NBFC shares suffer as Govt goes in demonetisation drive

“We believe companies which have lower exposure to the LAP books and low LTVs of around 60-65% would be in a better position to handle the deterioration in property prices. However, the near term demand for real estate is expected to be impacted,” Pandya said.

Non-banking financial companies (NBFCs), especially housing finance service providers, are likely to underperform given cash crunch arising out of demonetisation drive.

Nischint Chawathe, M B Mahesh and Abhijeet Sakhare of Kotak Institutional Equities said, “HFCs with high valuations are likely to underperform the growth expectations built in.”

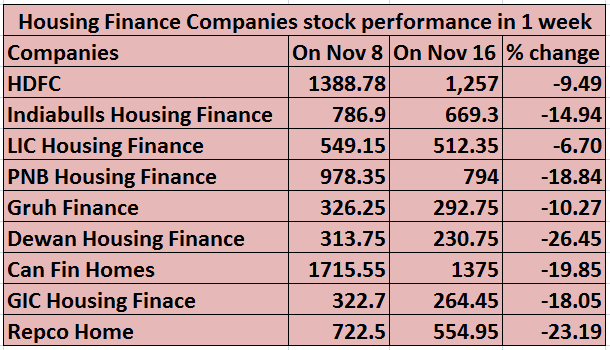

There are 14 housing finance companies (HFC) listed on BSE. Among the top 9 HFCs are– HDFC, Indiabulls Housing Finance, LIC Housing Finance, PNB Housing Finance, Gruh Finance, Dewan Housing Finance (DHFL), Can Fin Homes, Repco Home and GIC Housing Finance.

Stock performance of the above mentioned companies have already been under pressure.

Share price of these companies have slumped between the range of 6% to 27%.

Payal Pandya, Research Analyst (Wealth), Centrum Broking said, “Real estate and financing therein is a sector which is expected to be affected considerably due the fall in property prices and the removal of unofficial transaction value that formed a substantial part of the deals.”

Now that the correction in real estate prices is in picture, volumes are expected to be low which in turn will increase the holding period of real estate loans.

HDFC has about 10% exposure to developer/construction finance and about 30% non-individual exposure. DHFL has about 12% exposure towards developers, with majority of small players in tier II and III towns.

On the other hand, the loan-to-value (LTV) in case of the loan against property (LAP) books needs proper monitoring. Pandya said, “LTVs would increase substantially with fall in property prices, which have to be brought down by way of part recoveries from customers. As this may largely affect the asset quality of housing finance companies.”

HFCs with higher proportion of LAP loans business is also expected to take a hit. Also, lower property prices would substantially increase the LTVs of existing loans.

“We believe companies which have lower exposure to the LAP books and low LTVs of around 60-65% would be in a better position to handle the deterioration in property prices. However, the near term demand for real estate is expected to be impacted,” Pandya said.

Assuring the medium and long term outlook of HFCs, Pandya added, “The affordable housing scape is likely to gain more demand with availability of cheaper houses, thus further increasing customer affordability.”

Kotak said, “We believe that reduction of cash/ black money in the economy will see a rise in financial savings. As such, we expect inflows to mutual funds, life insurance companies and direct equities to increase, in addition to the inflow to bank deposits."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

05:08 PM IST

Q4 results likely to show recovery as note-ban woes fade

Q4 results likely to show recovery as note-ban woes fade HDFC Life, Max Life working on issues raised by Irdai: Vijayan

HDFC Life, Max Life working on issues raised by Irdai: Vijayan PNB Housing Finance surges 14% on market debut

PNB Housing Finance surges 14% on market debut  PNB Housing Finance IPO subscribed 30 times

PNB Housing Finance IPO subscribed 30 times  Bajaj Finance allots Rs 133 crore NCDs

Bajaj Finance allots Rs 133 crore NCDs