EXCLUSIVE: LIC Chairman M R Kumar says VNB margins to rise up to 25 per cent in 4-5 years, asks shareholders to remain patient

LIC Chairman on Zee Business: LIC recorded a Net Premium Income of Rs 1.32 lakh crore which was up by 26.9 per cent against Rs 1.04 Lakh crore YoY.

LIC Chairman on Zee Business: In an exclusive interview with Zee Business Managing Editor Anil Singhvi, Life Insurance Corporation of India (LIC) Chairman, M R Kumar said that LIC’s market share has increased and the Value of New Business (VNB) margin will increase up to 25 per cent in next 4-5 years.

आगे की तिमाही में भी दमदार प्रदर्शन का भरोसा...मार्केट शेयर बढ़कर 68% हुआ : M R कुमार, चेयरपर्सन, LIC

देखिए खास बातचीत अनिल सिंघवी के साथ...@LICIndiaForever @AnilSinghvi_ #MRKUMAR

#ZeeBusiness https://t.co/B2XAAYwPaK pic.twitter.com/MQiHqnJCiX

— Zee Business (@ZeeBusiness) November 24, 2022

Talking about the Q2 result, Kumar said, “In this quarter ending September, our market share increased to 68.25 per cent against 65.42 per cent. We also had good revenue premium growth of Rs 56,156 crores against Rs 50,258 crores. Through embedded value, our profits were at a valuation of 90 per cent which is now 100 per cent, according to this there was bifurcation during the listing which has led to the profitability growth of almost Rs 16,000 crore and we are optimistic that the growth will continue.”

LIC chairman further said that they have launched new non-par products to increase the VNB margins. “After the listing we are working on VNB margins, and we are bringing more non-participative (non-par) products. In the past six months, we have only launched non-par products, now we have 20 non-par products, VNB margins are getting regularised in the 14-15 range, we are confident to take it up to 25 per cent in 4-5 years,” he stated.

In the interview he said that in the upcoming 2-3 years new business premium growth will be stronger, and added, “We believe that new business premium growth will be high as penetration inference growth is low in India. We have 13 lakh agents, our bank insurance tie up is getting stronger and in the coming 2-3 years there should be a growth of 15- 20 per cent.”

Kumar said that the new products that will be launched will be profitable to all stakeholders. He believes that Indian markets are on strong footing, and said, “Our assessment is that the strain and pressure in the global markets in the past one year are have been overcome by the Indian markets and it will continue to do well.”

LIC chairman also said that the insurance provider will churn its portfolio to increase profitability. “In the last 2-3 years, we have seen a growth in the profit in our portfolio and we continue to churn the portfolio to increase the profitability," he added.

Describing the post-pandemic scenario, Kumar said that post pandemic, people are opting for term covers. “Post pandemic people are looking for term cover. In the six months ending September 2021, the death claim was around Rs 21,314 crore, against Rs 11,665 crore in six months ending September 2022. The death claim strain has gone away and many people are opting for term cover. Our 40 per cent agents who are millennials are thus pushing this product,” he opined.

Further speaking on the LIC stock value, Kumar said that people need to have patience. “We have been working for 67 years and since the past 20-25 years we are facing competition, still our market share is good — all this means that there is trust. Our focus on products, business in the coming days will bring portability and we are focused on ensuring stakeholder value. People have to be patient; they have to wait and we will continue to do well in terms of new business,” he summed up.

Friendshoring: How India can benefit from US' attempt to diversify supply chain

LIC Q2 results:

LIC recorded a Net Premium Income of Rs 1.32 lakh crore which was up by 26.9 per cent against Rs 1.04 Lakh crore YoY.

The Profit was up by 1012.67 per cent to Rs 15952.4 crore against Rs 1433.7 crore recorded in the corresponding quarter of previous year.

The VNB was up 59.8 per cent and stood at Rs 2975 crore against Rs 1861 crore YoY. VNB Margins were 14.6 per cent as compared to 13.6 per cent YoY.

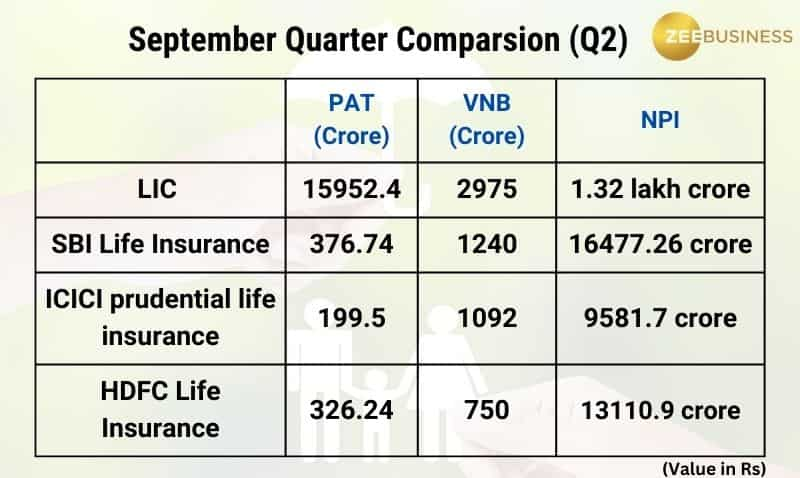

LIC Vs HDFC Life Insurance Vs SBI Life Insurance Vs ICICI Prudential Life Insurance

Comparing the second quarter result month ending September of the four major insurance companies in India on the basis of Profit After Tax (PAT), Value of New Business (VNB) and Net Premium Income (NPI).

Click here to get more Stock Market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SIP Calculation at 12% Annualised Return: Rs 10,000 monthly SIP for 20 years, Rs 15,000 for 15 or Rs 20,000 for 10, which do you think works best?

FD Rates for Rs 10 lakh investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 5-year fixed deposit returns

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

UPS vs NPS vs OPS: Last-drawn basic salary Rs 90,000 and pensionable service 27 years? What can be your monthly pension in each scheme?

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

04:26 PM IST

LIC Smart Pension Plan: Should you invest in this new scheme? Check eligibility and benefits

LIC Smart Pension Plan: Should you invest in this new scheme? Check eligibility and benefits Indian life insurance sector had non-claim amount of Rs 20,062 crore as of March 31, 2024, report says

Indian life insurance sector had non-claim amount of Rs 20,062 crore as of March 31, 2024, report says 6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit

6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit LIC gets GST demand notice of Rs 65 crore

LIC gets GST demand notice of Rs 65 crore Has your LIC policy lapsed due to non-payment of premiums? Here's what to do

Has your LIC policy lapsed due to non-payment of premiums? Here's what to do