Shubh Aarambh Home Loans: Axis Bank to 'waive' some of your EMIs

In a move to strengthen its home loan category, Axis Bank has launched "Shubh Aarambh" - an affordable housing loan product.

Key Highlights:

- Axis Bank launches Shubh Aarambh home loans product

- Axis Bank disbursed Rs 7,500 crore worth home loan in FY17

- Axis to waive of 4 EMIs on home loans up to Rs 30 lakh

Axis Bank on Thursday launched an affordable home loan product called "Shubh Aarambh home loans". It said that loans up to Rs 30 lakh will be given 'waiver' of 4 EMIs during every 4th, 8th and 12th year of the home loan.

According to Axis Bank, home loans worth Rs 7,500 crore has been disbursed in the financial year 2016 - 17 (FY17) by reaching out to existing savings account customers, using data analytics and a strong sales team.

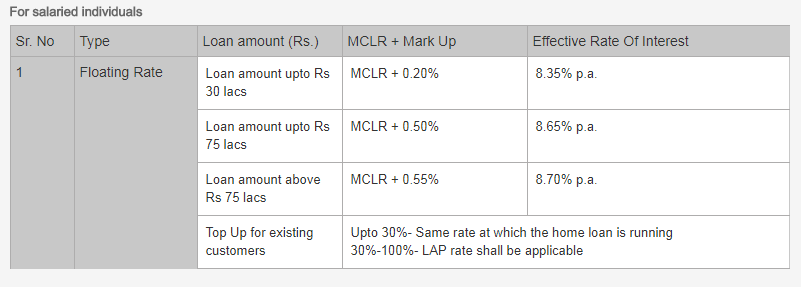

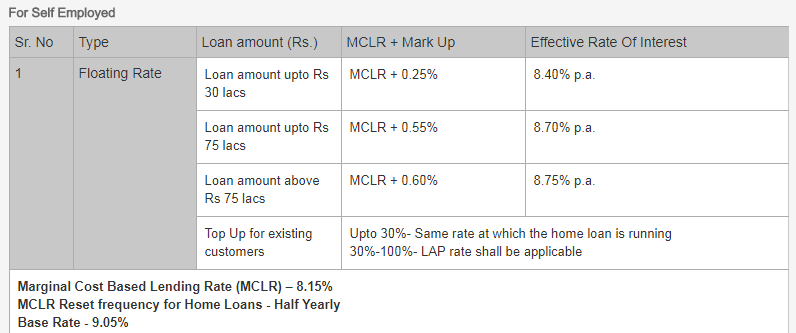

Currently, Axis Bank charges you with 8.35% per annum interest rate on home loan amount up to Rs 30 lakhs for salaried individuals. For self-employeed customers, it charges you with interest rate of 8.40% p.a on the similar loan amount.

Customers who have availed home loan disbursement or received a sanction prior to March 31, 2016, will continue to operate on base rate at Axis Bank.

Apart from this on Thursday, the bank has reviewed and retained the Marginal Cost of Fund Based Lending Rates (MCLR) at the same levels across tenors. The one-year MCLR stands unchanged at 8.25%.

Recently, Axis Bank revised the interest rates on savings account with immediate effect.

A person having savings account balance up to Rs 50 lakhs will now earn interest rate of 3.50% per annum - a cut of 50 basis points from previous rate. While balance of Rs 50 lakhs and above will continue to earn 4% interest per annum.

"We launched 'Shubhaarambh' our affordable housing product suite, as a pilot in Gujarat and Rajasthan," the bank said in its annual report for FY17.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

12:58 PM IST

No interest rate cut in RBI's February policy review, or anytime in FY26: Axis Bank chief economist Neelkanth Mishra

No interest rate cut in RBI's February policy review, or anytime in FY26: Axis Bank chief economist Neelkanth Mishra SEBI sends notices to Axis Bank, Axis Securities, Axis Capital over Max Life deal; more pain ahead for investors?

SEBI sends notices to Axis Bank, Axis Securities, Axis Capital over Max Life deal; more pain ahead for investors? Axis Bank shares zoom up 4% despite weak Q2; Here's what global brokerages suggest

Axis Bank shares zoom up 4% despite weak Q2; Here's what global brokerages suggest Axis Bank Q2 preview: PAT likely to increase 8.5% YoY; asset quality may be affected marginally

Axis Bank Q2 preview: PAT likely to increase 8.5% YoY; asset quality may be affected marginally