India's penchant for 'natural' personal care products is growing at an exceptional pace

Indian consumers prefer natural supplements when it comes to personal care products, the market for which as stated by the Nielsen report is at Rs 18,500 crore today.

Key Highlights

- Natural personal care market is estimated to be at Rs 18,500 crore in India.

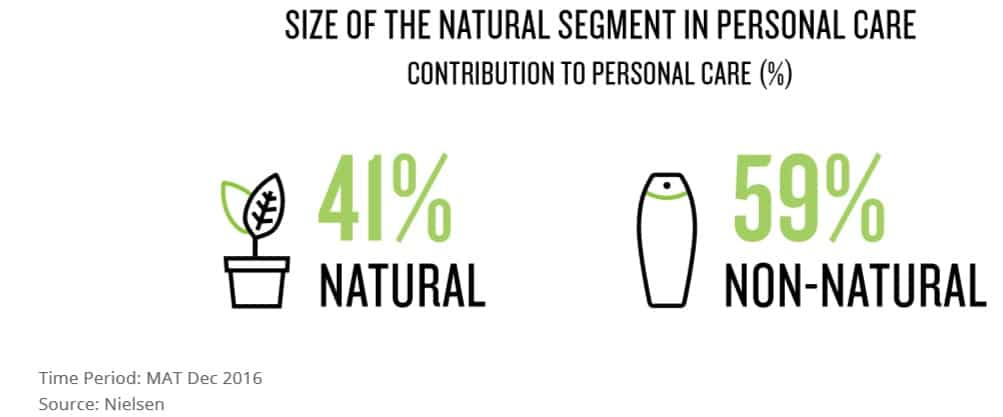

- 41% of the total personal care market belongs to natural supplements.

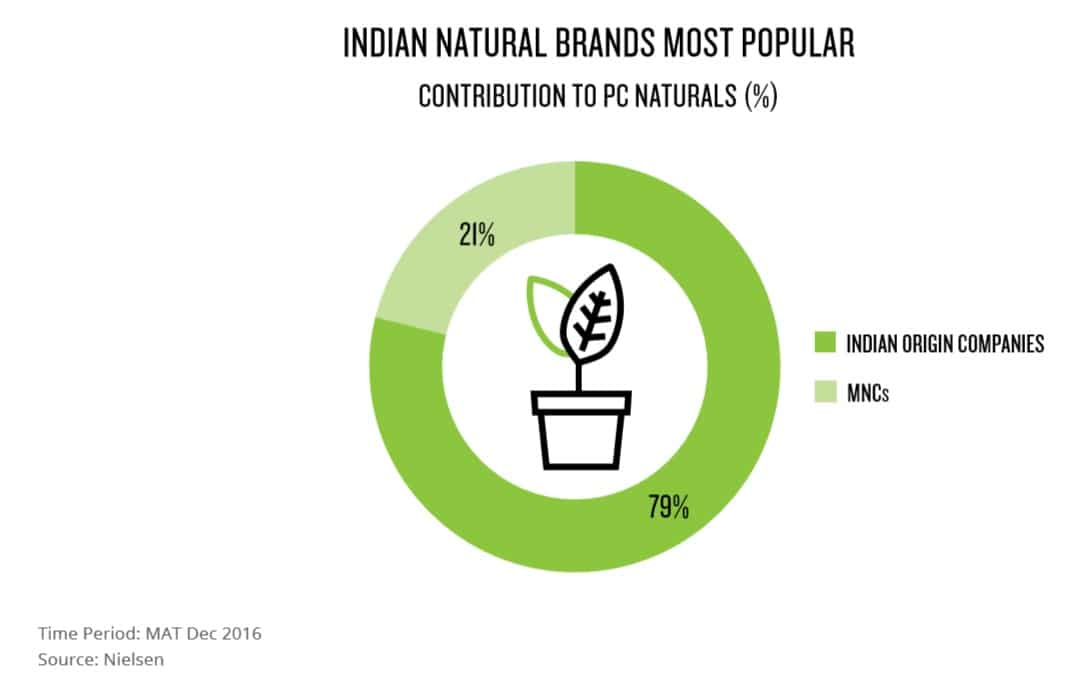

- Indians prefer ‘made in India’ brands for natural personal care products

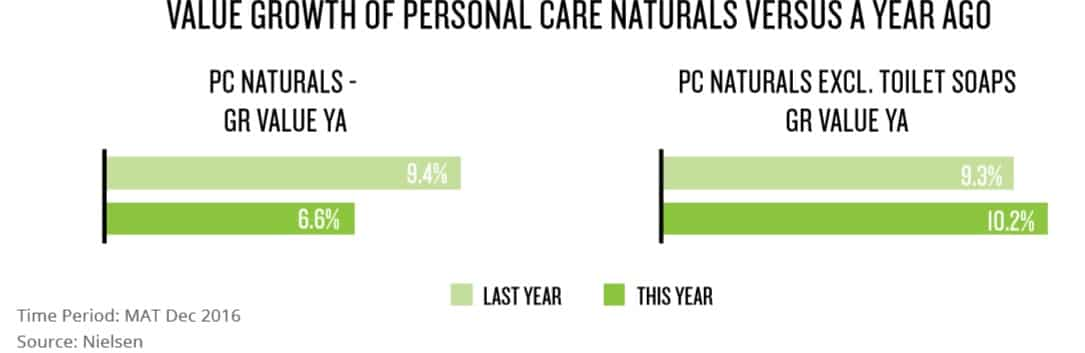

Even as Baba Ramdev captures imagination with Patanjali's natural and ayurvedic products, a Neilsen report says that Indians are going back to 'naturals' at a very fast rate. So much so, the value growth of the natural segment is racing ahead at almost 2.2 times that of non-naturals (2.9%).

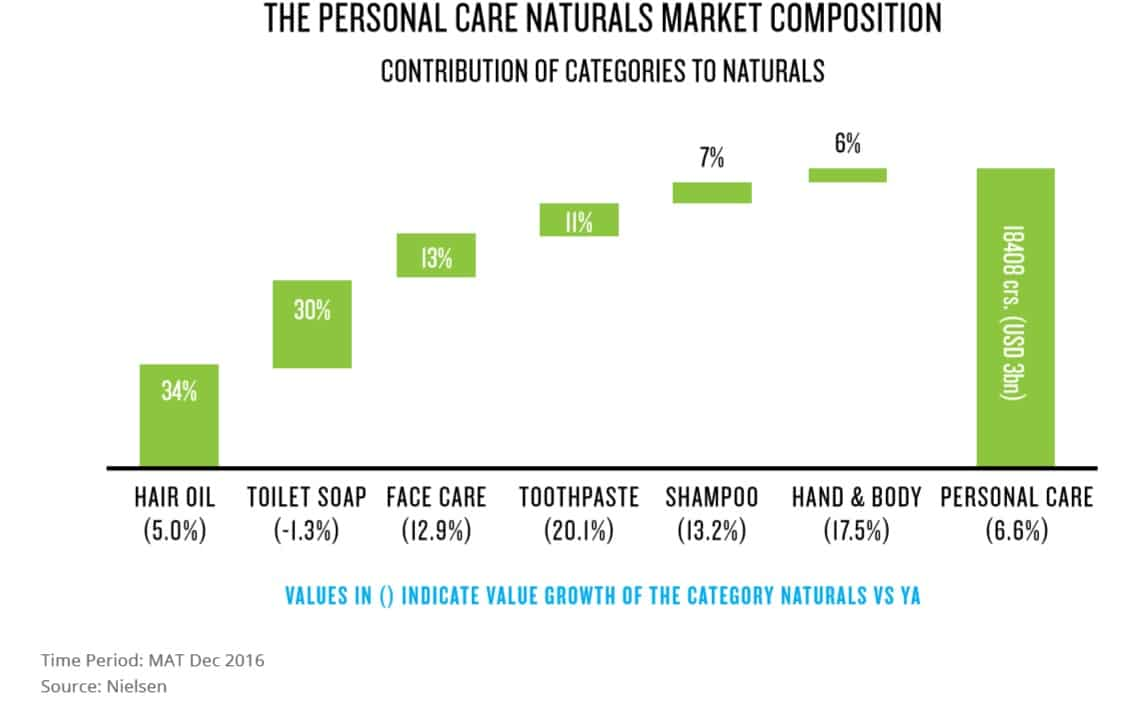

“The natural segment in India’s personal care market is estimated to be Rs 18,500 crore ($3 billion) which is 41% of the total personal care market,” Sameer Shukla, Executive Director, Nielsen South Asia said.

“There is a growing trend among Indian consumers who look for natural ingredients in personal care products – an affinity and innate belief in the goodness of ancient Indian wisdom,” Shukla added.

Consumers are drawn to Indian brands when it comes to naturals, under the assumption that manufacturers of these brands use ‘common kitchen ingredients’, making it safe for consumption and less likely to result in side effects or allergies, the report said.

When it comes to brands the report said that 77% formed core natural brands.

Although companies like Himalaya and Dabur had ayurvedic and 'natural' products in their array for quite some time, the entry of Patanjali has surely changed the dynamics of the market.

Also Read: How Ramdev hopes to achieve Rs 10,000-crore revenue goal for Patanjali Ayurved

Hindustan Unilever Ltd (HUL) too announced the re-launch of its ayurvedic brand – Ayush, with 20 products of toothpaste, skin creams and other beauty products, in December 2016.

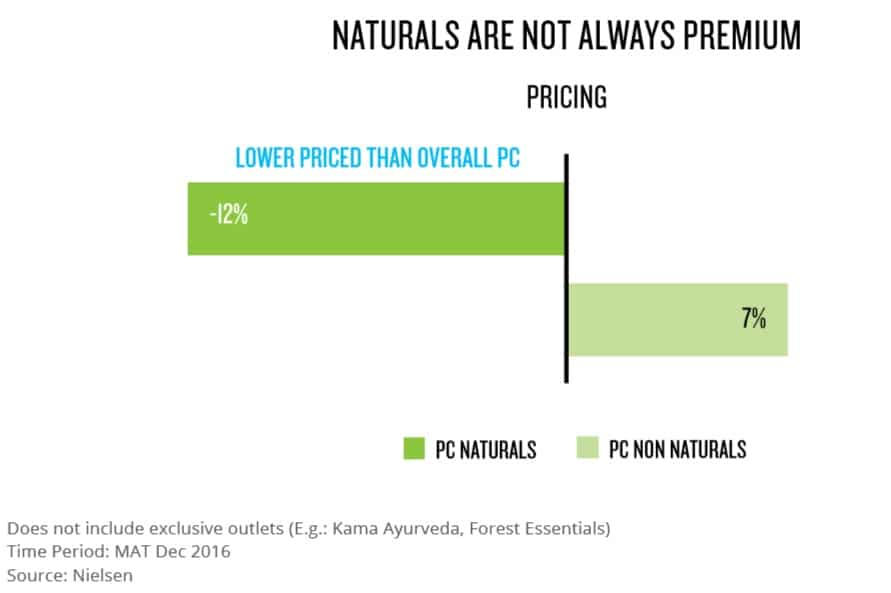

What's better, Neilsen points out, is the fact that pricing of the natural segments was much lower than other brands.

“As far as natural variants go, consumers don’t associate quality with price. Natural variants in personal care are priced 12% lower than the category average, making it 17% lower than average non-naturals,” the report added.

Hair oil was the most popular in the natural personal care segment at 34% and toilet soap came in second at 30%.

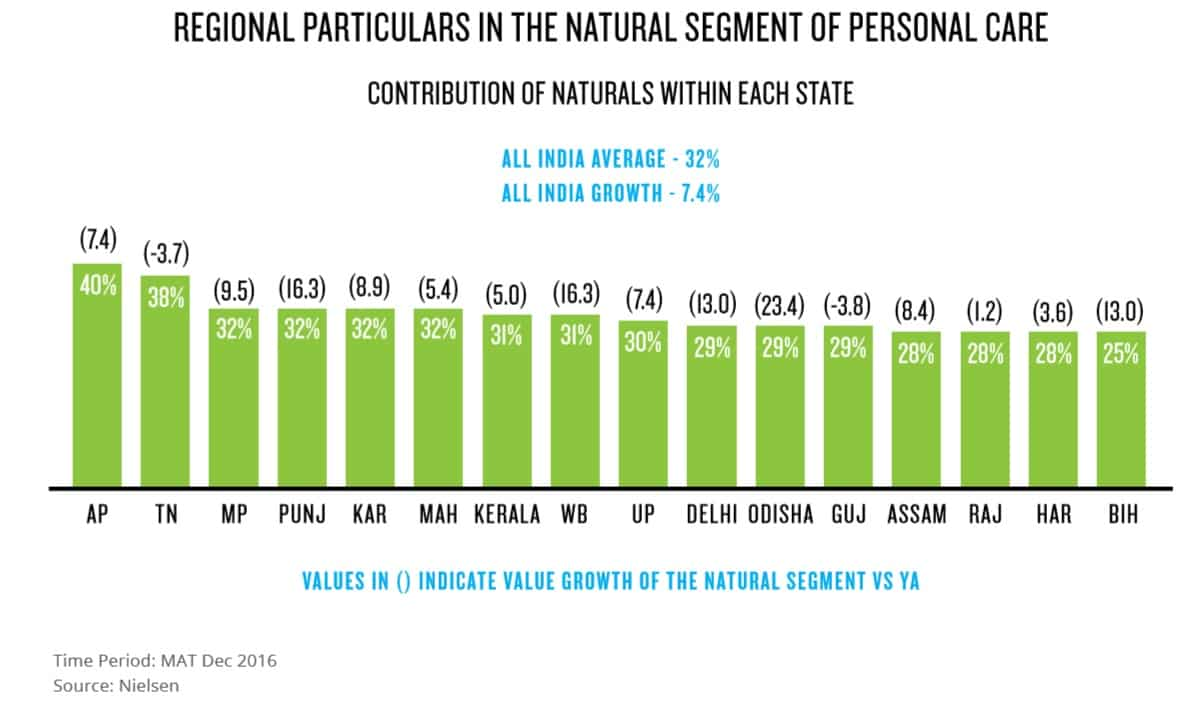

“In west Bengal, Delhi and UP, though naturals are contributing less than the national average, it is growing faster, indicating that these are regions where the opportunity lies,” Nielsen said.

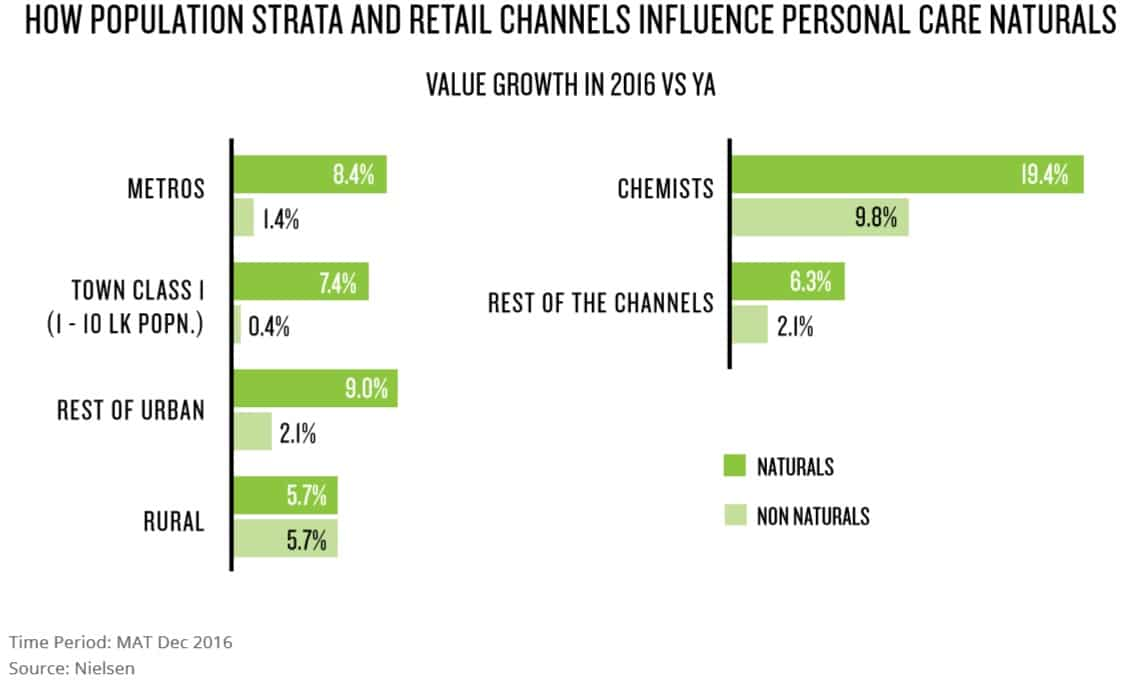

“While naturals are growing faster than non-naturals across population strata and channels, chemists emerge as the fastest growing channel for naturals,” the report added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

06:25 PM IST

Beauty, personal care market to touch $10 billion by 2021: IBHA

Beauty, personal care market to touch $10 billion by 2021: IBHA Personal Care sales disappoint; HUL readies to take on Patanjali with Ayush re-launch

Personal Care sales disappoint; HUL readies to take on Patanjali with Ayush re-launch When daughter inspired mother to set up Rs 90 crore beauty products startup

When daughter inspired mother to set up Rs 90 crore beauty products startup Patanjali eyes 2-fold rise in revenue at Rs 20,000 crore in FY18

Patanjali eyes 2-fold rise in revenue at Rs 20,000 crore in FY18 FMCG smiles: Colgate biggest beneficiary of GST; Patanjali, Dabur may cut rates, others neutral

FMCG smiles: Colgate biggest beneficiary of GST; Patanjali, Dabur may cut rates, others neutral