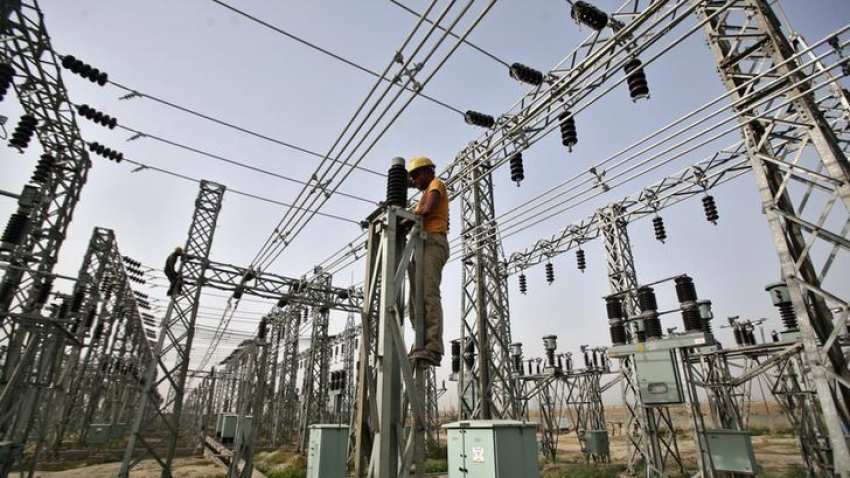

NTPC Q4 result: Profit jumps 48.7 pc to Rs 4,350.32 cr; power firm announces 25% final dividend

NTPC Q4 result: The final dividend is in addition to the interim dividend of Rs 3.58 per equity share for 2018-19 paid in February 2019. This is the 26th consecutive year of dividend payment by the company.

State-run power giant NTPC Saturday posted a 48.7 per cent jump in its standalone net profit at Rs 4,350.32 crore for the March quarter compared to the year-ago period mainly on the back of lower expenses. The company's standalone net profit in January-March 2018 was Rs 2,925.59 crore, an NTPC statement said. The company's total income slipped to Rs 22,545.61 crore in the March quarter from 23,617.83 crore year ago. Expenses also decline to Rs 19,008.44 crore in the quarter from Rs 20,229.26 crore.

For 2018-19, standalone net profit rose by 13.60 per cent to Rs 11,749.89 crore compared to Rs 10,343.17 crore in the previous year. Total income was Rs 92,179.56 crore in 2018-19, up from Rs 85,207.95 crore during the previous year. Consolidated net profit of the firm rose to Rs 12,633.45 crore in 2018-19 from Rs 10,501.50 crore in the previous fiscal. Total consolidated income also rose to Rs 97,537.34 crore in the last fiscal from Rs 89,641.59 in 2017-18.

The Board of Directors of NTPC Ltd has recommended a final dividend for 2018-19 at the rate of 25? per cent of the paid-up share capital (Rs?? 2.50 per equity share of the face value of Rs 10 each), subject to the approval of shareholders in the Annual General Meeting scheduled to be held in the month of August 2019.

The final dividend is in addition to the interim dividend of Rs 3.58 per equity share for 2018-19 paid in February 2019. This is the 26th consecutive year of dividend payment by the company.

The gross power generation of the NTPC Group for FY2018-19 was 305.90 billion units (BUs) as against 294.27 BUs during the previous year. The average power tariff of the firm was Rs 3.38 per unit in the fiscal under review.

The company's plant load factor or capacity utilisation (PLF) of coal based projects dropped to 77.58 per cent in March quarter from 79.03 per cent year ago. During the 2018-19, the company's PLF of coal fired power plants also declined to 76.68 per cent from 77.90 per cent in 2017-18.

The company's domestic coal supply rose to 46.94 million tonnes in March quarter from 44.36 million tonnes year ago. During the last fiscal the company's domestic coal supplies also increased to 175.05 million tonnes from 168.21 million tonnes.

Coal imports by the company also went up slightly to 0.66 million tonnes in March quarter from 0.10 million tonnes year ago. During the last fiscal, the company's coal imports also increased to 1.05 million tonnes from 0.32 million tonnes in 2017-18.

The NTPC Group's total installed capacity has increased to 55,126 MW as on March 31, 2019 from 53,651 MW as on March 31, 2018.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

04:20 PM IST

NTPC Renewable Energy bags 500-MW solar project in SECI auction

NTPC Renewable Energy bags 500-MW solar project in SECI auction  NTPC Green soars 8.31% after commercial operation begins at its 1st unit of Shajapur solar project

NTPC Green soars 8.31% after commercial operation begins at its 1st unit of Shajapur solar project NTPC Green Energy IPO to list tomorrow: What investors can expect

NTPC Green Energy IPO to list tomorrow: What investors can expect NTPC Green Energy IPO: How to check allotment status online

NTPC Green Energy IPO: How to check allotment status online NTPC Green Energy IPO oversubscribed on final day; retail portion booked over 3 times

NTPC Green Energy IPO oversubscribed on final day; retail portion booked over 3 times