a reduction in the fair value of Disposal Group held for sale amounting to $18 million (Rs 118 crore) in respect of Panaya had been recognized in the consolidated Profit and Loss for the quarter ended March 31, 2018.

During Q4FY18, Infosys reported 28.2% fall in net profit at Rs 3,690 crore in the quarter ended on March 31, 2018 on consolidated basis, in-line with expectations, as against Rs 5,129 crore reported in the December quarter of FY18.

The company had mentioned in Q4FY18 that it anticipates completion of the sale by March 2019 and accordingly, assets amounting to Rs 2,060 crore ($316 million) and liabilities amounting to Rs 324 crore ($50 million) in respect of the disposal group have been reclassified and presented as "held for sale".

Infosys then led by Sikka in February 2015, announced acquisition of Panaya for a value of $200 million. Before the acquisition, Panaya was already in a crisis and was on verge of shutdown, after many waves of layoffs were carried by the company. Between 2013 and 2014, Panaya laid off more than 25% of the company's employees. Also Panaya shutdown their Israeli-based sales development and moved them to Boston and the United Kingdom and replaced their CEO.

The controversy over Infosys' acquisition of Panaya was sparked off when questions were raised over a massive severance package for former CFO Rajiv Bansal.

Also, in 2017, whistleblowers alleged that there were issues with the company’s acquisition by Infosys and that top executives of the company had personal interest in acquisition.

This hefty package raised many eyebrows, as few Infosys employees and some founders, including N.R. Narayana Murthy questioned the rationale behind purchasing of the Israeli firm.

Burdened with back-to-back allegations, Sikka resigned on August 18, 2017.

However, post Q1FY19, the share price of Infosys was trading at Rs 1,357.50 per piece above Rs 48.40 or 3.70% on BSE. However, the share price of Infosys has touched an all-time high of Rs 1,384.40 per piece.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

02:21 PM IST

Traders' Diary: Buy, sell or hold strategy on Sagility, Dr Reddy, Wipro, LT, Infosys, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Sagility, Dr Reddy, Wipro, LT, Infosys, over a dozen other stocks today Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week Infosys double-upgraded to 'buy' from 'hold' by HSBC; target price raised by Rs 325

Infosys double-upgraded to 'buy' from 'hold' by HSBC; target price raised by Rs 325 Infosys to dish out average performance bonus of 90% for Q2

Infosys to dish out average performance bonus of 90% for Q2 Infosys stock falls 4% after mixed Q2 show: Should you buy, sell or hold it?

Infosys stock falls 4% after mixed Q2 show: Should you buy, sell or hold it?