IndusInd Bank's Q3FY18 net profit comes at Rs 936 crore; shares drop 2%

A Bloomberg poll of experts projected IndusInd Bank to be around Rs 943 crore in Q3FY18.

Private lender IndusInd Bank missed analysts estimates during the third quarter of FY18 (Q3FY18), by reporting nearly 25% year-on-year (YoY) rise in net profit.

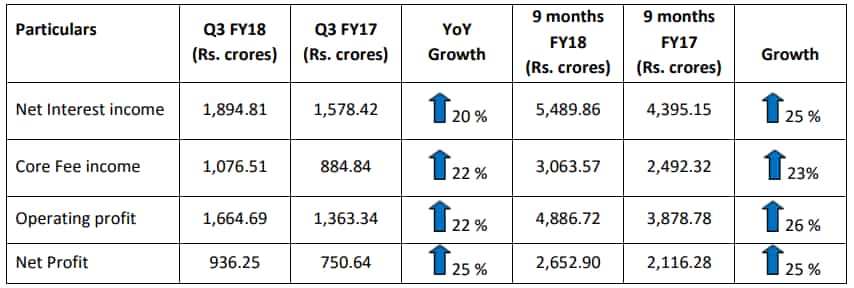

The bank posted net profit of Rs 936.25 crore, higher by 24.72% from Rs 750.64 crore in the corresponding period of previous year. The Q3FY18 PAT was also positive by 6.37% as against Rs 880.10 crore in the preceding quarter.

A Bloomberg poll of experts projected IndusInd Bank to be around Rs 943 crore in Q3FY18.

Romesh Sobti, MD & CEO, IndusInd Bank said, “The Bank has continued to show a steadfast performance again in this quarter. All vectors for both topline and bottom line have progressed as per plan.”

Meanwhile, the bank's net interest income (NII) came in at Rs 1,894.81 crore, witnessing growth of 20.04% year-on-year (YoY) and 4.05% quarter-on-quarter (QoQ) basis.

Net Interest Margin (NIM) remained subdued in Q3FY18 to 3.99%, compared to 4% each witnessed in Q3FY17 and Q2FY18 respectively.

Interestingly, the bank's provision and contingency stood at Rs 236.16 crore in Q3FY18, which was higher from Rs 216.85 crore of Q3FY17 but lower from Rs 293.75 crore of Q2FY18.

In it's financial audit, IndusInd stated that they have transferred an amount of Rs 70 crore towards floating provisions for advances during the quarter ended June 30, 2017. The floating provision has been considered while computing the net NPAs and provision coverage ratio (PCR).

On the other hand, gross non-performing assets (GNPA) of IndusInd, came in at Rs 1,498.70 crore – rising by 54.24% yoy and 11.40% qoq. The bank posted GNPA of Rs 971.62 crore in Q3FY17 and Rs 1,345.28 crore in Q2FY18.

Sobti added, “We have maintained a stable quality loan book. We believe in ‘responsive innovation’ as our central theme. Just like in the past, we will continue to launch a wide range of banking products and services which are not only unique but very germane to our consumers.”

Key Highlights of IndusInd Bank's QFY18 result:

- Non Interest income for the quarter was Rs. 1,186.76 crores as against Rs. 1,016.80 crores in the corresponding quarter of the previous year, a growth of 17 %.

- Core fee income for the quarter was Rs. 1,076.51 crores as against Rs. 884.84 crores in the corresponding quarter of the previous year, marking a growth of 22%.

- Operating Profit for the quarter was Rs. 1,664.69 crores as against Rs. 1,363.34 crores in thecorresponding quarter of the previous year, showing a growth of 22 %.

- Deposit growth up 23% Y-o-Y

- Saving Deposit Growth up 68% Y-o-Y

- Credit growth up 25% Y-o-Y

- Return on Assets (ROA) at 1.96 %

- Capital Adequacy Ratio (CRAR) at 15.83 %

With this, for the nine months period of FY18, IndusInd bank's NII registered robust growth of 25% to Rs 5,489.86 crore, compared to Rs 4,395.15 crore a year ago same period.

Also, net profit stood at Rs 2,652.90 crores in nine month period of FY18, higher by 25% from Rs 2,116.28 crore in similar period of previous fiscal.

Apart from this, IndusInd Bank also spoke on it's agreement with two companies namely Bharat Financial Inclusion Limited (BFIL) and Infrastructure Leasing and Financial Services Ltd.

On BFIL, IndusInd mentioned that the scheme is subject to the approval of the Reserve Bank of India (RBI), the Competition Commission of India (CCI), the Sebi, the respective shareholders of the bank and BFIL and lastly the National Company Law Tribunal (NCLT).

As for IL&FS' subsidiary, IndusInd said, “The proposed transaction is conditional on definitive agreements and approvals including regulatory approvals, and as such, does not have any bearing on the current financial result or the position of the bank as on December 2017.”

After the announcement of the result, IndusInd Bank share price dropped by 2.22% or Rs 38.55 on BSE, trading at Rs 1,696.20 per piece at around 1441 hours.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

02:44 PM IST

Indusind Bank Q1 Results: Net profit inches up 2%; reports uptick in stress in credit card segment

Indusind Bank Q1 Results: Net profit inches up 2%; reports uptick in stress in credit card segment  IndusInd Bank promoters' MF plan to affect shareholders' interest?

IndusInd Bank promoters' MF plan to affect shareholders' interest? IndusInd Bank shares slip post-Q4 result, dividend announcement; what should investors do?

IndusInd Bank shares slip post-Q4 result, dividend announcement; what should investors do? IndusInd Bank executes maiden programmable e-rupee transaction in Ratnagiri

IndusInd Bank executes maiden programmable e-rupee transaction in Ratnagiri IndusInd Bank edges lower post-Q4 update; brokerages bullish, Jefferies sees 35% upside

IndusInd Bank edges lower post-Q4 update; brokerages bullish, Jefferies sees 35% upside