KNOW ABOUT the 3 Adani Group FPIs in question! Names, PAN, stake, value of holding, demat account shares and other details

Adani group companies plunged on Monday in the wake of reports that the National Securities Depository Ltd (NSDL) froze the accounts of the three foreign funds that are among the top stakeholders in the firms.

After shares of Adani group companies plunged on Monday in the wake of reports that the National Securities Depository Ltd (NSDL) froze the accounts of the three foreign funds that are among the top stakeholders in the firms, billionaire Gautam Adani's group has said that accounts of three Mauritius-based funds that own the port-to-energy conglomerate's stocks were not frozen and any reports suggesting the contrary were "blatantly erroneous and misleading".

Here are all the DETAILS of 3 Adani Group FPIs (Foreign Portfolio Investors) that are in question - Check names, PAN, stake, value of holding and other details:-

1-COUNTRY: Mauritius-based funds

2- NAMES, PAN

Albula Investment Fund Ltd (PAN No. AAHCA3597Q)

APMS Investment Fund Ltd (PAN No. AAECM5148A)

Cresta Fund Ltd (PAN No. AADCC2634A)

3- DEMAT ACCOUNT DETAILS

- Cresta Fund had 10.76 crore shares of the six listed Adani group firms

- Albula Investment had 8.59 crore shares

- APMS Investment Fund account had 15.52 crore shares of five firms (it did not have had shares of APSEZ)

4- STAKE

-The three funds feature among the top 12 investors and owned about 2.1 per cent to 8.91 per cent stakes in five Adani Group companies as of March 31, 2020, annual investor presentations show.

5- VALUE OF HOLDING

The value of their holding in the five Adani group firms was valued at USD 7.78 billion before the Adani Group companies' stocks witnessed mayhem on Monday.

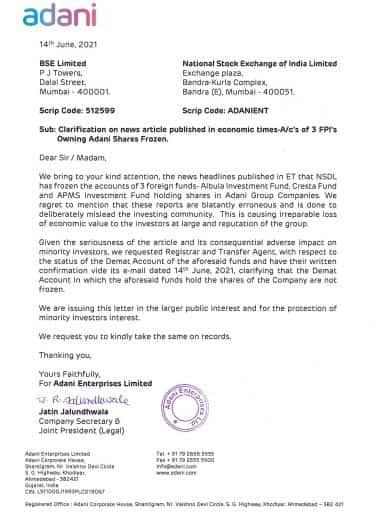

ADANI GROUP's STATEMENT

In a statement later, the ports-to-energy conglomerate said the FPIs (Foreign Portfolio Investors) in question have been investors in Adani Enterprises Ltd for more than a decade.

While Adani group said all the accounts of its top shareholder funds were active, NSDL in an email to the group also confirmed their 'active' status.

Adani Enterprises, the conglomerate's flagship company, as also Adani Ports and Special Economic Zone, Adani Green Energy Ltd, Adani Transmission Ltd, Adani Power and Adani Total Gas Ltd in identical filings to the stock exchanges said the reports of NSDL freezing accounts of Albula Investment Fund, Cresta Fund and APMS Investment Fund holding shares in the group firms were "blatantly erroneous and is done to deliberately mislead the investing community."

"This is causing irreparable loss of economic value to the investors at large and reputation of the group," they said.

Given the seriousness of the issue and its consequential adverse impact on minority investors, "we requested Registrar and Transfer Agent, with respect to the status of the Demat Account(s) of the aforesaid funds and have their written confirmation vide its e-mail dated 14th June, 2021, clarifying that the Demat Account(s) in which the aforesaid funds hold the shares of the company are not frozen," the firms said.

Clarification on news article published in the Economic Times – A/cs of 3 FPIs Owning Adani Shares Frozen.https://t.co/IFiqd6xj9L

— Adani Group (@AdaniOnline) June 14, 2021

As per a PTI report, NSDL in an email to Adani group said, "the status of demat accounts mentioned in your trail email are held in 'Active' status in NSDL system".

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

RBI Rule: New system for online money transfers to be implemented from April 1, 2025; here's all you need to know

Rules of 72, 114, 144 & 8:4:3: How long will it take for your Rs 50 lakh investment to become Rs 1 crore?

SBI Latest FD Rates: This is what you can get on Rs 10 lakh investment in 1-year, 3-year, and 5-year tenures

Top 7 SBI mutual funds with highest SIP returns in 15 years: Rs 7,777 monthly investment in No. 1 scheme has zoomed to Rs 97,64,660

09:33 PM IST

Adani Green shares plunge, 4 other group stocks under pressure

Adani Green shares plunge, 4 other group stocks under pressure Gautam Adani, nephew Sagar Adani summoned by US regulator

Gautam Adani, nephew Sagar Adani summoned by US regulator  Kenya cancels airport and energy deals with Adani group after US indicts the tycoon

Kenya cancels airport and energy deals with Adani group after US indicts the tycoon  Final Trade: Sensex ends 423 pts lower, Nifty settles at 23,350; as Adani, PSU Bank stocks tank

Final Trade: Sensex ends 423 pts lower, Nifty settles at 23,350; as Adani, PSU Bank stocks tank Adani Energy Solutions hits 20% lower circuit amid bribery charges

Adani Energy Solutions hits 20% lower circuit amid bribery charges