SBI rate cut: Here are 11 banks who continue to offer higher savings interest rates

With State Bank of India (SBI) announcing the revision of interest rates on savings account for balances of Rs 1 crore and below, other banks likely to follow suit.

Key Highlights

- State Bank of India slashed interest rate for balance of Rs 1 crore or below to 3.5%

- As a trend setter, other banks likely too follow SBI and announce rate cut soon

- RBL Bank is charging highest interest rate on savings account

India's largest bank State Bank of India (SBI) on Monday announced the revision of interest rates on savings account of under Rs 1 crore to 3.50%. This revision was the first time in six years after Reserve Bank of India (RBI) deregulated savings bank deposit rates in 2011.

SBI said that while bank balance over Rs 1 crore will continue to earn interest at 4% per annum, interest at 3.50% per annum will be offered on balances of Rs 1 crore and below.

In a conference call, SBI Managing Director Rajnish Kumar said that the rationale for the rate cut was that the real interest rates are really high and "there was no choice for the bank but to bring down the savings bank account interest rate...We have been cutting the term deposit rates and were watching for a right time (to cut rates)."

Under the current circumstances, Kumar said the choice before the bank was to either raise the marginal cost of lending rates (MCLR) or cut savings bank interest rates.

When asked if the bank would further cut both the lending and savings rate if RBI cuts the key repo rate in its August 2 monetary policy review, Kumar said the bank will take a call accordingly.

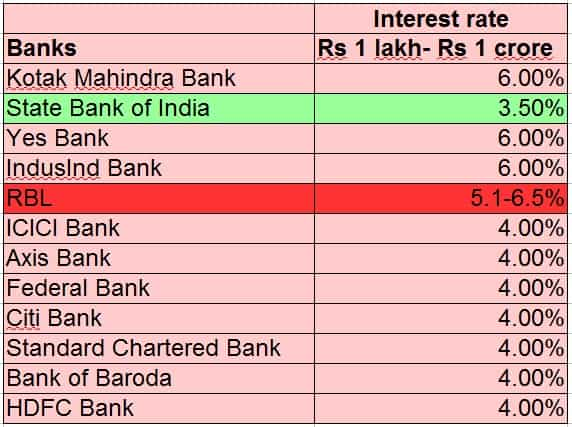

The lender is a trend setter and may prompt peers to follow suit. Here are 10 banks who offer savings interest rates in the range of 4-6.5%:

RBL's interest rate on savings bank is the highest at 6.5% for balance above Rs 10 lakh. Kotak Mahindra Bank, Yes Bank and IndusInd Bank offers interest rate at 6% for balance above Rs 10 lakh.

Now, with banks still sitting with huge liquid cash, the case become stronger for other banks to follow SBI to match lower rates.

Speaking with Zeebiz, an analyst from CARE Ratings said, "Whether other banks will cut the rates, will be a wait and watch situation as it will depend on their call on maintaining MCLR."

SBI's announcement came in just two days before the Reserve Bank of India's bi-monthly policy review.

At 1140 hours the shares of SBI were trading at Rs 310.10 per piece, down 0.78% or Rs 2.45 on BSE.

ALSO READSBI slashes deposit rates for bank balances lower than Rs 1 crore

SBI's various charges on cash withdrawals; here's the list

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

12:18 PM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate