How Reliance Jio bundled the telecom sector into 'one plan'

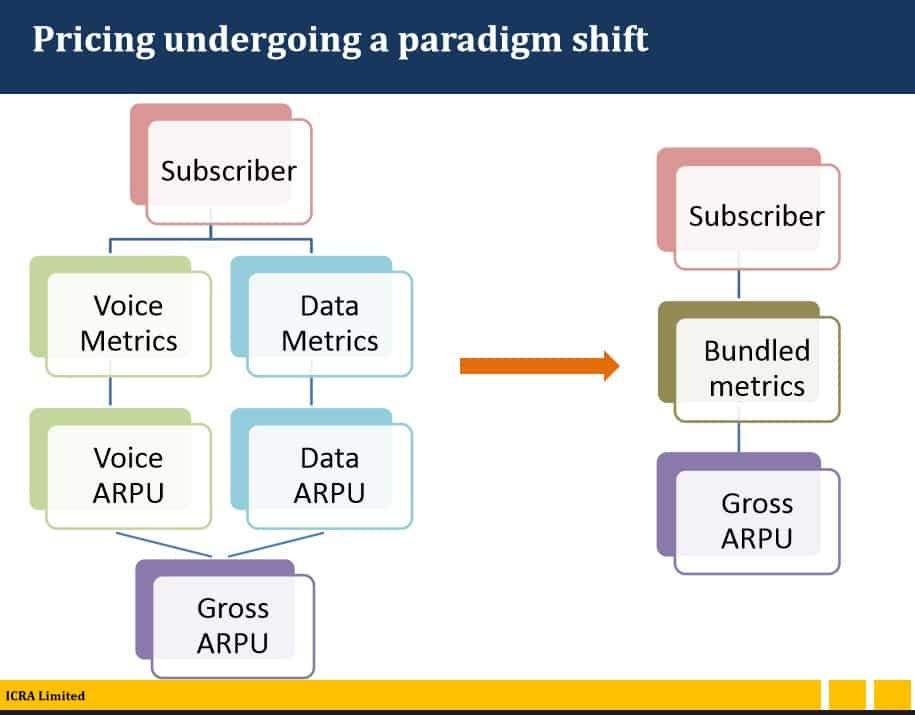

Pricing paradigm of the telecom industry has changed and one of the major reasons for this change was the entry of Reliance Jio.

Till at least two years ago, a pre-paid or a post-paid customer of a telecom company would choose separate billing plans for data and voice.

However, with data gaining more traction and revenues from voice and text messages on the decline, telecom companies started bundling the two as one in order to maintain their profits and ARPUs (Average Revenue Per User).

With the entry of Reliance Jio (RJio) and its bundled plans of free voice calling and only 4G data charges, the death of these traditional data and voice plans stands accelerated.

“Jio’s entry is a major reason for telecoms’ shift in the pricing paradigm’s focus to data instead of voice; however this can also be attributed to increase in penetration of 3G and 4G services,” said Gaurav Dixit, Care Ratings’ telecom analyst.

In a webinar conducted by ICRA, telecom sector head, Harsh Jagnani, too said that voice and data metrics telecom companies have moved to bundled data metrics.

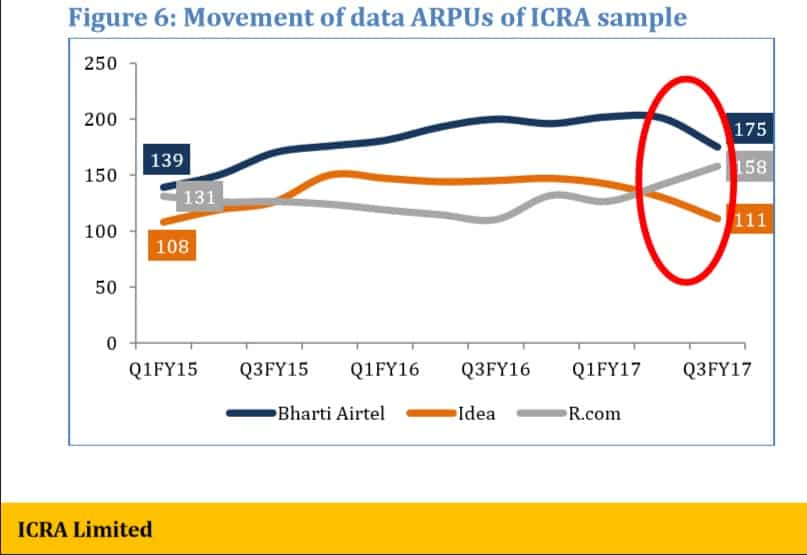

“With RJio offering free data, data subscribers shifted their use of data to RJio, resulting in decline in data subscribers and volumes for incumbents,” ICRA said.

ICRA said that in Q1 FY15 Airtel, Idea and Reliance Communications’ data ARPU was Rs 139, Rs 108 and Rs 131 respectively.

In Q3 FY17, data ARPUs of the companies started to converge and slowly decline with Airtel’s ARPU at Rs 175, Reliance Communication at Rs 158 and Idea at Rs 111, ICRA report showed.

Care Ratings’ Dixit to comment he said, “The rise of 3G and 4G services have increased consumption of data by subscribers. Data is where the revenue is going ahead.”

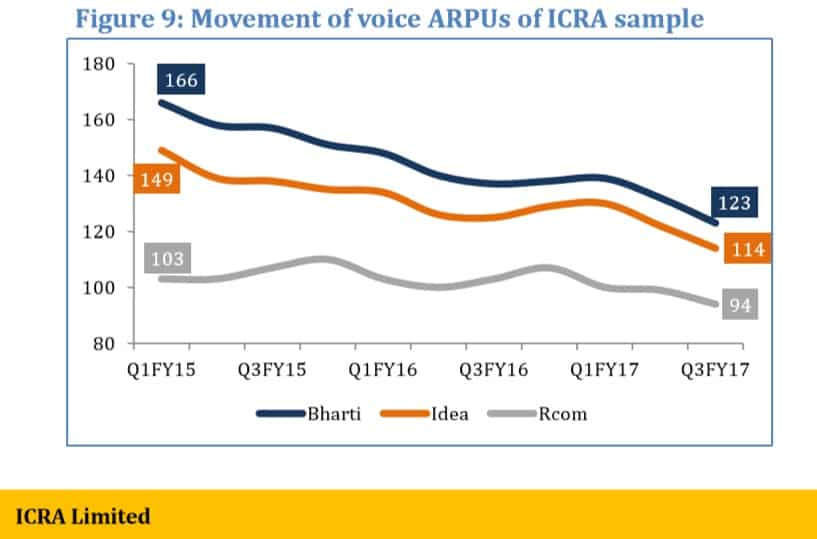

Revenue for voice calling in the telecoms in Q1 FY15 were far spaced with Reliance Communications ARPU at Rs 103, Idea ARPU at Rs 149 and Airtel ARPU at Rs 166.

These ARPUs have converged in Q3FY17 as RCom was at Rs 94, Idea was at Rs 114 and Airtel was at Rs 123, which were a consequence of Jio making voice calls free.

“Life time free voice offering by RJio forced incumbents to reduce prices, thereby exerting pressure on voice realisations. Although volumes increased steadily, voice revenues have been under pressure,” ICRA said.

Jio the accelerator

With the entry of RJio last September, plans that were in the pipeline for nearly seven years got accelerated to the near point of completion.

“The profitability of the operators has been under severe stress after the price war which started after the 2010 spectrum auctions. Since then few smaller operators have also made exit from the India market. The other operators have also been in discussions for mergers for a long time and what we are seeing now is the culmination of the efforts which have been going on for the past few years. The entry of Reliance Jio has only accelerated the consolidation process,” Dixit told Zeebiz.

Also Read: Telecom wars with Jio may have an unintended consequence: Your wallet

Few years ago, there were 10 players in the market inclusive of Sistema, Telenor and Videocon that have exited or will soon fold into bigger players, the market will soon consolidate to just five major players.

Industry experts said that price wars on account of RJio and thinning profit margins have caused major consolidation in this sector.

However the pricing strategy of the telecoms have entered a new direction which will see further modification in the future.

Dixit said, “Going ahead, the industry will try to increase its ARPUs on the back of increased data consumption. Right now most of the operators are offering unlimited data and voice in price bracket of around Rs 300-400. I would say that we can expect various combinations of higher data and voice offers which is similar to what is the current situation and this pattern will continue in the future as well.”

Margins for telecoms will continue to be under pressure, experts from ICRA said while maintaining a ‘Negative’ outlook on the sector, which has been the case for the past few quarters.

“One certainty for the industry is elevated debt level (Rs. 4,10,000 crore as on Mar-2016) which are expected to remain high for some time. Debt/EBITDA estimated at over 5.6 times,” ICRA said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

11:22 AM IST

Spectrum auction: DoT to issue demand note to telcos this week for payment

Spectrum auction: DoT to issue demand note to telcos this week for payment Telecom spectrum auctions done, all eyes now on imminent tariff hikes: Analysts

Telecom spectrum auctions done, all eyes now on imminent tariff hikes: Analysts  Spectrum auction Day 1: Telcos place bids worth about Rs 11,000 crore in five rounds

Spectrum auction Day 1: Telcos place bids worth about Rs 11,000 crore in five rounds Vodafone Idea approves offer price of Rs 11 per equity share for Rs 18,000 crore-FPO

Vodafone Idea approves offer price of Rs 11 per equity share for Rs 18,000 crore-FPO Reliance Jio gets $2.2 bn fund support from Swedish Export Credit agency to finance 5G roll-out

Reliance Jio gets $2.2 bn fund support from Swedish Export Credit agency to finance 5G roll-out