Llyods shares drop but is this a good deal for Havells India?

Naveen Trivedi, analyst at HDFC Securities said, “The revenue and EBITDA expected from Lloyd Consumer is Rs 1,850 crore and Rs 11,000 crore respectively for FY17. This deal is significant for Havells as Lloyd will contribute 30% and 13% to its FY17 revenue and EBITDA numbers.”

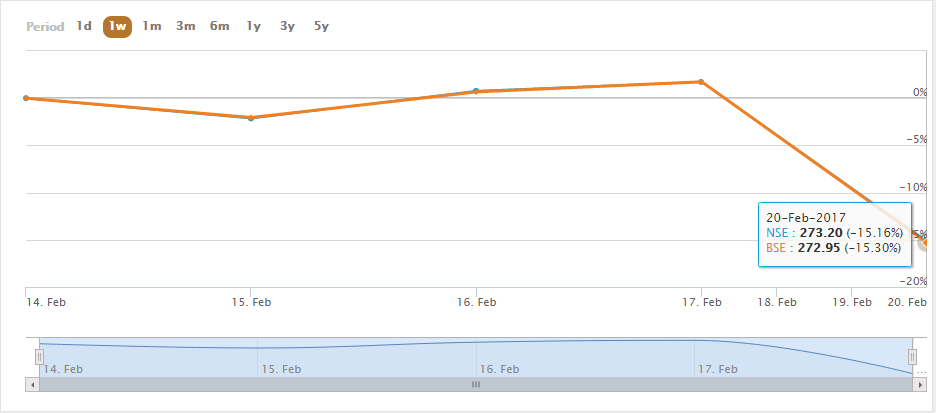

Shares of Lloyd Electric & Engineering Ltd has lost nearly Rs 50 in the past two days as the company said it is selling its consumer durable business to Havells India.

Within two days of trading, shares of Lloyd have tumbled nearly 17%, trading at Rs 273-mark compared to Rs 328-level in its previous week.

On the other hand, shares of Havells India were not much impacted. From previous week's trading, share price of Havells India is down only 3%.

The deal:

As per the agreement, Havells India has acquired Lloyd Electric's consumer durable business for an enterprise value of Rs 1600 crore on debt free, cash free basis.

Havells will gain Lloyd's intellectual property, manpower and distribution network. The deal is expected to be completed by March-end and is valued at 0.9x EV/revenue and 14.5x EV/EBITDA of FY17.

What's stored in for Havells?

Naveen Trivedi, analyst at HDFC Securities said, “The revenue and EBITDA expected from Lloyd Consumer is Rs 1,850 crore and Rs 11,000 crore respectively for FY17. This deal is significant for Havells as Lloyd will contribute 30% and 13% to its FY17 revenue and EBITDA numbers.”

EBITDA is termed as earnings before interest tax depreciation and amortisation.

The revenue break-up for Lloyd Consumer are – air conditioners (Acs) accounting 70% of business , TV panels 20-22% and the rest from washing machine & appliances.

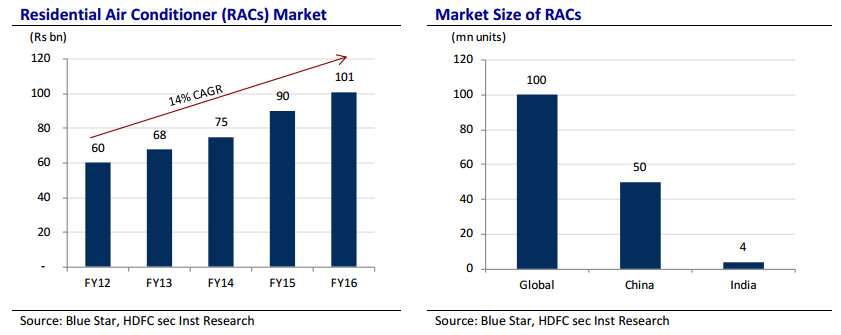

The air condition market in India has a huge potential for growth ahead. The country's residential air conditioner (RAC) market is growing at a compounded annual growth rate of 14%.

However, compared to global peers, India's RAC market has not marked much growth. Market size of India's RAC has been 4 million units which is very low compared to China's RAC market size of 50 million units and global 100 million units.

While RAC penetration in India has been at 3% compared to 25% of China's and 30% globally.

Yet, HDFC Securities believe that there has been a consistent growth in India's RAC market and is expected to reach 10 million units by 2020.

In the RAC market, Lloyd stands at number 3 after Voltas and LG.

Trivedi added, “HAVL has forayed into new territory with high competition in prices and rapid technological changes. Lloyd has positioned itself in the economy price segment of the market for ACs’ and offers higher distribution margins to gain market share.”

In terms of financial performance, Lloyd's consumer business has grown significantly.

Revenue of Lloyd has reached Rs 1,243 crore with a growth of 48% in nine-month period of current fiscal (9MFY17), compared to Rs 839 crore recorded a year ago same period. In FY15, Lloyd's revenue stood at Rs 871 crore.

Meanwhile, earning before interest and tax (EBIT) growth for 9MFY17 is 35%, at Rs 87.4 crore compared to Rs 64.7 crore of same period of last year.

Trivedi said, "We considered Lloyd’s consumer business at inflexion point and cash-rich Havells has the ability to manage this business in the correct manner."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

03:22 PM IST

Bajaj Auto, Havells India and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

Bajaj Auto, Havells India and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses Dividend, stock split shares: Infosys, Havells India, IEX, Page Industries, and other stocks trade ex-date today

Dividend, stock split shares: Infosys, Havells India, IEX, Page Industries, and other stocks trade ex-date today Havells India Q4 Results: Net profit grows by one-fourth to Rs 447 crore, EBITDA up 20%; FMEG firm declares dividend

Havells India Q4 Results: Net profit grows by one-fourth to Rs 447 crore, EBITDA up 20%; FMEG firm declares dividend Havells hits 52-week high: Five reasons why Goldman Sachs has double upgraded the stock

Havells hits 52-week high: Five reasons why Goldman Sachs has double upgraded the stock Havells stock trades flat after firm report weak Q3 numbers; misses Street estimates

Havells stock trades flat after firm report weak Q3 numbers; misses Street estimates