Infosys Q1 results: From bonus to delisting, check out key takeaways

The company statement said that it approved and recommended issue of bonus shares to celebrate the 25th year of Company’s public listing in India and to further increase the liquidity of its shares. The bonus issue of equity shares and ADSs will be subject to approval by the shareholders, and any other applicable statutory and regulatory approvals. T

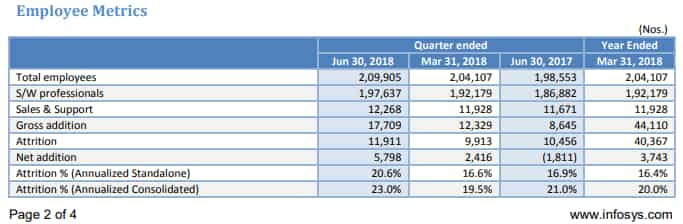

India's second-largest software services major Infosys today reported 3.7 per cent growth in consolidated net profit at Rs 3,612 crore for the quarter ended on June 30, 2018, compared to a net profit of Rs 3,483 crore in the year-ago period. In a BSE filing, the Bengaluru-based firm informed that revenues from operations grew 12 per cent to Rs 19,128 crore in the April-June quarter compared to Rs 17,078 crore in the year-ago period. Here are the key takeaways:

1. Bonus issue of equity shares

The company statement said that it approved and recommended issue of bonus shares to celebrate the 25th year of Company’s public listing in India and to further increase the liquidity of its shares. The bonus issue of equity shares and ADSs will be subject to approval by the shareholders, and any other applicable statutory and regulatory approvals. The bonus shares once allotted shall rank pari passu in all respects and carry the same rights as the existing equity shareholders and shall be entitled to participate in full, in any dividend and other corporate action, recommended and declared after the new equity shares are allotted.

2. Assets Held for Sale

During the three months ended June 30, 2018, on re-measurement, including consideration of progress in negotiations on offers from prospective buyers for Panaya, the Company has recorded a reduction in the fair value of Disposal Group held for sale amounting to Rs 270 crore in respect of Panaya. Consequently, profit for the three months ended June 30, 2018 has decreased by Rs 270 crore resulting in a decrease in Basic earnings per equity share by Rs 1.24 for the quarter ended June 30, 2018.

3. Adoption of Ind AS 115 - Revenue from contracts with customers

Effective April 1, 2018, the Company adopted Ind AS 115 “Revenue from Contracts with Customers” using the cumulative catch-up transition method which is applied to contracts that were not completed as of April 1, 2018. Accordingly, the comparatives have not been retrospectively adjusted. The effect on adoption of Ind AS 115 was insignificant.

4. Voluntary delisting of American Depositary Shares from Euronext Paris and London

In line with the announcement made on June 11, 2018, the Company has voluntarily delisted its American Depository Shares (“ADSs”) from Euronext Paris and London on July 5, 2018 and its ADS were removed from Euroclear France on July 10, 2018. The primary reason for voluntary delisting from Euronext Paris and London was the low average daily trading volume of Infosys ADSs on these exchanges, which was not commensurate with the related administrative expenses. Infosys ADSs will continue to be listed on the NYSE under the symbol “INFY” and investors can continue to trade their ADSs on the New York Stock Exchange.

Watch this Zee Business video

5. Addition to the Board

The Board appointed Michael Gibbs as an Independent Director of the Company effective July 13, 2018 for a period of three years, based on the recommendation of the Nomination and Remuneration Committee of the Board.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Fundamental picks by brokerage: These 3 largecap, 2 midcap stocks can give up to 28% return - Check targets

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

Retirement Planning: Investment Rs 20 lakh, retirement corpus goal Rs 3.40 crore; know how you can achieve it

05:22 PM IST