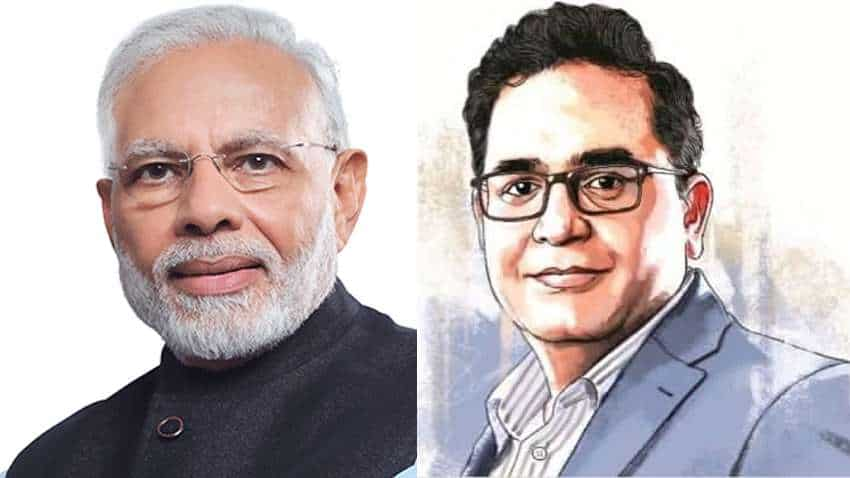

#IndiaFightsCorona: Paytm to donate Rs 500 crores; takes this amazing initiative - PM Narendra Modi lauds it

To support the fight against COVID-19 pandemic, digital payments and financial services platform Paytm on Sunday said it is aiming to contribute Rs 500 crore to the PM CARES Fund.

Paytm founder Vijay Shekhar Sharma confirmed, "We at @Paytm are aiming ₹500 crore towards PM CARES Fund. Not just when you donate on Paytm, we will add up to ₹10 for every payment done using Paytm Wallet/UPI/PaytmBank Debit Card. As #IndiaFightsCorona, your contributions for #PMCaresFund matters."

We at @Paytm are aiming ₹500 crore towards PM CARES Fund.

Not just when you donate on Paytm, we will add up to ₹10 for every payment done using Paytm Wallet/UPI/PaytmBank Debit Card.

As #IndiaFightsCorona, your contributions for #PMCaresFund matters. https://t.co/VLUZ0PNJ1b

— Stay Home, Stay Safe (@vijayshekhar) March 28, 2020

Lauding coronavirus donation by Paytm, PM Narendra Modi said, "Good initiative. Will empower many people to donate to PM-CARES Fund. Let us keep contributing to this cause. #IndiaFightsCorona."

Good initiative. Will empower many people to donate to PM-CARES Fund. Let us keep contributing to this cause. #IndiaFightsCorona https://t.co/qxtUav5bH9

— Narendra Modi (@narendramodi) March 29, 2020

PM Modi had earlier on Saturday announced the creation of the Prime Minister's Citizen Assistance and Relief in Emergency Situations Fund (PM-CARES) where people can contribute and help the government in the fight against the COVID-19.

The PM-CARES Fund accepts micro-donations too. It will strengthen disaster management capacities and encourage research on protecting citizens.

Let us leave no stone unturned to make India healthier and more prosperous for our future generations. pic.twitter.com/BVm7q19R52

— Narendra Modi (@narendramodi) March 28, 2020

The PM CARES Fund is exempt under the Income Tax Act, 1961 under Section 10 and 139 for return purposes. Contributions towards PM-CARES are notified for 100 per cent deduction from taxable income under section 80(G) of the Income Tax Act, 1961.

The country is witnessing a 21-day lockdown, as announced by the PM, to contain the spread of the virus. According to the health ministry, the number of COVID-19 cases crossed 979 in India on Sunday with the death toll rising to 25.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

11:50 AM IST

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore

Paytm arm to sell Stock Acquisition Rights in Japan's PayPay for Rs 2,364 crore Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN

Paytm rolls out UPI Lite auto top-up for recurring daily payments under Rs 500 without PIN Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers

Paytm rallies 149% in 6 months, can you still join the party? Analysts list key triggers Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29

Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29 Paytm shares surge 12% after NPCI nod for onboarding new UPI users

Paytm shares surge 12% after NPCI nod for onboarding new UPI users