GST helps ITC enter the 'Rs 4-lakh crore market cap' club

ITC Ltd is now has the fourth highest market capitalisation in India, at over Rs 4 lakh crore. Shares of the company rose after clarity on excise duty post Goods and Services Tax roll out.

Key Highlights:

- Finance Ministry removes additional excise duty on cigarettes under GST regime

- ITC market capitalization touched Rs 415,804.92 crore

- Q4FY17 cigarette gross sales increased by 6.5% for ITC

Cereals to cigarette maker ITC Ltd is now a Rs 4-lakh crore market cap company.

On Monday, share price of ITC Ltd rose 6% after the government issued a clarification on excise duty structure on cigarettes stating that they will no longer have additional excise duty.

What this means is that additional excise duty on tobacco, pan masala and cigarettes has been removed.

Nillai Shah and Indira Badrinarayan of Morgan Stanley said, "We expect the stock to react positively to this development,even as clarity on NCCD is likely to emerge over the next few days."

On Monday, ITC Ltd's market capitalisation stood at Rs 4,15,804.92 crore, following HDFC Bank at Rs 4,26,814.20 crore and Reliance Industries with Rs 4,50,049.22 crore. Tata Consultancy Services (TCS) continues to lead with market cap of Rs 4,67,661.37 crore.

Credit Suisse, in its report said, “ITC trades at 32% discount to Hindustan Unilever as compared to an average of 20% over the past ten years. We thus see significant scope for further re-rating in ITC as the earnings momentum comes back to the high teens trajectory that ITC had before FY14.”

ITC has given nearly 11% returns in last three trading session.

Credit Suisse maintains 'outperform' rating on ITC.

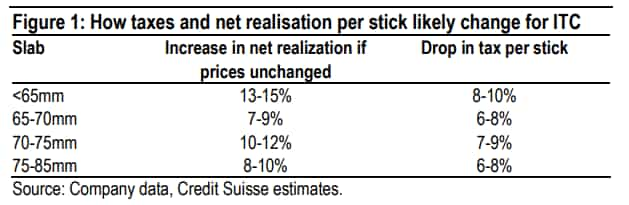

Under GST, taxes are levied on demerit and luxury goods over and above the peak GST rate of 28%. The cess on tobacco will vary from 71-204%.

Filter and non-filter cigarettes not exceeding 65 mm will have a cess of 5% plus Rs 1,591 per 1,000 sticks. While, Non-filter cigarettes exceeding 65 mm but not exceeding 70 mm have cess of 5% plus Rs 2,876, while for filter cigarettes the levy is 5% plus Rs 2,126 per thousand sticks.

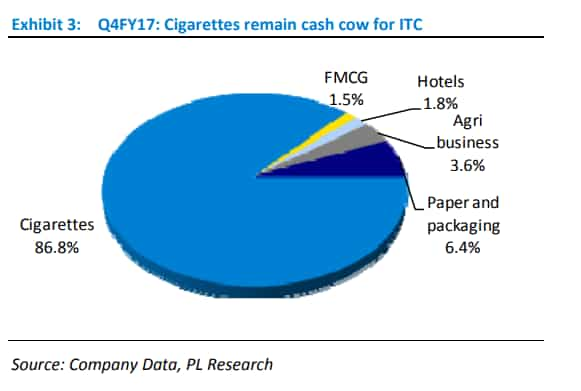

For ITC, cigarettes are still a cash cow.

Q4FY17 cigarette gross sales increased by 6.5% and EBIT increased by 8%, on 110 basis points margin expansion in ITC.

Hikes in cigarette taxes during last three years (FY16, 17, 18) were 13%, 10% and 6% respectively, compared to more than 20% annual hikes in the previous three-year period. The GST rates continue this trend by lowering the rate of taxes for the first time, as per Credit Suisse.

Richard Liu and Vicky Punjabi, analysts at JM Financial said, “For every rupee of profit that the cigarette business earns, the government makes 3.4x. ITC contributed $5 billion (Rs 32,500 crore approx) to the Exchequer in FY17 through excise, state-taxes, income-tax, DDT – these now account for 74% of the value-added by the company.''

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

IPL Auction 2025 Free Live Streaming: When and where to watch Indian Premier League 2025 mega auction live online, on TV, Mobile Apps, and Laptop?

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

01:08 PM IST

FIRST TRADE: ITC lifts Sensex, Nifty holds above 24,400

FIRST TRADE: ITC lifts Sensex, Nifty holds above 24,400 ITC shares in focus post-Q2 earnings: Should you buy, hold or sell?

ITC shares in focus post-Q2 earnings: Should you buy, hold or sell? ITC Q2 FY25 Results: Cigarettes-to-hotels conglomerate clinches Rs 5,078 crore profit, in line with estimates

ITC Q2 FY25 Results: Cigarettes-to-hotels conglomerate clinches Rs 5,078 crore profit, in line with estimates  ITC Q2 results preview: PAT may climb 3%; margin likely to slip 120 bps

ITC Q2 results preview: PAT may climb 3%; margin likely to slip 120 bps HSBC maintains buy on largecap FMCG major ITC; check target price

HSBC maintains buy on largecap FMCG major ITC; check target price