Fixed Deposits, MSME borrowing becomes easier in Indian Overseas Bank; here's how

This comes as a good news for customers, because when they invest their hard-earned money in FDs, which is the most traditional form of investment, they will earn a better interest rate in IOB.

The state-owned Indian Overseas Bank (IOB) which has huge chunk of stressed assets in it's book, has buckled up in improving it's operations and looks like the bank is targeting depositors and borrowers anew. In a major relief, IOB decided to reduce lending interest rates for MSMEs borrowers, while on the other hand, it encouraged investment in fixed deposits (FDs) by hiking the interest rate for the indicator. It needs to be noted that government sees potential in lending to MSMEs for revival in banks credit growth, and looks like IOB has decided to follow the guidance. As for customers this comes as a good news, because when they invest their hard-earned money in FDs - which is the most traditional form of investment, they will earn good interest rate in IOB.

Here's what you need to know.

According to IOB, MSMEs are the backbone of Indian economy as they provide employment to over 120 million people across the country.

In a notification, the bank said, "IOB is giving more thrust to financing MSME units by providing customised schemes launched to cater their varying needs."

To support this segment, IOB has reduced the interest rates by minimum 15 basis points to 90 basis points across different categories. Further the bank has also reduced the commission on opening of Letter of Credit and Bank Guarantees.

For loans ranging from Rs 25 lakh to Rs 2 crore the interest rate is reduced by 50 basis points and for loans above Rs 2 crore, the rate is reduced by 15 basis points to 90 basis points depending on the rating of the MSME units.

In February month, Finance Minister Arun Jaitley launched CriSidEx, India’s first sentiment index for micro and small enterprises (MSEs) developed jointly by CRISIL & SIDBI.

The Finance Minister said the health of MSME sector is extremely vital to the economy and with the number of steps taken by the government in the past 2 years, there is increased integration of MSME sector into formal economy.

Highlighting the significant role played by the MSME sector in creation of jobs, Jaitley said, “MSME sector is backbone of the economy. It is one of the largest employer in the country and with the vast population where employment either in government or in the large industry itself has limited potential."

The effective date of the above reduction is for the loans availed or renewed from April 1, 2018.

Fixed Deposits

Banks allow an individual to open an FD account by depositing a sum of money for a fixed period of time, which may range between 1 month, 6 months, 1 year, 5 years etc.

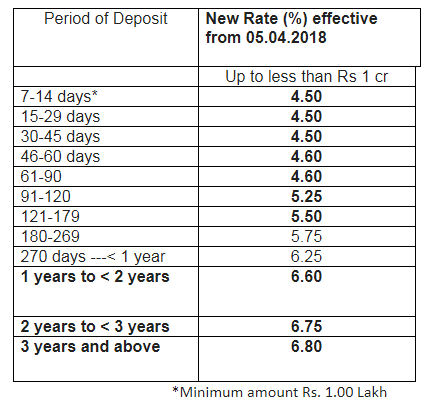

IOB has hiked interest rates on its fixed deposit (FDs) across various tenures by 10-80 basis points (bps) effective from today.

IOB has hiked rates for tenures ranging from one week to 5 years and above, upto less than Rs 1 crore and will now earn between 4.5 percent and 6.8 percent.

The senior citizens will continue to have additional rate of 0.50 percent. The interest rate for IOB tax saver deposit stands at 6.8%. There has been no revision on the interest rates for the NRE deposits.

Below is the table indicating the interest rates across various tenures:

This one is effective from April 05, 2018.

Generally, most people choose FD because this is considered to be safe investment, and it help them grow their financial assets without any exposure to volatility and other risks.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

06:48 PM IST

Indian Overseas Bank to sell Rs 11,500-crore NPAs to ARCs

Indian Overseas Bank to sell Rs 11,500-crore NPAs to ARCs Indian Overseas Bank opens retail loan processing centres across cities

Indian Overseas Bank opens retail loan processing centres across cities  Indian Overseas Bank aims to open 88 new branches in FY2024-25: MD & CEO

Indian Overseas Bank aims to open 88 new branches in FY2024-25: MD & CEO Indian Overseas Bank Q4 results: Profit rises 24% to Rs 808 crore

Indian Overseas Bank Q4 results: Profit rises 24% to Rs 808 crore  Indian Overseas Bank to sell 92 NPAs worth Rs 13.5 crore, shares plunge

Indian Overseas Bank to sell 92 NPAs worth Rs 13.5 crore, shares plunge