Sector Outlook 2022: Star Cement plans to create a capacity of 12-15 million tonnes in next 5 years: Sanjay Kumar Gupta, CEO

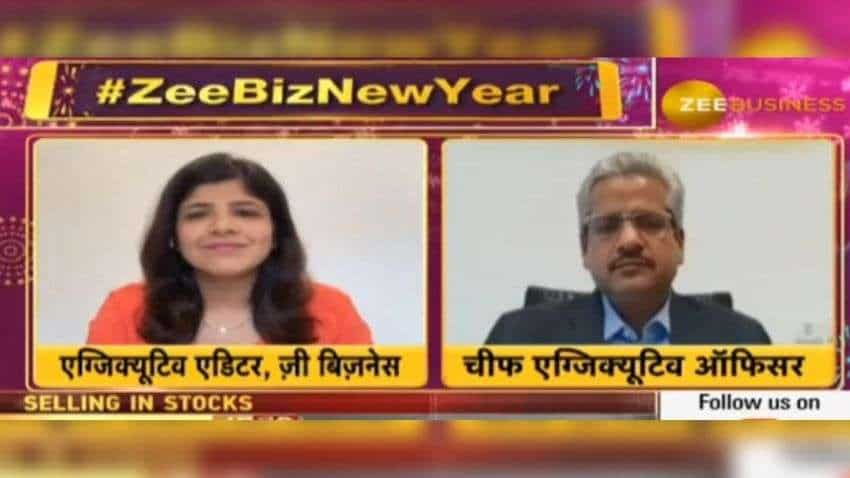

Sanjay Kumar Gupta, CEO, Star Cement, talks about his growth outlook for 2022, price hike plans, targets, CapEx, demand situation and expansion plans among others during a candid chat with Swati Khandelwal, Zee Business.

Sanjay Kumar Gupta, CEO, Star Cement, talks about his growth outlook for 2022, price hike plans, targets, CapEx, demand situation and expansion plans among others during a candid chat with Swati Khandelwal, Zee Business. Edited Excerpts:

Q: How the year 2022 seems to you particularly for the cement sector and how upbeat are you for your company?

A: The year 2022 from both perspectives is looking good for the industry. As far as the calendar year 2021 is concerned, definitely, we have seen slight sluggishness in the demand in the last couple of years but I think it is due to the monsoon risk. We saw a significant drop in cement demand in November, but with the end of Monsoon, but it seems to be coming in December. So, I feel in the coming years, especially in the calendar year 2022, the demand will be good and overall the cement sector will be able to maintain the normal trend of 6-7% of annual growth.

Q: Have you taken any price hikes recently or do you plan any further price hikes?

A: There have not been any price hikes in the recent past. I think, the prices have actually dropped by 7-8% in October and November in different regions and it has also declined by around 10% in certain regions. However, from December onwards, as the volume growth is looking slightly better, the prices will increase from here. I feel that from January, February, March and April - that is termed as the fourth quarter and the first quarter - definitely the prices will look better from these levels. There are two accounts (i) the prices that have fallen has to be recovered and (ii) the entire cement industry is facing the cost pressure, it will also have to pass on. We are looking forward to price increases in the coming quarters.

Q: Can you please give an idea related to the timeline of the price hikes and the quantum to which it can happen?

A: It is a bit difficult to say that what will be the timeline. It will depend on how the demand will shape up in the coming fourth quarter and the first quarter. I guess, that slight price increases and firmness will be seen from the second half of January and we expect that the fallen prices will recoup by March 2022.

Q: Last when we had an interaction with you, we understood your goals of selling 3 million tonne cement by year-end. Now that we are at the end of the year, how have your sales been?

A: As far as targets are concerned, we will be able to achieve our annual targets and we are targeting around 3.2 billion tonnes and I believe that our sales are in line with achieving 3.2 million tonnes for the full year. Our growth on the top line will be maintained.

Q: What is the current capacity and going forward, what will be the CapEx for further growth and what kind of investments are being lined up for the purpose?

A: Currently, we have a capacity of around 6 million tonnes of which 3 million tonnes is clinker and 3 million tonnes is grinding plant. In January 2021, we started a grinding plant of 2 million tonnes in Siliguri. Now, we are moving towards a CapEx expenditure and have decided to set up a 3 million tonnes clinker plant in the Lumshnong plant in Meghalaya. After it, we will set up a 2 million tonnes grinder plant in Guwahati. I expect that these two CapEx will be completed in the next three years. One of our CapEx for setting up a 13 MW WHR plant is continuing at present.

Q: What will be the total investment that will be required for these CapEx and how will raise it and are you comfortable on the capital front?

A: The total expenditure stands around Rs 1,400-1,500 crore. Our company is a cash surplus company and already have a CapEx of around Rs 600 crore. In the coming quarters, the volume targets of the company are maintained and the company generally generates an EBITDA of around Rs 400-450 crore. Therefore, I do not think that there is any need to raise any debt and we can fund the CapEx through internal accruals.

Q: There is a demand but is there any region where sluggishness is felt or the same trend is visible across the country? What is your outlook in terms of demand and what is your view on certain concerns like raw material prices, realisations?

A: There is sluggishness across the board. There is sluggishness in all the regions but you will find more sluggishness in the East. The demand degrowth in North East is replicating the degrowth of East. There has been demand degrowth in other reasons in the month of November but December has been good till date and we expect that the month will be almost equal to the corresponding December of the last year. So, the overall demand outlook is looking slightly better from January onwards across the board. As far as concerns are concerned, the industry is grappling with cost pressure and if you have a look then coal prices have more than doubled. So, there is an increase in the prices of coal and pet coke and it has a straightaway impact on the companies that manufacture clinker as it is used as a fuel for the purpose at the same time, coal is also used in power generation. So, both of these costs have had a huge impact of around Rs 30-40 per bag on the entire industry. Definitely, the fuel price increase - petrol and diesel prices - are also have an impact on total transport cost as 25-30% of total topline accounts for transport. So, these two factors have created a lot of cost pressure and the industry will have to pass on the cost with demand to at least maintain the margin.

Q: You are a dominant player in North East and Eastern regions. Do you have any plans to slowly grow in other markets as well, if yes, when will you try to do so or you would like to consolidate in the North-Eastern region?

A: As a company, we are quite focused on the East. We have plans to create a capacity of 12-15 million tonnes in next 5 years in East. As I have already informed that we will set up a capacity of 3 million tonnes clinker and 2 million tonnes grinding in Meghalaya and Guwahati in coming three years and after that, we have plans to set up a 2 million tonnes plant in Bihar and a 2 million tonnes plant in Durgapur to take up our total grinding capacity to around 12 million tonnes. At the same time, we are also planning a clinker capacity in Chhattisgarh or Madhya Pradesh to feed these two units. So in the next five years, the company has created its future plans to create a capacity of around 12-15 million tonnes in East.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

12:23 PM IST

Cement stocks gain up to 10% in otherwise weak market; mid-cap companies outperform heavyweights

Cement stocks gain up to 10% in otherwise weak market; mid-cap companies outperform heavyweights Star Cement Q2 profit down 22.79% to Rs 46.53 cr

Star Cement Q2 profit down 22.79% to Rs 46.53 cr