India Inc's sales growth slows to 0.1%

RBI said, "Expenditure, at the aggregate level, continued to contract, though at a lower rate as compared with the previous quarter. This resulted in a slowdown in operating profit at the aggregate level."

Aggregate sales growth of corporate India slowed to just 0.1% in the first quarter of current fiscal year, Reserve Bank of India (RBI) said on Wednesday.

RBI said, "Expenditure, at the aggregate level, continued to contract, though at a lower rate as compared with the previous quarter. This resulted in a slowdown in operating profit at the aggregate level."

The data is based on abridged financial results of 2,775 listed non-government non-financial companies for first quarter of 2016-17.

RBI said that the data was for listed non-government non-financial companies.

While overall net profit growth of these companies declined to 11.2% from 16.4% of the preceding quarter, RBI stated that, net profit tumbled significantly in IT sector, while contracted substantially for the services sector but had improved for manufacturing sector.

Overall operating profit (EBITDA – earnings before interest tax depreciation and amortisation) also saw slowdown in growth to 9.6% against 16.8% of the preceding quarter.

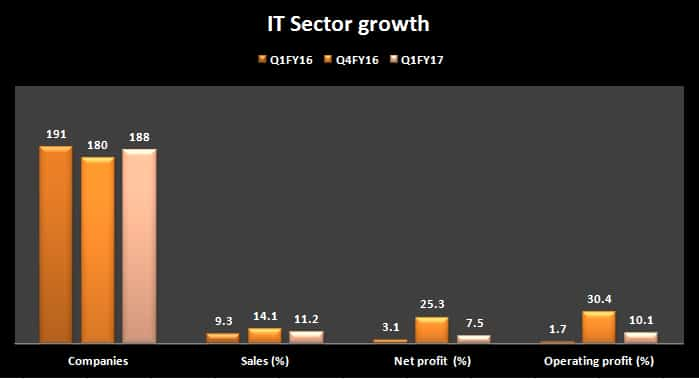

Despite of rise in number of companies in Q1FY17, the segment failed to record better sales compared to previous quarter.

Service sector (Non-IT) tumbled even more.

Its sales fell by 0.3%, at Rs 870 billion as against 0.4% growth in Q4FY16 and 6.8% in Q1FY16. Net profit stood at Rs 36 billion, down 38.9% from negative 24.9% in preceding quarter.

Operating profit for service sector was at Rs 189 billion, a growth of 6.1% this quarter, versus 22.6% and 16.4% growth in Q4FY16 and Q1FY16 respectively.

IT and service sector saw most decline in Q1. Sales for IT sector stood at Rs 729 billion, while net profit at Rs 151 billion and operating profit at Rs 187 billion.

Overall IT sector was better compared to corresponding period of the previous year.

It was manufacturing sector which saw better performance in terms of net profit and EBITDA.

Sales pressure was also seen in manufacturing sector as it dropped 1% to Rs 5152 billion as against Rs 5,381 billion (0.9%) and in Q1FY16 it stood at Rs 5,414 billion (-4.85%).

As per India Ratings and Moody's, there is an urgent need to revive private investment in India.

Moodys stated that India's reform process is on slow pace led by muted muted private investment. It said it may upgrade India's rating in next two if it sees the reforms improving ahead.

On October 20, 2016 Moodys said that the India’s public-private partnership (PPP) model has the potential to attract investment if tweaked properly.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

12:10 PM IST

India Inc set to touch new heights, fastest pace of growth in Modi 3.0: Assocham

India Inc set to touch new heights, fastest pace of growth in Modi 3.0: Assocham Berger Paints Q2 preview: EBITDA estimated to jump 87% YoY; gross margins likely to improve

Berger Paints Q2 preview: EBITDA estimated to jump 87% YoY; gross margins likely to improve Federal Bank reports 35.5% YoY rise in Q2 net profit to Rs 954 crore; NII up 17%

Federal Bank reports 35.5% YoY rise in Q2 net profit to Rs 954 crore; NII up 17% India Inc set to show further improvement in credit metrics in Q2: Report

India Inc set to show further improvement in credit metrics in Q2: Report Q3 Earnings Review: India Inc’s profitability moderated during December quarter; Financials once again in vanguard

Q3 Earnings Review: India Inc’s profitability moderated during December quarter; Financials once again in vanguard