Diwali Gift! HDFC Bank Fixed deposits rates hiked! Enjoy higher interest now; know how your rate is calculated

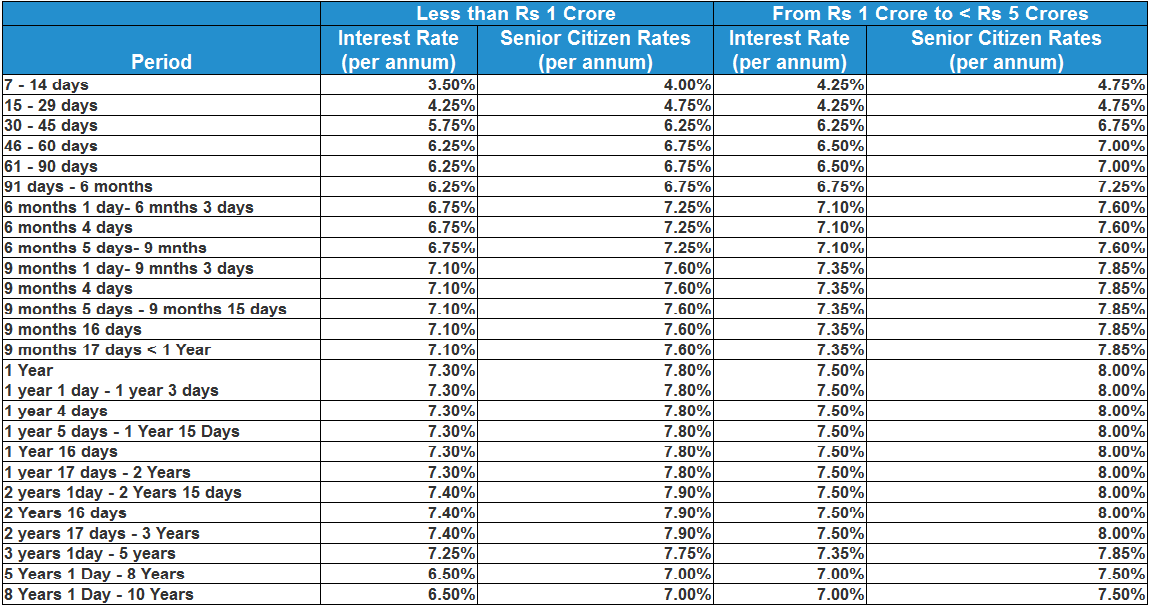

HDFC Bank has hiked interest rates ranging from 0.05% to 0.50% on term deposits below Rs 1 crore and above Rs 1 crore but less than Rs 5 crore for various tenure.

In the midst of Diwali, the largest private lender HDFC Bank is promising to gifted its customers hard money. HDFC Bank has hiked interest rates on fixed deposits. HDFC Bank not only gave good news to resident individuals, but even NRIs, who can now enjoy the benefit of higher FD rates. It would be senior citizens who will be the biggest beneficiaries with current hike in HDFC Bank Fixed Deposit rates. Generally, banks hike interest rate for senior citizen more compared to other categories. Today, HDFC Bank has hiked interest rates ranging from 0.05% to 0.50% on term deposits below Rs 1 crore and above Rs 1 crore but less than Rs 5 crore for various tenure.

In its domestic/NRO/NRE term deposits, HDFC Bank for FDs below Rs 1 crore, now offers 7.30% interest rate to general public for 1 years tenure. In the same tenure, HDFC Bank offers 7.80% interest to senior citizens on their FDs.

Over 2 years tenure but less than 3 years, HDFC Bank gives 7.40% interest rate to general public and 7.90% interest rate to senior citizens for their term deposits below Rs 1 crore.

However, the interest on FD now is at 7.25% and 7.75% for customers and senior citizens whose tenure is between 3 years to 5 years on below Rs 1 crore deposits.

For FDs over Rs 1 cr but less than Rs 5 crore, HDFC Bank gives 7.50% interest rate for general public and 8% interest rate to senior citizens on their deposits made for 1 year tenure. This interest rate is similar on tenures till 3 years for both senior citizens and general public.

The interest rate stands at 7.35% and 7.85% for customers and senior citizens for tenure between 3 years to 5 years for deposits made over Rs 1 crore till Rs 5 crore.

Interest rates are subject to change from time to time. Applicable interest rates will be given as on the date / time of receipt of the funds by the bank.

HDFC Bank in its notification says, "When booking FD through NetBanking please note the actual interest rate being applied on the "Confirm" screen. This screen appears before you confirm your request for opening a new FD. In order to see the latest information, we request you to clear your browsers cache to see the updated interest rates."

Also, the Senior Citizen Rates are only for Resident Indians and do not apply to NRIs. Only Senior Citizens / Retired Personnel (60 years and above) who are Resident Indians are eligible. The special rates are applicable only for Resident deposits.

When you open a Fixed deposit with HDFC Bank Interest on Term Deposits is calculated as below

1) On a Quarterly basis for deposits > 6 months.

2) Simple interest is paid at maturity for deposits <= 6 months.

3) Cumulative Interest/ re-investment interest is calculated every quarter, and is added to the Principal such that Interest is paid on the Interest earned in the previous quarter as well.

4) In case of monthly deposit scheme, the interest shall be calculated for the quarter and paid monthly at discounted rate over the Standard FD Rate.

Minimum tenure for earning FD interest is 7 days.

In case of premature closure of Fixed Deposit (including sweep in / partial closure) the interest rate will be 1.00% below the contracted rate or the rate applicable for the period the deposit has remained with the bank, whichever is lower.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

05:52 PM IST

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week HDFC Bank gets Sebi warning letter over alleged regulatory non-compliance

HDFC Bank gets Sebi warning letter over alleged regulatory non-compliance  TCS, HDFC Bank, 6 other blue-chip firms gain Rs 2 lakh crore mcap in a week

TCS, HDFC Bank, 6 other blue-chip firms gain Rs 2 lakh crore mcap in a week HDFC Bank declines after hitting all-time highs for past 2 sessions: Should you buy, sell or hold?

HDFC Bank declines after hitting all-time highs for past 2 sessions: Should you buy, sell or hold? HDFC Bank hits all-time high; rises nearly 3% in 4 sessions

HDFC Bank hits all-time high; rises nearly 3% in 4 sessions