Maruti Q2 Results: PAT grows 80% YoY to Rs 3,716.5 crore, revenue rises 24%

Maruti Q2 Results: Total revenue from operations came in at Rs 37,062.1 crore, up 23.8 per cent YoY.

)

Maruti Q2 Results: Maruti Suzuki India (MSIL), India's leading car manufacturer, reported on Friday, October 27, a standalone profit after tax (PAT) or net profit of Rs 3,716.5 crore for the quarter ended September 30, 2023, translating into an 80.3 per cent jump on a year-on-year (YoY) basis. The carmaker had reported a profit of Rs 2,061.5 crore in the year-ago period. Maruti said that the jump in net profit was on account of higher net sales, a softening of commodity prices, cost reduction efforts, and higher non-operating income.

Total revenue from operations came in at Rs 37,062.1 crore, up 23.8 per cent YoY.

The company's bottom line beat analysts' estimates by a big margin. Zee Business analysts had estimated the company's standalone profit to soar by 52.8 per cent to Rs 3,150 crore against Rs 2,062 recorded in the same quarter last fiscal. Its revenue from operations was estimated to soar to Rs 37,000 crore, translating into a jump of 23.6 per cent YoY.

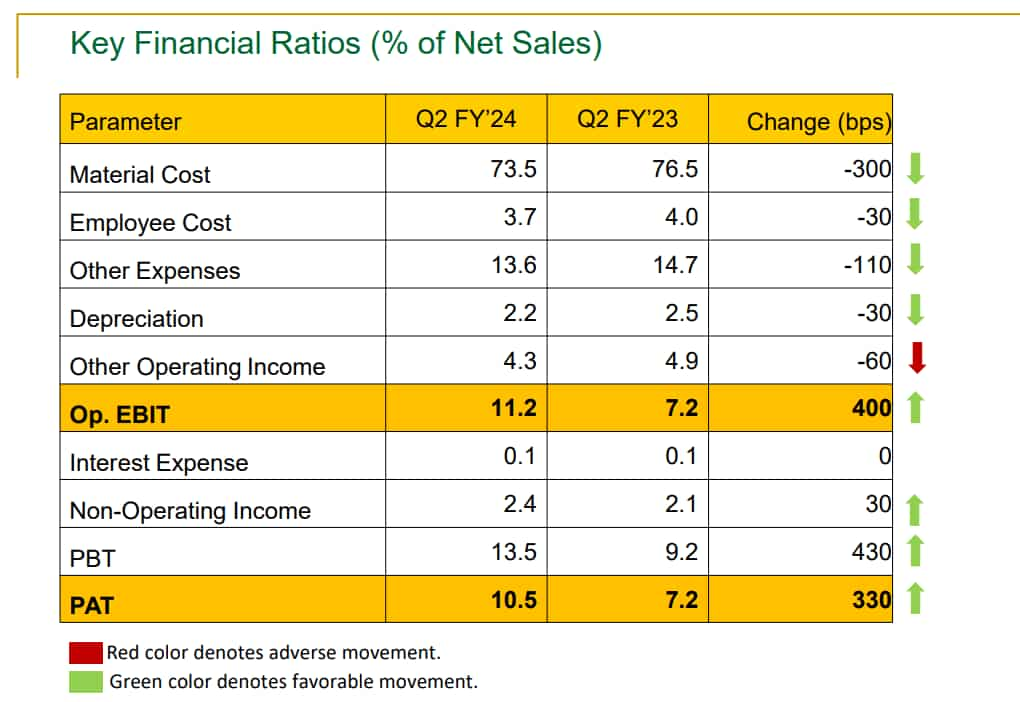

The company's operating earnings before interest, and tax (EBIT) jumped 95 per cent YoY to Rs 3,990.1 crore.

Key financial ratios

Source: Investor Presentation

Highlights: Q2 (July–September), FY 2023–24

The company recorded its highest-ever quarterly sales volume, net sales, and net profit in this quarter, the earnings release added.

During the quarter, 552,055 vehicles were sold. Sales in the domestic market were 482,731 units, while 69,324 cars were exported. The same period in the previous year saw total sales of 517,395 units, comprising 454,200 units in domestic and 63,195 units in export markets.

During the quarter, the company registered net sales of Rs 35,535.1 crore against Rs 28,543.5 crore logged in the same period the previous year, owing to higher sales volume and product mix.

This was on account of higher net sales, a softening of commodity prices, cost reduction efforts, and higher non-operating income.

Highlights: H1 (April-September), FY 2023-24

In FY2023–24, the company recorded its highest-ever half-yearly sales volume, net sales, and net profit.

The company sold a total of 1,050,085 units during the period, a growth of 6.6 per cent over H1 FY2022-23. Sales in the domestic market stood at 917,543 units and exports at 132,542 units.

The company registered net sales of Rs 66,380.3 crore in FY2023–24 as compared to Rs 53,829.8 crore in H1FY2022-23.

The company made a net profit of Rs 6,201.6 crore in H1FY2023-24 as against Rs 3,074.3 crore in H1FY2022-23.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

03:51 PM IST

Nifty Auto jumps over 73% in 1 year; will the impressive run continue? PV, CV, 2W—which segment looks most promising?

Nifty Auto jumps over 73% in 1 year; will the impressive run continue? PV, CV, 2W—which segment looks most promising? Most awaited Maruti Suzuki cars, know launch details

Most awaited Maruti Suzuki cars, know launch details Hyundai Motors, Maruti Suzuki top list of carmakers in terms of dealer satisfaction: Industry body FADA

Hyundai Motors, Maruti Suzuki top list of carmakers in terms of dealer satisfaction: Industry body FADA Maruti Suzuki total sales rise to 1,81,630 units in July

Maruti Suzuki total sales rise to 1,81,630 units in July  Maruti recalls 87,599 units of S-Presso, Eeco to replace faulty steering tie rod

Maruti recalls 87,599 units of S-Presso, Eeco to replace faulty steering tie rod