Reliance shares continue to rise on Jio plans

Since the announcement, shares of the company has been surging and on Wednesday last week, it had touched eight-year high.

Shares of Reliance Industries continue to rally even a week after its big Jio plans announcements. At 0930 hours the shares of Reliance were trading at Rs 1246.05 per piece, up 5.37% or Rs 63.45 on BSE.

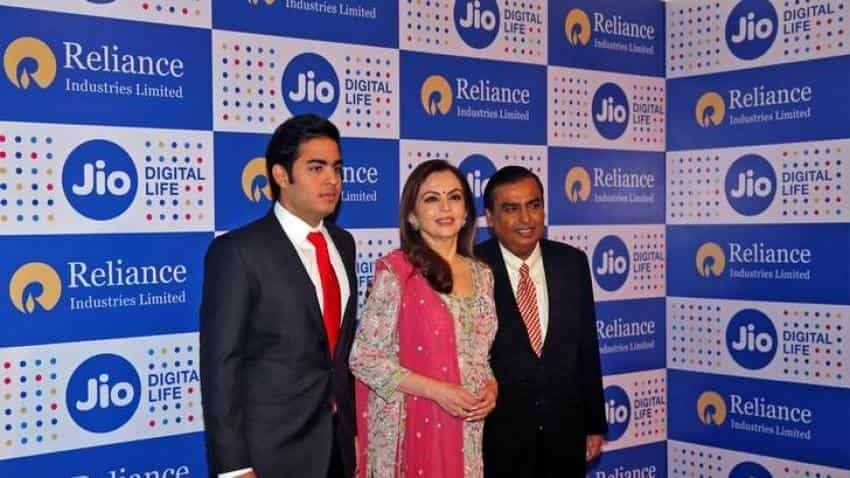

Last week, company's chairman Mukesh Ambani had unveiled plans to start charging current 100 million and new customers for using 4G data at Reliance Jio networks.

Ambani had also announced the introduction of Jio Prime Membership, a loyalty program, that will offer unlimited benefits to existing customers of ‘Happy New Year’ offer till March 31, 2018. The company also said that customers would be required to pay a nominal one-time enrollment fee of Rs 99 and an introductory plan of Rs 303 per month to avail of the benefits.

India Ratings analyst pointed out, “…the tariff plan under its Prime Membership Programme of Rs 303 per month per subscriber generates an ARPU of Rs 260 (net of taxes), which is higher than the industry-blended ARPU (Incumbents blended ARPU of Rs 190 and data ARPU of Rs 150).”

“Our current FY18 revenue and EBITDA estimates of Rs 201 billion (20,100 crore) and –Rs 18.5 billion (18,500 crore), respectively, factor in nearly 100 million subscribers and ARPU of Rs 200,” Aliasgar Shakir and Jay Gandhi analysts from Motilal Oswal said in a report dated February 21.

Since the announcement, shares of the company has been surging and on Wednesday last week, it had touched eight-year high. On February 21, the shares of the company were trading at Rs 1088 per piece. Presently, the shares are trading at Rs 1249 per piece, giving returns of 14% in just one week to investors.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

09:50 AM IST

Mcap of top-10 most valued firms slumps Rs 4.95 lakh crore; TCS, Reliance hardest hit

Mcap of top-10 most valued firms slumps Rs 4.95 lakh crore; TCS, Reliance hardest hit 6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit

6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week

SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week Reliance Industries shares drop nearly 4%; market valuation erodes by Rs 77,606.98 crore

Reliance Industries shares drop nearly 4%; market valuation erodes by Rs 77,606.98 crore  Gas price for Reliance hiked to $10.16; CNG, piped cooking gas rates unchanged

Gas price for Reliance hiked to $10.16; CNG, piped cooking gas rates unchanged