LIC warns policyholders against linking Aadhaar via SMS; here's how you should do it

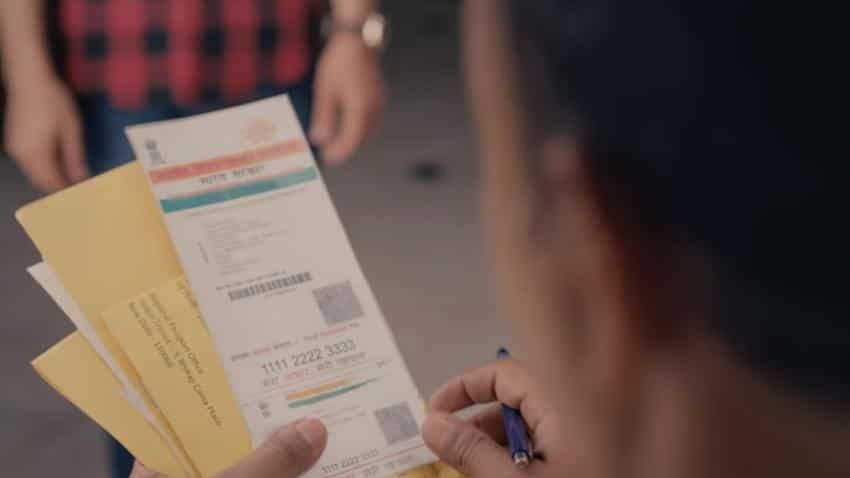

Just like bank accounts, Indian citizens are being guided to link their policies with Aadhaar and PAN by end of December 2017.

Life Insurance of India (LIC) has warned its policy holders against linking their 12-digit biometric Aadhaar with policies via text message, as it may lead to fraudulent activities.

Issuing a notification, LIC said, "Our attention is drawn to some messages circulated in social media with our emblem and logo asking policy holders link their Aadhaar number by sending SMS to designated number."

"No such messages has been sent by LIC. Also no facility to link Aadhaar number to policies is available through SMS in LIC," it said, adding "As and when LIC will enable linking of Aadhaar number with policies through SMS, our website will be duly updated of this option."

Notice - regarding linking of Aadhaar Number through SMS pic.twitter.com/wun1sCKyCV

— LIC India Forever (@LICIndiaForever) November 23, 2017

LIC is India's largest policies service provider and has market share of 76.09% market share garnering over 20 million new policies as on March 2017.

It may be noted that just like linking bank account, mobile phones, PAN, it was also made mandatory for Indian citizen to link Aadhaar number with their Insurance policies products like life insurance, health insurance or any other types of insurance being owned.

Earlier on November 8, insurance regulator IRDA said, "Central Government vide gazette notification dated 1st June 2017 notified the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017 making Aaadhar and PAN/Form 60 mandatory for availing financial services including insurance and also for linking the existing policies with the same."

IRDA notification stated that these rules have statutory force and, as such, Life and General insurers (including Standalone Health insurers) have to implement them without awaiting further instructions.

LIC has already circulated methods in linking Aadhaar and PAN with policies before December 31, 2017, on its website. A policy can be linked with Aadhaar and PAN, using just four-steps.

- Keep your Aadhaar Card and PAN card handy along with the list of policies.

- Mobile Number as registered with UIDAI is to be entered. OTP will be sent to the number provided.

- After submitting the form, a message will be shown on the success of the registration for linkage.

- After verification with UIDAI, SMS/mail confirmation will be sent to you. The verification may take a few days.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:42 PM IST

LIC Policy: Return 20 Lakh on maturity on payment of Rs 251, daily – details here!

LIC Policy: Return 20 Lakh on maturity on payment of Rs 251, daily – details here! LIC policy benefit: Know how section 10 helps you save income tax

LIC policy benefit: Know how section 10 helps you save income tax  LIC policy: Get guaranteed return of Rs 1 lakh to Rs 5.4 lakh, pay just Rs 341 to Rs 5,118 premium in Jeevan Aadhaar plan; tax benefit available too

LIC policy: Get guaranteed return of Rs 1 lakh to Rs 5.4 lakh, pay just Rs 341 to Rs 5,118 premium in Jeevan Aadhaar plan; tax benefit available too LIC policyholder? Check 5 tax benefits on your insurance premiums

LIC policyholder? Check 5 tax benefits on your insurance premiums  LIC policyholder? Beware of these frauds to save your money - Check do's and don’ts

LIC policyholder? Beware of these frauds to save your money - Check do's and don’ts