Tata Sons issues appeal to its stakeholders

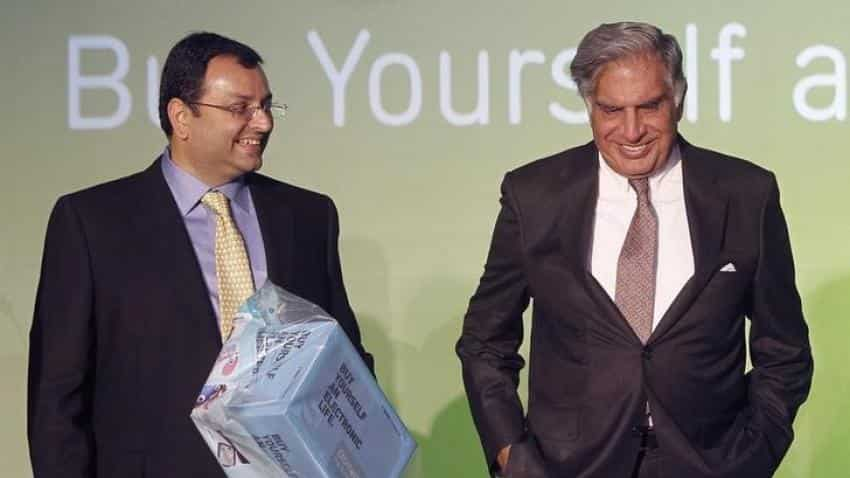

Tata Sons on Sunday issued an appeal to all stakeholders of Tata companies thanking them for their continued support in the management's decision to remove Cyrus P Mistry from Tata Group company's board.

Here's the full text of the appeal Tata Sons has issued to its shareholders-

Extraordinary General Meetings of various Tata Companies are coming up over the next few weeks. We, at Tata Sons Ltd., the principal shareholder and promoters of the various Tata Companies, would like to thank you for your continued support. In order to assist you to exercise your shareholder rights in an informed manner, it would be appropriate to bring to your attention some key facts which resulted in the loss of confidence in Mr. Cyrus P. Mistry by Tata Sons.

1. Mr Cyrus Mistry misled the Selection Committee set up in 2011 for selecting a Chairman of Tata Sons to succeed Mr Ratan Tata, by making lofty statements about his plans for the Tata Group and more importantly indicated an elaborate management structure for managing the Tata Group, given its diversity of business, by suggesting a management structure aimed at dispersal of authority and responsibility. These statements and commitments from Mr Cyrus Mistry played an important role in the Selection Committee’s final selection of Mr. Mistry as Chairman. After waiting for a period of four years, almost none of these management structures and plans have

been given effect to. Clearly, in our opinion, the Selection Committee was misled in its choice of Mr Mistry.

2. When Mr Mistry was appointed as Executive Vice-Chairman in 2011, he was informed that he should distance himself from his family enterprise - Shapoorji Pallonji & Company and the other Shapoorji Pallonji Group entities of which he is a major shareholder by putting his shareholding in an arms-length Trust. This was suggested keeping in mind good corporate governance principles. Mr Mistry agreed but after some time, Mr Mistry retracted his position and indicated that he could not find a way of doing so. Such conduct by Mr. Mistry was inappropriate and created a sense of breach of trust on his part. It also posed a significant challenge to the high corporate

governance principles Tata Sons strived for. This retraction, created grave concerns on Mr Mistry’s ability to lead the Tata Group devoid of personal conflicts and put to risk the high standards of self-less governance, that lies at the core of the Tata philosophy.

3. The Tata Sons Board has been concerned for some time about the financial performance of Tata Sons of which Mr Mistry was the Executive Chairman and primarily responsible for its performance. During Mr Mistry’s tenure as Executive Chairman, dividend income (other than from TCS) declined continuously and on the other hand, staff costs more than doubled. All this would have resulted in losses but for the TCS dividend. Mr Mistry did not show concern about these issues and the increasing dependence of Tata Sons on TCS. The Board could not accept this any further as it had the potential to risk the financial viability of Tata Sons.

ALSO READ: Cyrus Mistry's ouster well-considered, says Ratan Tata

4. Mr Mistry has gradually over the past three/four years concentrated all power and authority only in his own hands as Chairman in all the major Tata operating companies and gone about systematically diluting the representation of Tata Sons on the Boards of various Tata Companies, whilst being fully cognizant that Tata Sons is the main promoter and largest shareholding group. This was very much against the past practices and traditions of the Tata Group. Mr Mistry has claimed that he was not given a "free hand". Ironical, it may be, but in our view, it was this "free hand" and trust in him that Mr Mistry took advantage of, to weaken management structures in Tata Companies acting contrary to his fiduciary duties.

5. Mr Mistry was appointed as the Chairman of the various Tata Companies only through his Chairmanship of the parent company Tata Sons Ltd. which has been a longstanding convention in the Tata Group. Therefore, when Mr. Mistry was removed as Chairman of Tata Sons, propriety and reason demanded that he step down from the Chairmanship of the various Tata Companies. Instead, Mr Mistry has chosen to resort to selective media leaks, media statements and to make a public spectacle, knowing fully well that his actions would hurt and damage the companies even while remaining as their Chairman.

6. Mr Mistry constantly complains about “bad” legacy issues. However, he was fully aware of these and nevertheless assumed the responsibility of Chairman of Tata Sons as a challenge to turn around and resolve these issues. Mr. Mistry conveniently ignores the good legacies which he inherited, namely TCS and JLR, which account for nearly 90% of the Group’s total profits and which helped him to claim good aggregate Group results. It has always been Tata's policy to tackle difficult situations and turn them around but instead he has only taken the easy option of taking large amounts of writeoffs to huge detriment of the shareholders and blaming it all on the past management, while doing little to fix the challenges faced by certain companies. In its long history, Tatas have faced many critical problems in companies like Tata Steel, Tata Motors, Tata Chemicals and even Jaguar Land Rover (before Mr Mistry's tenure) which have been overcome by strong management action and financial support from Tata Sons at the group level and the shareholders and most importantly the motivation of employees

and their resolve to overcome challenges. All such constituents have always rallied round to turn around difficult situations so as to protect their companies under the TATA flag. In our opinion, mature responses to challenges of business are at the core of the Tata philosophy, and in our opinion, Mr Mistry has failed to live up to it.

7.It was Mr. Mistry who decided to go on a public campaign in the media by making irresponsible and incorrect allegations to which Tata Sons was compelled to respond in a rather long public statement because there was a lot to be said. Mr Mistry’s statements have caused the Group (including the companies where he continues to be the Chairman) enormous damage and caused considerable financial loss to all shareholders, running into tens of thousands of crores and in our opinion, Mr Mistry alone is responsible for such losses directly arising from his irresponsible and incorrect statements. His actions and statements have also caused instability and confusion in

these companies and their managements which would have been avoided if he had done the right thing by stepping down from the Chairmanships and Boards as is normally done. Instead, Mr Mistry seems to have taken the stand that even if he ultimately has to relinquish, he would have the satisfaction of damaging a great institution built up over 150 years after just five years of his tenure. It is also ironical that Mr Mistry is resisting his removal from the Boards of these very same Tata Companies which he has attacked by his false allegations and caused enormous harm to. On one hand, he alleges legacy issues faced by Tata Companies and on the other

Mr. Mistry seeks to entrench himself in the Board of such Tata Companies, whilst making false allegations against such companies. In our opinion, his actions are driven by a perverse motivation to cause harm to the “Tata” brand and to intentionally erode shareholder value.

ALSO READ: Cyrus Mistry seeks shareholders support to stay on Tata Power's board

8.Finally - and most importantly - it must be recalled that the operating Tata companies and Tata Sons have, for many decades, worked cohesively and seamlessly for the benefit of all stakeholders, namely, the companies, their shareholders and employees and for society at large. There has been no other agenda or personal interest as ultimately even the dividends paid to Tata Sons and subsequently to its own shareholders went back to philanthropy except for those paid to the minority shareholders. The operating Tata companies have individually grown and prospered but they have also benefitted in no small measure from being part of the Tata Group.

This encompasses the ability to attract and retain management and employees, use the TATA brand nationally and internationally, which has been painstakingly built up over the past decades, help in the marketing of their products and their ability to attract capital in all forms and give the comfort of safety because of the past default-free record. Therefore, Tata companies do not exist in a vacuum but benefit from being part of the Tata Group which is most evident in times of difficulty. All such benefits are likely to be at stake if Mr Mistry continues to remain Chairman, as his continuance is likely to lead to fragmentation of the Tata Group. For this purpose alone, Tata Sons would need the support of all, big and small, shareholders who have stood with the Tata Group at all times.

It is the firm resolve of Tata Sons to put the current turmoil in the Group behind it and Tata Sons is sure that the managements and employees of the companies will also want to get back to normal. Tata companies have always been managed by dedicated professionals under the supervision of their Boards which, till recently, comprised a judicious mix of persons representing the promoters, the management and independents - as prescribed by the

applicable regulations and which is also the case in almost all corporate entities in our country.

This structure ensures that the interests of all constituents, namely, shareholders (big and small), employees and consumers are protected and good corporate governance is followed and constantly improved upon. Tata companies must therefore quickly return to focusing on financial consolidation, prudent and strong Balance Sheets and sustainable returns and values to their shareholders, big and small.

ALSO READ: Taking charge is in the interest of stability of Tata Sons: Ratan Tata to employees

Mr Mistry’s latest letter to the shareholders (which was released at a Press Conference) dwells at length on the subject of corporate governance. Tata Sons takes strong objection to his accusation of lack of corporate governance in Tatas which he also extends to the Tata Trusts. The Tata Group has functioned for 149 years and set standards of corporate governance all through this period. It is therefore shocking that Mr. Mistry, who was given the privilege of heading the Group, should, in a short period of four years, be now lecturing us on corporate governance. The corporate structure of the Group which prevailed under the leadership of Mr J R D Tata for over 50 years and thereafter Mr Ratan Tata for over 20 years, exemplified the best corporate governance practices. Mr Mistry consciously dismantled this long established corporate structure by identifying himself as the only Tata Sons representative on the boards of Tata operating companies. It is relevant to mention that under the Governance Guidelines Framework which Mr Mistry himself introduced in 2015 (and referred to in his last Press Release), there is a clause to the effect that all employees of a Tata company should, after their employment ceases, immediately resign from the Boards of all Tata companies where they are functioning as Non-Executive Directors. Therefore Mr Mistry, on ceasing to be the Executive Chairman of Tata Sons, should have immediately resigned from the Boards of all other companies under his own guidelines. Yet he has chosen not to do so in wilful breach of the Governance Guidelines Framework.

By extending his criticism of corporate governance to the Tata Trusts, he is betraying a total lack of knowledge and understanding of the role of the Tata Trusts who have benefitted millions of Indian lives over the past several decades with its annual disbursements for philanthropic and charitable causes now amounting to over ₹800 crores per year. The Tata Trusts have been undertaking these activities for decades before the current mandatory CSR allocations recently came into force for the corporate sector. It is also the duty of the Trustees to protect the value of their assets represented by their corpus. A valuable component of these assets is the shareholdings of the Trusts in Tata Sons which were first donated by the sons of Jamsetji Tata. Surely, it is the duty of the Trustees to protect the 66% shareholding in Tata Sons by ensuring that the decisions of the company do not come in the way of the flow of adequate dividends from the company to the trusts, absent which the Tata Trusts would not be able to undertake their mission. Tata Sons is sure that the shareholders, big and small, and the public at large will see through the absurdity of these allegations.

APPEAL:

Tata Sons is therefore compelled to propose the removal of Mr Cyrus P Mistry as the Chairman and Director of all Tata Companies by convening Extraordinary General Meetings of shareholders as prescribed by the law. For this purpose, Tata Sons would need the support of all big and small shareholders who have stood with Tatas always.

Tata Sons therefore urges all the constituents of Tata companies to give serious thought to all that has been said above and support the resolutions placed before them.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:07 PM IST

Tata Group exposed to perilous regulatory violations: Mistry

Tata Group exposed to perilous regulatory violations: Mistry Cyrus Mistry seeks shareholders support to stay on Tata Power's board

Cyrus Mistry seeks shareholders support to stay on Tata Power's board Ratan Tata seeks shareholders support ahead of EGM to remove Mistry

Ratan Tata seeks shareholders support ahead of EGM to remove Mistry Cyrus Mistry's ouster well-considered, says Ratan Tata

Cyrus Mistry's ouster well-considered, says Ratan Tata Taking charge is in the interest of stability of Tata Sons: Ratan Tata to employees

Taking charge is in the interest of stability of Tata Sons: Ratan Tata to employees