Infosys posts 7% fall in net profit at Rs 6,128 crore for Q4, misses estimates; declares final dividend of Rs 17.5

Infosys Q4: The company reported a 7 per cent quarter-on-quarter (QoQ) decline in its consolidated net profit at Rs 6,128 crore while its revenue slipped 2.3 per cent QoQ to Rs 37,441 crore.

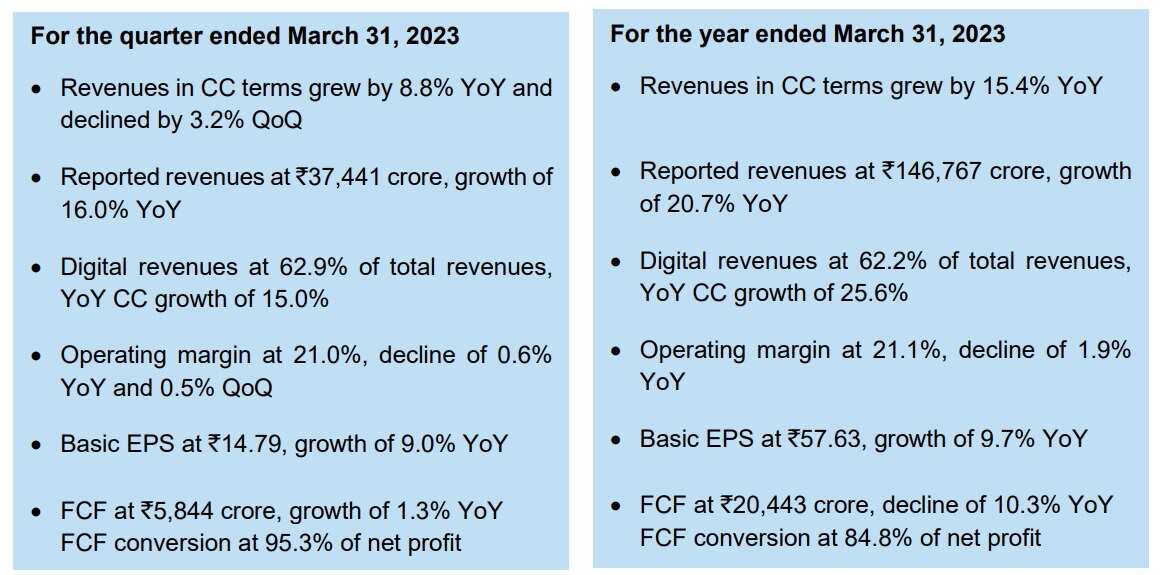

Infosys on April 13 reported a 7 per cent quarter-on-quarter (QoQ) decline in its consolidated net profit at Rs 6,128 crore for the quarter ended March 2023 (Q4FY23). On a yearly basis, the profit grew 7.8 per cent. Revenue for the period stood at Rs 37,441 crore, down 2.3 per cent QoQ and up 16 per cent on a year-on-year (YoY) basis.

Both the bottom line and top line missed Zee Business analysts' estimates as the research house had projected revenue growth of 1.8 per cent on a sequential basis to Rs 39,000 crore while PAT or profit after tax was expected to come in at Rs 6,600 crore, up 0.2 per cent.

The company's revenue in constant currency (CC) terms grew by 8.8 per cent on a YoY basis but declined 3.2 per cent QoQ. For the full fiscal year, revenue in CC terms grew by 15.4 per cent. That apart, Infosys won deals worth $2.1 billion in the fourth quarter while for the full fiscal year, total contract value or TCV stood at $9.8 billion. That apart, the company has given revenue growth guidance of 4 per cent -7 per cent in constant currency terms while the operating margin for FY24 is seen at 20 per cent - 22 per cent.

KEY HIGHLIGHTS

Source: Infosys' earnings release

Operating profit for the three-month period came in at Rs 7,877 crore, up 13.2 per cent YoY but down 4.4 per cent on a sequential basis. The operating margin for the Salil Parekh-led company was 21 per cent for the quarter, down 0.6 per cent YoY and 0.5 per cent QoQ.

Commenting on the March quarter performance, Salil Parekh, CEO and MD, said, “Our strong performance in FY23 is a testimony to the continued focus on digital, cloud and automation capabilities which resonated with our clients. We have launched exciting programs with our clients leveraging generative AI platforms."

“As the environment has changed, we see strong interest from our clients for efficiency, cost and consolidation opportunities, resulting in a strong large deal pipeline. We have expanded our internal program on efficiency and cost to build a path to higher margins in the medium term. We continue to invest in our people and in supporting our clients”, the CEO added.

Further, the company announced a final dividend of Rs 17.50 apiece. The record date for the purposes of the Annual General Meeting and payment of the final dividend is June 2, 2023. The dividend will be paid on July 3, 2023.

"Our continued focus on cost optimisation and operational efficiencies have helped in achieving operating margins of 21 per cent in FY23, said Nilanjan Roy, Chief Financial Officer. “Free cash generation in Q4, led by robust collections, was strong. Executing on our capital allocation policy, we successfully completed the share buyback and have proposed a final dividend of Rs 17.50 for FY23”, Roy added.

Infosys said its growth was broad-based across industry verticals and geographical regions. Digital comprised 62.2 per cent of overall revenues and grew at 25.6 per cent in constant currency, the earnings release stated.

Attrition and total headcount

Attrition continued to decline in Q4 as during the quarter, the attrition rate stood at 20.9 per cent as compared to 24.3 per cent in the December quarter and 27.7 per cent in the year-ago period. The total staff as of March 31, 2023, stood at 3,43,234.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

07:43 AM IST

Infosys Q4 Results Key Takeaways: PAT, revenue, attrition rate, dividend, and more

Infosys Q4 Results Key Takeaways: PAT, revenue, attrition rate, dividend, and more Infosys elevates independent director Ravi Venkatesan as co-chairman

Infosys elevates independent director Ravi Venkatesan as co-chairman  Here are 10 key takeaways of Infosys Q4 FY17 earnings

Here are 10 key takeaways of Infosys Q4 FY17 earnings