European steel mills to remain under pressure from imports: Tata Steel

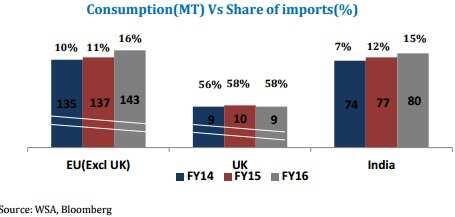

Hans Fischer, MD & CEO of Tata Steel in Europe, said, "Modest forecasted growth in European steel demand this year is still being undermined by increased imports which is leading to continued declines in domestic deliveries. That's why its vital we continue every effort to improve our competitiveness."

Leading steel-maker Tata Steel on Monday said that its European steel mills will continue to remain under pressure from imports.

China to blame for imports?

China produces about half of the globe`s steel output and is accused of flooding the world market with oversupply sold at below cost in violation of global trade rules.

Hit by the crisis in steel industry had led Tata Steel to put its loss-making British operations up for sale in March, leaving thousands of jobs at risk.

Hans Fischer, MD & CEO of Tata Steel in Europe, said, "Modest forecasted growth in European steel demand this year is still being undermined by increased imports which is leading to continued declines in domestic deliveries. That's why its vital we continue every effort to improve our competitiveness."

As per the regulatory filing submitted by the company, it expects supply pressure from imports to continue.

As we had reported earlier, overcapacity and weak steel prices have piled pressure on Tata Steel , which is in merger talks with German conglomerate Thyssenkrupp.

The Chinese steel sector has added about a billion tonnes of capacity since 2000, helping to take global excess capacity to about 700 million tonnes.

The debt of the top 30 companies is dwarfed by China`s steel sector debt, estimated at $500 billion.

Financial result and UK business

Yesterday, the company had announced its financial results for the quarter ended on June 30. The company's a net loss of widened 10-fold on year-on-year basis. It reported a net loss of Rs 3183 crore in June 2016 as against Rs 317 crore in June 2015.

However, on the quarterly basis, the net loss has been narrowed from Rs 3320 crore.

T V Narendran, Managing Director of Tata Steel said, "Seasonal headwinds and a slowdown in a large steel consuming sector like real estate affected steel demand in the quarter. While regulatory changes have supported stem the flood of imports, domestic supply has increased and added to the competitive pressure.

During the quarter ended on June 30, the company's European operations' revenue declined by 12% to Rs 13,100.47 crore as against Rs 14,865.39 crore in June 2015.

In Europe, the EBITDA rose to Rs 856 crore compared to a loss of Rs 325 crore during the same period previous year.

In March, the company had decided to sell its UK business, after reporting years of losses, before the UK's decision to step out of European Union.

After various discussions with the interested buyers, the company in July decided not to go ahead with the sale of UK business. Instead, it aimed to cut costs by 100 million pounds.

In June, it completed the sale of 4.5 million tone of long products division to Greybull Capital.

However, in the regulatory filing released by the company yesterday, it again hinted that it may look selling the UK business.

Koushik Chatterjee, Group Executive Director, said, "With the completion of the Long Products divestment, Tata Steel Europe will focus on being a premium strip player and the management and employees of

Tata Steel Europe continues to strive to structurally improve the business performance. The strategy for exploring further strategic consolidation in Europe is a step in that direction. Tata Steel UK also continues to be engaged with several stakeholders including unions, the Trustee and the UK government to find a structural solution to the pension exposure of the UK business."

Outlook

The company in the filing said that the EU economy is expected to continue to grow gradually though UK's stronger growth may slow down following the referendum result.

The weaker pound is expected to improve UK's short term competitive position on exports, however it will add cost pressure due to higher cost of raw materials purchased in US dollars.

The company also expect the EU steel demand to increase by 1.1% in 2016 in line with modest economic growth.

Talking about the company's outlook, Fischer, said, "We are making progress as a result of business improvement initiatives and the restructuring announced last year. We remain committed to investing in our customers through new product development and enhancing our manufacturing capability. In July, we started construction of a new slab caster in IJmuiden which will enable us to make more higher-strength steels, particularly for car manufacturers."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:53 PM IST

Tata Steel engages with miners NMDC, OMC to secure future iron ore needs By Abhishek Sonkar

Tata Steel engages with miners NMDC, OMC to secure future iron ore needs By Abhishek Sonkar Tata Steel reports Rs 759 crore net profit in Q2

Tata Steel reports Rs 759 crore net profit in Q2 Tata Steel Q2FY25 preview: Weak pricing, high costs to weigh on earnings

Tata Steel Q2FY25 preview: Weak pricing, high costs to weigh on earnings Tata Steel UK signs contract for electric furnace in green steelmaking drive By Aditi Khanna

Tata Steel UK signs contract for electric furnace in green steelmaking drive By Aditi Khanna Tata Steel, L&T Finance & More: Brokerage recommends buying these 7 stocks for up to 3 months for huge profit| Check targets, stop losses

Tata Steel, L&T Finance & More: Brokerage recommends buying these 7 stocks for up to 3 months for huge profit| Check targets, stop losses