Dear SBI, when will YOU move? Now, ICICI Bank hikes FD interest rates by 25 bps, senior citizens see most benefit

Fixed deposits are the safest traditional form of investment in India. You must have been motivated by an elder to invest in FD schemes rather than taking risks with markets.

The fixed deposits interest rate war is in full swing, with private lender ICICI Bank being the latest one to announce an attractive hike. Interestingly, ICICI Bank's new hike is not applicable on all tenures, but some specific long-term deposit ones. Once again, it would be senior citizens, who reap the most benefit compared to the general category. Fixed deposits are the safest traditional form of investment in India. You must have been motivated by an elder to invest in FD schemes rather than taking risks with markets.

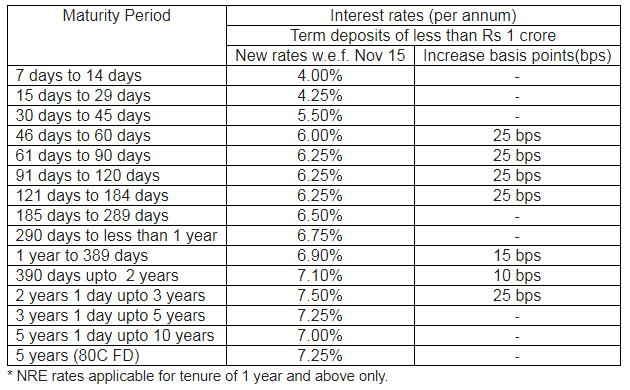

Today, ICICI Bank increased its fixed deposit interest rates by 25 basis points on less than Rs 1 crore with immediate effect. The new rates are applicable across various tenors for domestic term-deposits. It is also applicable for Non Resident Ordinary (NRO) & Non Resident External (NRE) term-deposits.

Pranav Mishra, Senior General Manager & Head – Retail Liabilities Group, said, “With the prevailing volatility in financial market, we see renewed interest by customers to invest in fixed deposits which offer a combination of attractive interest rates, liquidity and assured returns."

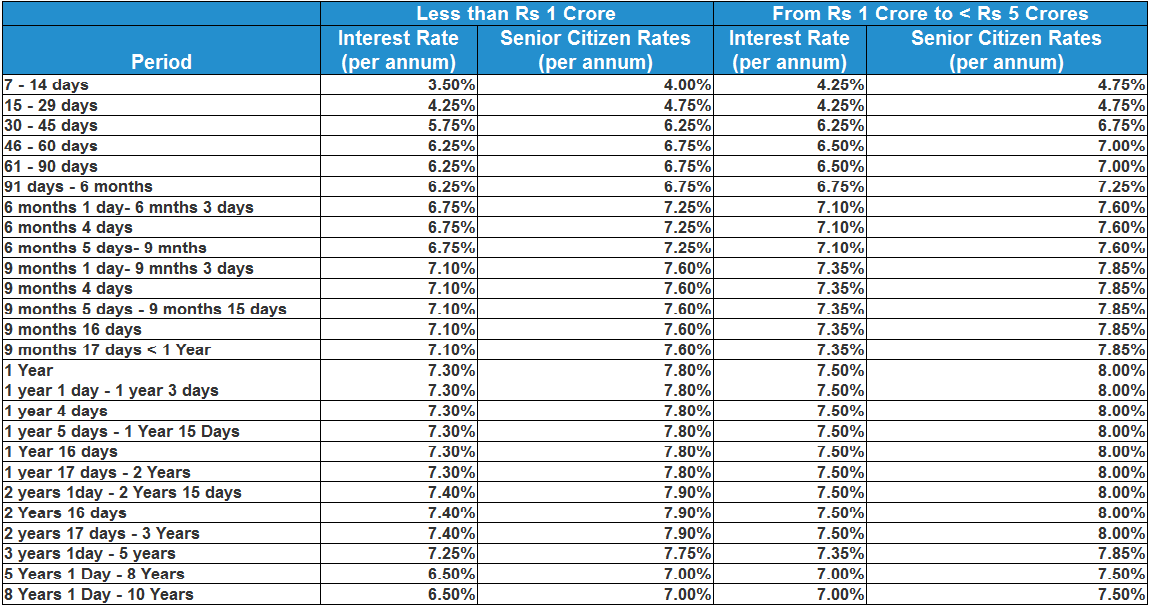

Mishra added, "The 2-3 years tenor offers customers an opportunity to invest at a higher interest rate of 7.50% p.a. (8.00% p.a. for senior citizens). As a prudent asset allocation strategy, we feel customers should definitely look at capitalising on this opportunity.”

With this hike, ICICI offers a peak interest rate of 7.50% on term-deposits with a maturity of above 2 years upto 3 years.

ICICI Bank offers term-deposits with various maturities starting as low as 7 days and up to 10 years. It also offers a 50 basis points higher interest rate to senior citizens across term-deposits of all maturities.

The bank in its notification said, "Customers can open a term-deposit at any of the Bank’s branches. In addition, they can conveniently open a deposit from the comfort of their home/office or on-the-go, using the Bank’s internet and mobile banking platforms as well as from ATMs and phone banking. "

Interestingly, ICICI Bank is not alone to hike their FD rates, many lenders like HDFC Bank, ICICI Bank, Axis Bank and Bank of Baroda have on multiple occasions increased the fixed deposit interest rate to lure customers.

One big reason for rising FD rates would be that, the bank wants to push its credit growth. Lending money is their major tool of earnings, and most of the funds are used to lend borrowers using the deposits made by citizens

What is surprising is that the largest lender SBI has still not made any hike in its fixed deposit interest rates. Most of the time, it would be SBI who makes the first move to hike FDs, and others have followed suit. Now that, major private lenders HDFC, ICICI and Axis Bank are increasing their rates on FDs to make it look much attractive, it will only be a matter of time when SBI follows the same dilemma.

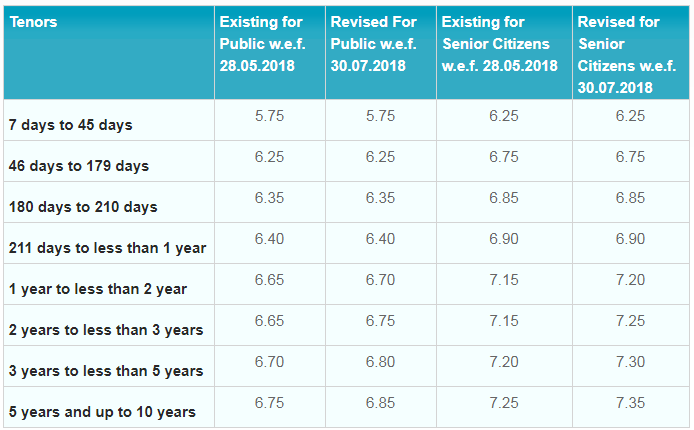

If we compare now the ICICI Bank and HDFC Bank who also announced a hike in FD rates this month only, SBI's FD interest rate are not that better.

SBI offers 6.40% interest rate on FDs for normal category, whereas 6.90% to senior citizens for tenure between 211 days to 364 days on deposits below Rs 1 crore.

As for between 1 year to less than 2 year, SBI gives 6.70% to normal category, while 7.20% to senior citizen. From 2 years to less than 3 years, 6.75% rate is offered and 7.25% to senior citizens. Meanwhile, for 3 years to less than 5 years, SBI gives 6.80% to normal ones and 7.30% to senior citizens. The highest interest rate is given for tenure between 5 years to 10 years, at 6.85% to normal category and 7.35% to senior citizens.

Coming to largest private lender HDFC Bank, it gives 7.30% to normal and 7.80% to senior citizen for tenure of 1 years and till 2 years. The highest interest rate given by the bank would be 7.40% to normal ones and 7.90% for a tenure of 2 years to 3 years.

After the third year, the HDFC Bank's deposit rates have started to decline, as it stood at 7.25% (normal ones) and 7.75% (senior citizen) for 3 years to 5 years tenure, while was at 6.50% (normal ones) and 7% (senior citizen) for 5 years to 10 years tenure.

Hence, all eyes will now watch when SBI will nudge and provide a some hike in their FD rates. The last time SBI made a hike in FDs was in the end of July month this year.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Large Cap Mutual Funds With Best SIP Returns in 10 Years: Rs 8,877 monthly SIP investment in No. 1 fund has jumped to Rs 28,69,944; see key details

Top 7 SBI mutual funds with highest SIP returns in 15 years: Rs 7,777 monthly investment in No. 1 scheme has zoomed to Rs 97,64,660

Rules of 72, 114, 144 & 8:4:3: How long will it take for your Rs 50 lakh investment to become Rs 1 crore?

06:56 PM IST

What are green deposits and how do they work?

What are green deposits and how do they work? Explained | Are fixed deposits better than stocks?

Explained | Are fixed deposits better than stocks? Best FD Rates: Which banks are giving the highest fixed deposit rates?

Best FD Rates: Which banks are giving the highest fixed deposit rates? Floater Fund vs Fixed Deposit: Know which offers higher return?

Floater Fund vs Fixed Deposit: Know which offers higher return? Financial Planning: With jobs being unstable, try out these 5 investment options to get monthly returns

Financial Planning: With jobs being unstable, try out these 5 investment options to get monthly returns