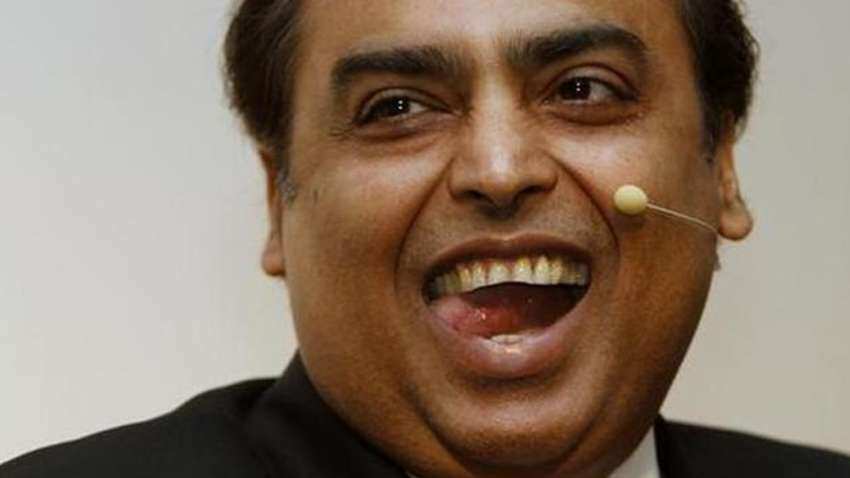

Reliance-Urban Ladder deal: What RIL said in its 1st official statement in regulatory filing after acquiring 96 pc stake for Rs 182 crore

UrbanLadder was incorporated in India on February 17, 2012. UrbanLadder is in the business of operating a digital platform for home furniture and décor products.

Reliance Industries (RIL) in a late night regulatory filing on Saturday confirmed that Reliance Industries' retail arm has acquired 96 per cent stake in online furniture retailer Urban Ladder for Rs 182.12 crore.

Reliance-Urban Ladder deal: Top points from 1st official statment of regulatory filing

- SUBJECT: Disclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 – Investment in Urban Ladder Home Décor

Solutions Private Limited

- Reliance Retail Ventures Limited (“RRVL”), a subsidiary of Reliance Industries Limited (“RIL” or the “Company”) has acquired equity shares of Urban Ladder Home Décor

Solutions Private Limited (“UrbanLadder”) for a cash consideration of ~INR 182.12 crore (Indian Rupees one hundred eighty two crore and twelve lakh only).

- The said investment represents ~96% holding in the equity share capital of UrbanLadder.

- RRVL has a further option of acquiring the balance stake, taking its shareholding to 100% of the equity share capital of UrbanLadder

- RRVL proposes to make a further investment of up to INR 75 crore (Indian Rupees seventy-five crore only). The further investment is expected to be completed by December

2023.

-UrbanLadder was incorporated in India on February 17, 2012. UrbanLadder is in the business of operating a digital platform for home furniture and décor products. It also has

a chain of retail stores in several cities across India.

-UrbanLadder’s audited turnover was INR 434.00 crore, INR 151.22 crore and INR 50.61 crore, and Net Profit / (Loss) of INR 49.41 crore, INR (118.66) crore and INR (457.97) crore

in FY 2019, FY 2018 and FY 2017 respectively.

- The aforesaid investment will further enable the group’s digital and new commerce initiatives and widen the bouquet of consumer products provided by the group, while enhancing user engagement and experience across its retail offerings.

- No governmental or regulatory approvals were required for the said investment. The investment does not fall within related party transactions and none of RIL’s promoter / promoter group / group companies have any interest in the transaction.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

01:20 PM IST

ONGC, Oil India fall; Chennai Petroleum and MRPL trade with gains up to 3% as centre scraps windfall gains tax on crude

ONGC, Oil India fall; Chennai Petroleum and MRPL trade with gains up to 3% as centre scraps windfall gains tax on crude  Jio Financial Services shares continue to slide; stock hits 5% lower circuit again

Jio Financial Services shares continue to slide; stock hits 5% lower circuit again Reliance shares rise after oil-to-telecom conglomerate reports 2% decline in Q4 revenue

Reliance shares rise after oil-to-telecom conglomerate reports 2% decline in Q4 revenue Reliance Jio Q3 Results: Net profit jumps 28.3% to Rs 4,638 crore

Reliance Jio Q3 Results: Net profit jumps 28.3% to Rs 4,638 crore Reliance Q3 Results 2023: RIL's net profit drops 15% YoY in December quarter to Rs 15,792 crore

Reliance Q3 Results 2023: RIL's net profit drops 15% YoY in December quarter to Rs 15,792 crore