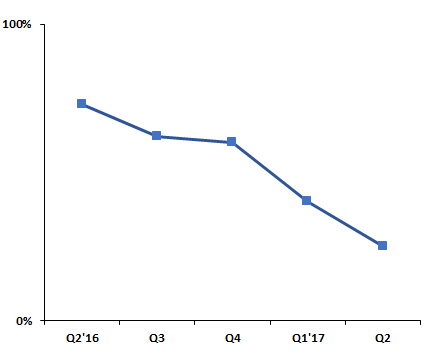

Driver incentives of Uber, Ola in Q2 plummet as profitability remains key focus

Driver incentives continued to plummet during the last few quarters as online cab players look for profitability in the country.

Key highlights:

- Driver incentives of online cab aggregators have seen a large decline from Q1 2017 to Q2 2017

- Driver incentives have plummeted from nearly 80% in Q2 2016 to nearly 20% in Q2 2017

- Driver cab supply continues to be a worry for online cab aggregators

Despite several driver strikes during the year, online cab aggregators seem focused on key profitability by way of reducing driver incentives. Driver incentives of online cab aggregators, such as Uber and Ola, have seen a large decline from Q1 2017 to Q2 2017.

Despite strong opposition by drivers, cab aggregators continued to reduce expenditure on incentives with Bengaluru and Delhi seeing the biggest incentive drop in Q2 2017, said a RedSeer Consulting report.

It further said that profitability remains the key focus of cab aggregators with the dropping driver incentives.

Source: RedSeer Consulting

Driver incentives have plummeted from nearly 80% in Q2 2016 to nearly 20% in Q2 2017. This is a drop of nearly 60% in driver incentives in the just a matter of 1 year.

The drop in incentives is one of the reason why many drivers are choosing to leave the taxi-hailing app cab services such as Uber and Ola. As pointed by a recent RedSeer report, driver cab supply continues to be a worry for online cab aggregators as it has been dropping at a fast rate since Q4 2016.

“While the industry witnessed an improvement in monthly engagement of partner drivers, continuous drop in cab network remains a worry. This drop in cab network was as a result of drivers continuing to leave the online cab aggregator platforms because their demands were not met,” said the report.

The registered cab supply in Q2 2017 has declined to nearly 3 lakh from nearly 5 lakh cabs in Q4 2016.

This comes as a disappointment to online cab players who had seen a rise in registered cab supply from nearly 3 lakh in Q2 2016 to nearly 5 lakh in Q4 2016.

“This trend continued as revisions in incentives, commission rates and working hours were not rolled back,” it added.

While earlier the Indian online cabs market seems to have bounced back growth of 15% in terms of the ride count in Q2 2017, these taxi-hailing apps services still have to shake of the driver agitation which had hurt in in the previous quarter.

RedSeer Consulting data show that there was a 5% decline in the overall cab bookings for the industry in Q1 2017. This is a first decline in app-based cab bookings in India.

Past one year has been tumultuous for Ola and Uber with the two hit by driver agitations as these companies cut incentives which were earlier at an all time high.

The report had noted that driver income declined by 45% quarter on quarter (QoQ) due to a sharp reduction in ride incentives, by the online cab companies to push profitability, in an earlier report.

These cab drivers incentives were so high at one point in time that companies such as Uber last year advertised that they were offering drivers a monthly income of up to Rs 1 lakh.

This had resulted in Uber and Ola drivers and unions going on strikes several times over the past few months in Delhi-NCR, Bengaluru and even Mumbai. This had hit the supply of cabs severely.

The online cab players in India however are looking to push their car-pooling services to sort their cab supply issues. This has worked to an extent as car-pooling has seen a growth in the last few quarters,

In Q2 2017 car-pooling it witnessed a 22% growth in comparison with the previous quarter. In Q1 2017 it had seen a steady growth of 9%.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

11:19 AM IST

Cab supply of Uber, Ola drop as drivers continue to leave over unfulfilled demands

Cab supply of Uber, Ola drop as drivers continue to leave over unfulfilled demands Uber to allow driver-partners to share location

Uber to allow driver-partners to share location Taxi app wars begin: Is Ola getting the better of Uber?

Taxi app wars begin: Is Ola getting the better of Uber? Dreams of Ola, Uber drivers crash as incentives trickle and loans catch up

Dreams of Ola, Uber drivers crash as incentives trickle and loans catch up Ola, Uber drivers might remain off road tomorrow

Ola, Uber drivers might remain off road tomorrow