Indian Hotels shareholders worry over Cyrus Mistry taking battle to courts

A day after Cyrus P Mistry's sudden decision to quit from the boards of six Tata group companies, Indian Hotels Company Ltd (IHCL) shareholders at the EGM on Tuesday expressed concern over his taking the battle to the courts.

Following Mistry's decision, there was no voting on removing him as director at the IHCL Extraordinary General Meeting (EGM), but shareholders showed concern over the ousted Tata Sons Chairman's intention of taking legal course in the ongoing board room war at the over $100 billion group.

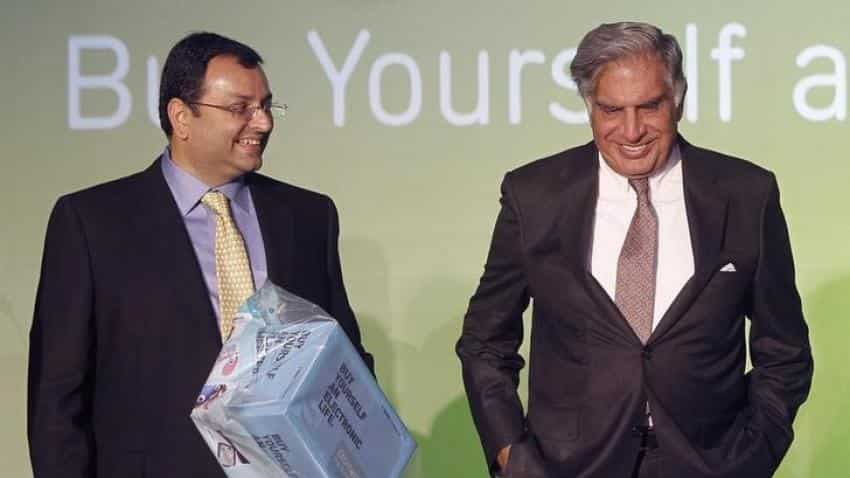

Mistry quit ahead of five Tata companies -- Indian Hotels, Tata Steel, Tata Motors, Tata Power and Tata Chemicals -- calling EGMs starting on Tuesday to remove him as a director on company boards in view of his abrupt removal from the group's holding firm Tata Sons on October 24.

Ratan Tata, a scion of the conglomerate's founding family, replaced him as chairman of the group's holding company.

ALSO READ: Fight was not for position but for long-term reforms of Tata Group: Mistry

In a dramatic turn to India's biggest boardroom spat, while quitting on Monday from the boards, Mistry launched a scathing broadside against Ratan Tata vowing to shift his fight to a "larger platform".

On Tuesday's EGM, 35 shareholders expressed their views to interim chairman Ratan Tata along with Tata Trusts trustee R K Krishna Kumar and Sir Dorabji Tata Trust Managing Trustee R Venkataramanan who attended the meeting.

IHCL Managing Director and Chief Executive Officer Rakesh Sarna chaired the meeting, in which directors, including Deepak Parekh, Mehernosh Kapadia and Nadir B Godrej, were also present.

Most of the shareholders said the public spat, which could have been resolved amicably, has damaged the Tata brand and decreased the market value of the company.

"This hassle is not good for the image of the company. There was no need to wash dirty linen in public," said one of the shareholders, Jahangir Batliwala.

ALSO READ: Four Tata firms to vote on Cyrus Mistry's removal as director this week

Echoing a similar view, Aloysious Mascarenhas said Mistry should have resigned long back.

"I request Mistry not to take the legal course as it takes long long time and is also not good for the image of the company," he said.

Former Managing Director GIC Mahesh Rao said somewhere down the line maturity was lacking in case of Mistry.

"The group was run by Ratan Tata for so many years and there was not a single controversy. Reputation doesn't come with paying high dividends, but it comes with how gracefully and with dignity you run the company. No amount of criticism is going to touch this group."

At the EGM, former Executive Director and IHCL CFO Anil Goel clarified on Mistry's allegations about overpayment on Sea Rock project and expensive overseas acquisitions and said they were false.

"The allegations on overpayment on Sea Rock project are not true. It was expensive but not overpayment. There were third party valuers who valued it. The delay in the project was mainly due to hurdles like getting various approvals" Goel said.

On overseas acquisitions, he said, when they took place the economic environment were different. "We should not be critical about it. We should fix it and move on from there."

Adil Polad Irani, one of the shareholders who had earlier supported Mistry, said his earlier statements were against the chair and not aimed at a person.

At the EGM of Tata Consultancy Services (TCS), Irani had sought reasons for Mistry's removal as the ousted chairman as the IT behemoth's performance was much better during his tenure than previous years.

ALSO READ: Removal from Tata Teleservices not surprising, Mistry says

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

04:36 PM IST

Tata stocks gain as Cyrus Mistry resigns from boards

Tata stocks gain as Cyrus Mistry resigns from boards Tata stocks in focus as Cyrus Mistry resigns

Tata stocks in focus as Cyrus Mistry resigns Four Tata firms to vote on Cyrus Mistry's removal as director this week

Four Tata firms to vote on Cyrus Mistry's removal as director this week Fight was not for position but for long-term reforms of Tata Group: Mistry

Fight was not for position but for long-term reforms of Tata Group: Mistry Removal from Tata Teleservices not surprising, Mistry says

Removal from Tata Teleservices not surprising, Mistry says